2.1 Overview

This topic describes the overview about the Decision service.

The Decision service provides automatic decision making capabilities that can allow lenders to develop simple business processes and strengthen the decision-making process.

It gives flexibility to adjust the credit scoring model according to the lending policy.

When an organization calls the decision service to make a decision based on data attributes shared, system solves the best fit scoring model and provide scores and decisions.

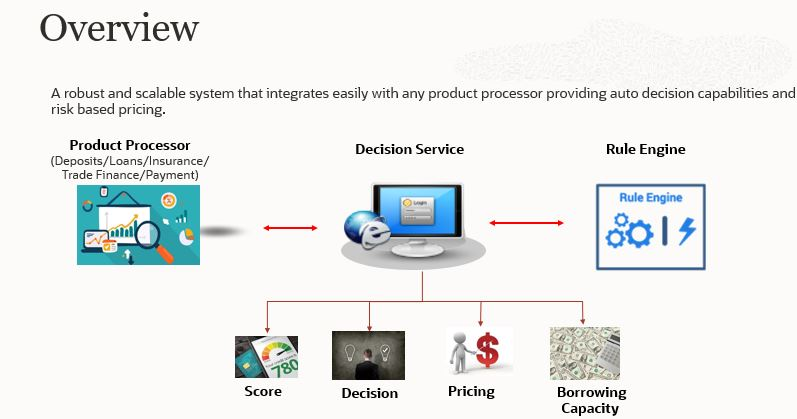

Decision Service is a robust and scalable system that can be easily integrated with any product processor providing auto decision capability and risk based pricing.

Decision service can be called from various product processor such as Collections, Deposits, Loans, Insurance, Trade Finance or Payment etc. This product processor calls the decision service and the decision service intern uses the rule engine to configure various complex rules.

The decision service can calculate behavioral scores and suggest the best recommended collection strategy accordingly. For lending products, it can offer a credit score, a decision based on the score, the recommended rate of interest and the ability to calculate which is the maximum amount that can be borrowed by the applicant.

Parent topic: Bureau Integration Service