- Oracle Banking Common Core User Guide

- Decision Service

- Execution Summary

- View Execution Summary

3.18.1 View Execution Summary

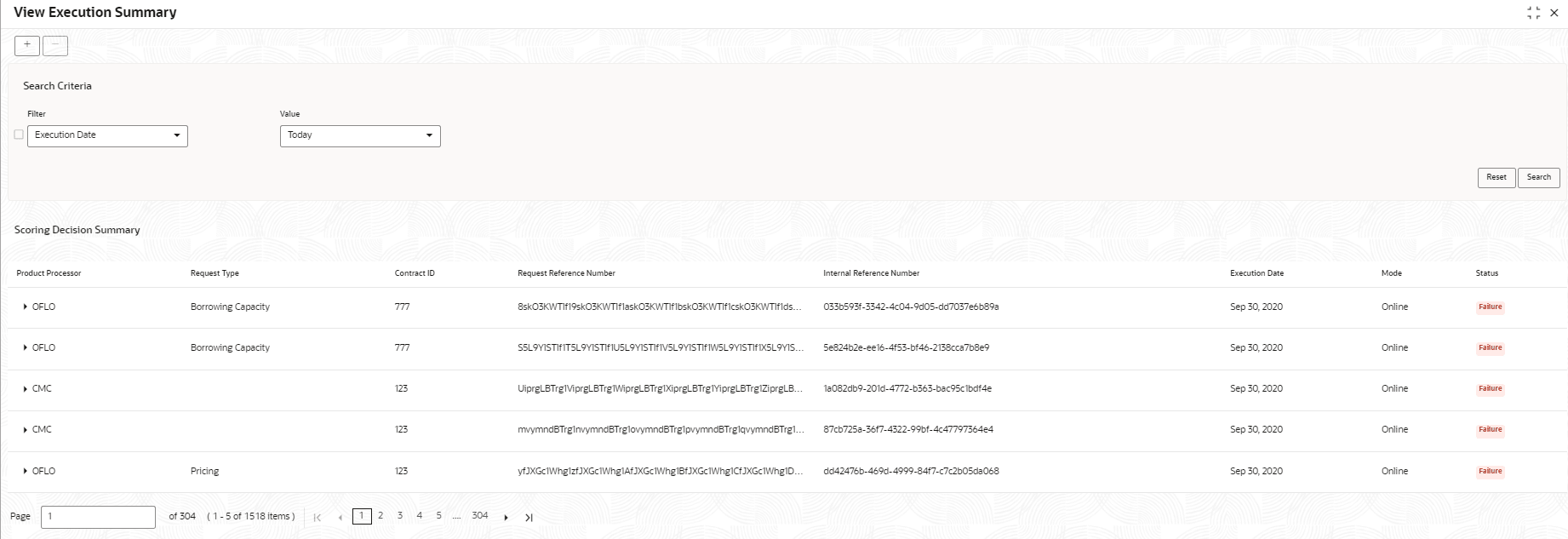

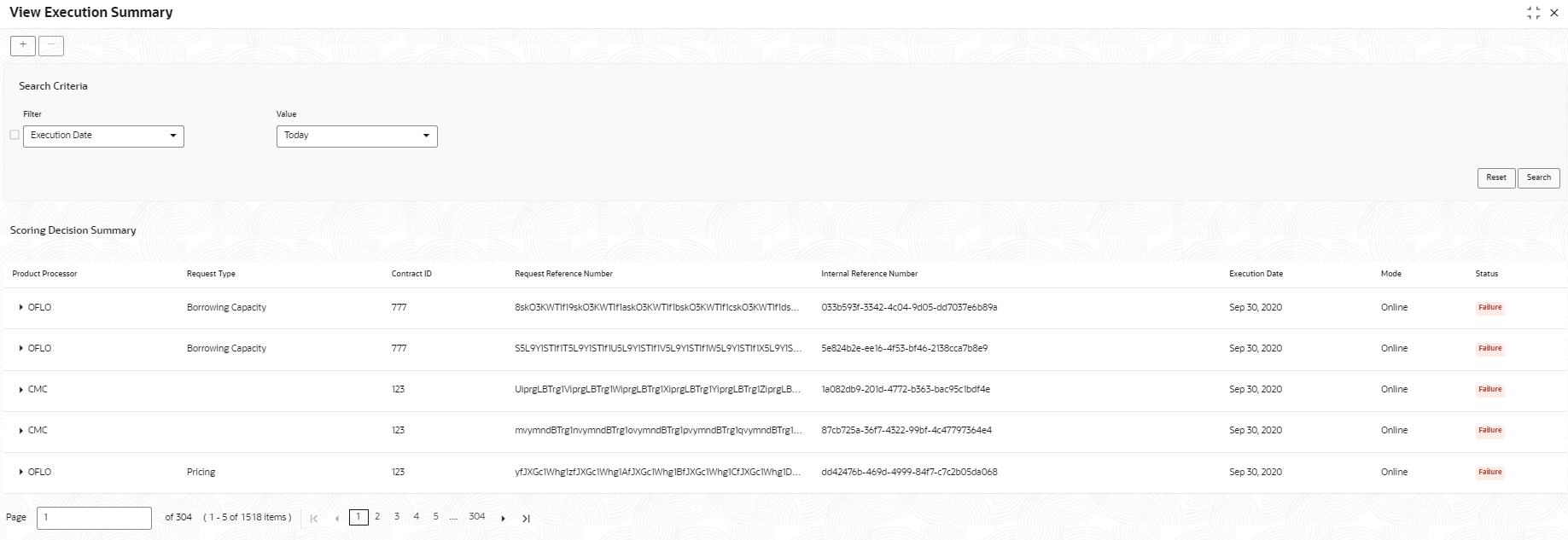

This topic describes the systematic instructions to view the execution summary based on the various filter options provided.

- On Home screen, click Core Maintenance. Under Core Maintenance, click Credit Decision.

- Under Credit Decision, click Operations. Under Operations, click Execution Summary.The View Execution Summary screen displays.

For more information on fields, refer to the field description table.

Table 3-100 View Execution Summary - Field Description

Field Description + icon Click the icon to add a new row. - icon Click the icon to delete a row, which is already added. Filter Select the required option to search for the execution summary.

The available options are:

- Reference Number

- Internal Reference Number

- Decision

- Batch/Online

- Product Processor

- Status

- Request Type

- Execution Date

- Contract ID

Value Specify the required details or select an appropriate option for the selected filter option.

This field appears once you select an option from the Filter list.From Date Select the start date of the period during which the execution summary is generated.

This field appears if you select the filter option as Execution Date and value as Date Range.To Date Select the end date of the period during which the execution summary is generated.

This field appears if you select the filter option as Execution Date and value as Date Range. - In the Search Criteria section, specify the details and click Search.

The search results displays with the list of records based on the specified criteria.

- Click Reset to reset the search criteria.

For more information on fields, refer to the field description table.

Table 3-101 Scoring Decision Summary - Field Description

Field Description Product Processor View the name of the product processor that sent the request. Request Type View the request type sent by product processor. Contract ID View the contract ID sent by the product processor. Reference Number View the request reference number sent by product processor. Internal Reference Number View the internal reference number of the application. Execution Date View the execution date of the processing application. Mode View the mode of execution of the application. Status View the status of the processed application. - Click the corresponding

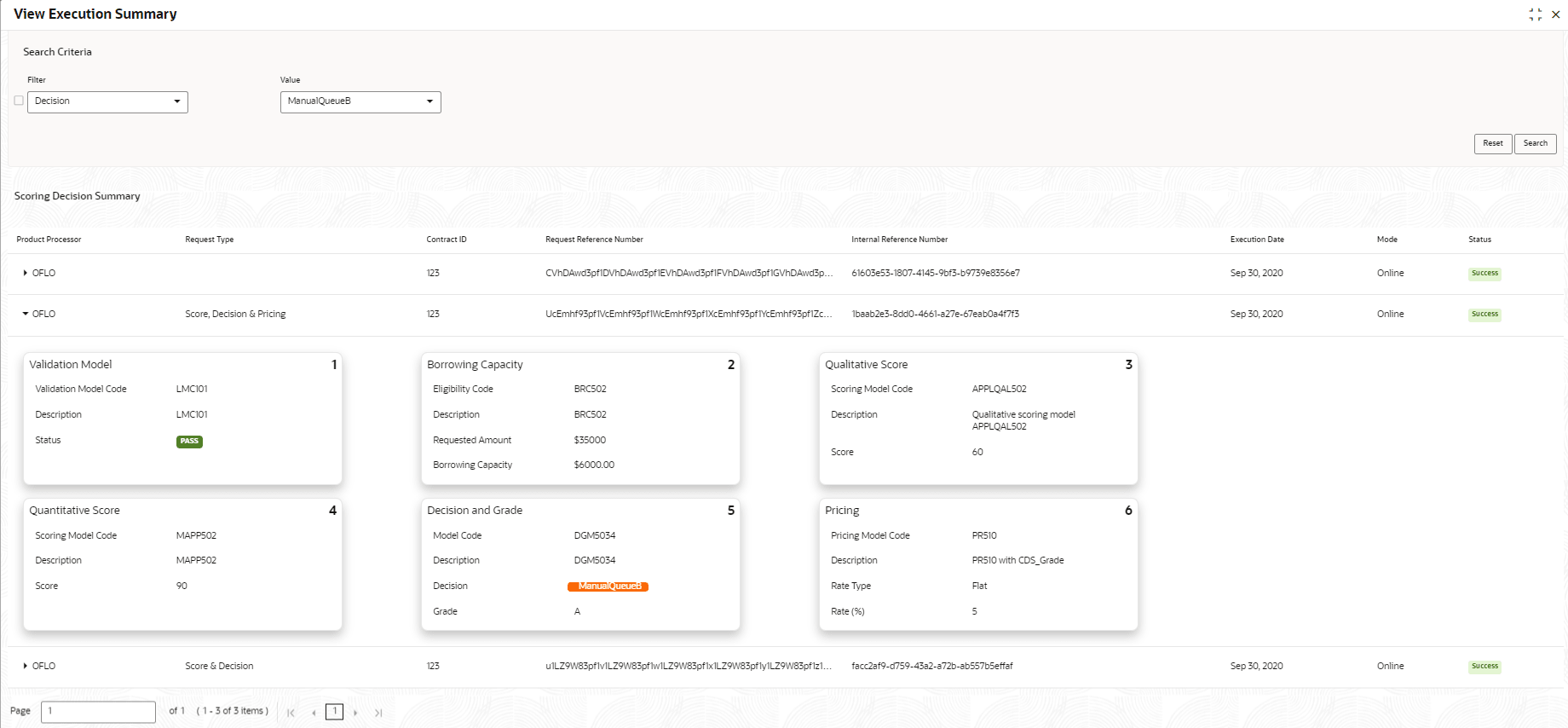

icon to the required record to view the decision related details on each widget. Only one record can be viewed at a time. To view another record, close the previous record and then the next record can be viewed. The widgets are arranged in a flow in which the execution is done. These are indicated by showing the sequence 1, 2, 3 numbers at the top right corner. The widgets are selectable, on mouseover, the color of the widget changes to indicate that the widget is selectable.

icon to the required record to view the decision related details on each widget. Only one record can be viewed at a time. To view another record, close the previous record and then the next record can be viewed. The widgets are arranged in a flow in which the execution is done. These are indicated by showing the sequence 1, 2, 3 numbers at the top right corner. The widgets are selectable, on mouseover, the color of the widget changes to indicate that the widget is selectable. - When the status of the processed application Fails, a click on the

failure message displays the step that is failed. For example, in case of the Qualitative Score Model is not resolved, then an error message is displayed in the Qualitative Score Model widget. The previous widget will show the data which was processed. If the validation processing fails, then the Fail status is shown in the Validation Model widget, and the reason for failure is displayed by a click on the widget.

failure message displays the step that is failed. For example, in case of the Qualitative Score Model is not resolved, then an error message is displayed in the Qualitative Score Model widget. The previous widget will show the data which was processed. If the validation processing fails, then the Fail status is shown in the Validation Model widget, and the reason for failure is displayed by a click on the widget.For more information on fields, refer to the field description table.

Table 3-102 View Execution Summary - Field Description

Field Description Validation Model Widget Displays the status of the validation model processed. Validation Model Code Displays the validation model code, resolved for credit decision. Description Displays the validation model description, resolved for the credit decision. Status Displays the status of the validation model processed.

- For status Pass, the color is shown as Green.

- For status Fail, the color is shown as Red.

Borrowing Capacity Widget Displays the maximum lendable amount that can be given for an application. Eligibility Code Displays the eligibility model code, resolved for calculating the borrowing capacity. Description Displays the eligibility model description, resolved for calculating the borrowing capacity. Requested Amount Displays the requested amount for the lending application. Borrowing Capacity Displays the maximum lendable amount that can be given for the application. Qualitative Score Widget Displays the qualitative credit score, post credit decision of the application. Scoring Model Code Displays the scoring model code, resolved for credit decision.

- When Is Application Decision Required is Yes, the application level decision scoring code is displayed.

- When Is Application Decision Required is No, the applicant level decision scoring code is displayed.

- When Is Application Decision Required is No, and Is Primary Applicant is No, the application level decision scoring code is displayed.

Description Displays the scoring model description, resolved for credit decision. Score Displays the qualitative credit score post credit decision of the application.

- When Is Application Decision Required is Yes, the system performs the aggregation, which can be minimum, maximum or average of all applicant’s score. The aggregation performed is defined as rules and linked at the application level scoring model and this aggregated score is displayed.

- When Is Application Decision Required is No, the score is displayed by resolving the applicant level scoring model.

- When Is Application Decision Required is No, and Is Primary Applicant is No, the system performs the aggregation, which can be minimum, maximum or average of all applicant’s score. The aggregation performed is defined as rule and linked at the application level scoring model and this aggregated score is displayed.

Quantitative Score Widget Displays the quantitative credit score post credit decision of the application. Scoring Model Code Displays the scoring model code, resolved for credit decision.

- When Is Application Decision Required is Yes, the applicationlevel decision scoring code is displayed.

- When Is Application Decision Required is No, the applicant level decision scoring code is displayed.

- When Is Application Decision Required is No, and Is Primary Applicant is No, the multi applicant level scoring code is displayed.

Description Displays the scoring model description, resolved for credit decision. Score Displays the quantitative credit score, post credit decision of the application.

- When Is Application Decision Required is Yes, the system performs the aggregation, which can be minimum, maximum or average of all applicant’s score. The aggregation performed is defined as rules and linked at the application level scoring model and this aggregated score is displayed.

- When Is Application Decision Required is No, the score is displayed by resolving the applicant level scoring model.

- When Is Application Decision Required is No, and Is Primary Applicant is No, the score is displayed by resolving the multi applicant level scoring model.

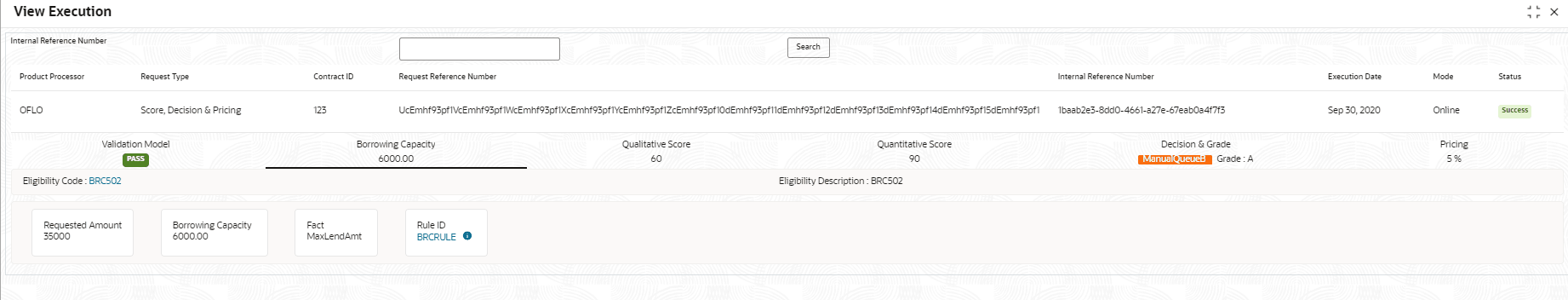

Decision and Grade Widget Displays the credit decision and scoring grade, taken for the application. Model Code Displays the model code, resolved for credit decision and grade. Description Displays the model description, resolved for credit decision and grade. Decision Displays the credit decision, taken for the application. Grade Displays the scoring grade, post credit decision of the application. Pricing Widget Displays the rate applicable post credit decision. Pricing Model Code Displays the pricing model code, resolved for credit decision. Description Displays the pricing model description, resolved for credit decision. Rate Type Displays the rate type applicable post credit decision. Rate % Displays the rate applicable post credit decision. Click on the Validation Model widget, the following fields are displayed. The details for the request which was clicked on the landing page is displayed.For more information on fields, refer to the field description table.

Table 3-103 Validation Model Widget - Field Description

Field Description Product Processor Displays the name of the product processor that sent the request.

This field will be shown on click of each widget.Request Type Displays the request type sent by the product processor.

This field will be shown on click of each widget.Contract ID Displays the contract ID sent by the product processor.

This field will be shown on click of each widget.Request Reference Number Displays the request reference number sent by product processor.

This field will be shown on click of each widget.Internal Reference Number Displays the internal reference number of the application.

This field will be shown on click of each widget.Execution Date Displays the execution date of the processing application.

This field will be shown on click of each widget.Mode Displays the mode of execution of the application.

This field will be shown on click of each widget.<Validation Model Code> Displays the validation model code that is resolved for credit decision. Click the hyper link to view the rule executed to resolve the model.

Show Rule Log Click to see the rule log.

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Description Displays the description of the validation model. Status Displays the status of validation model. Rule ID Displays the rule ID executed for validation model processing. Click the hyperlink to view the rule executed.

Show Rule Log Click to see the rule log.

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Sequence Displays the sequence in which the rules are executed for validation model processing. Status Displays the status of the rule execution. In case the status is failed, the reason for failure is displayed as Reason <>. The options are:- Pass

- Not Executed - This status is displayed against a rule if the Stop on Failure is set as ON and previous rule sequence has failed.

The following fields are displayed once the user click the Borrowing Capacity widget.

Figure 3-100 Borrowing Capacity Widget

For more information on fields, refer to the field description table.

Table 3-104 Borrowing Capacity Widget - Field Description

Field Description <Eligibility Code> Displays the eligibility code resolved for calculating the borrowing capacity. Click the hyperlink to view the rule executed to resolve the borrowing capacity.

Show Rule Log Click to see the rule log.

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Eligibility Description Displays the eligibility description resolved for calculating the borrowing capacity. Requested Amount Displays the requested amount for the lending application. Borrowing Capacity Displays the maximum lendable amount that can be given for an application. Fact Displays the fact using which the maximum lendable amount was calculated. Rule ID Displays the rule ID executed for calculating the maximum lendable amount. Show Rule Log Click to see the rule log.

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. The following fields are displayed once you click the Qualitative Score widget.

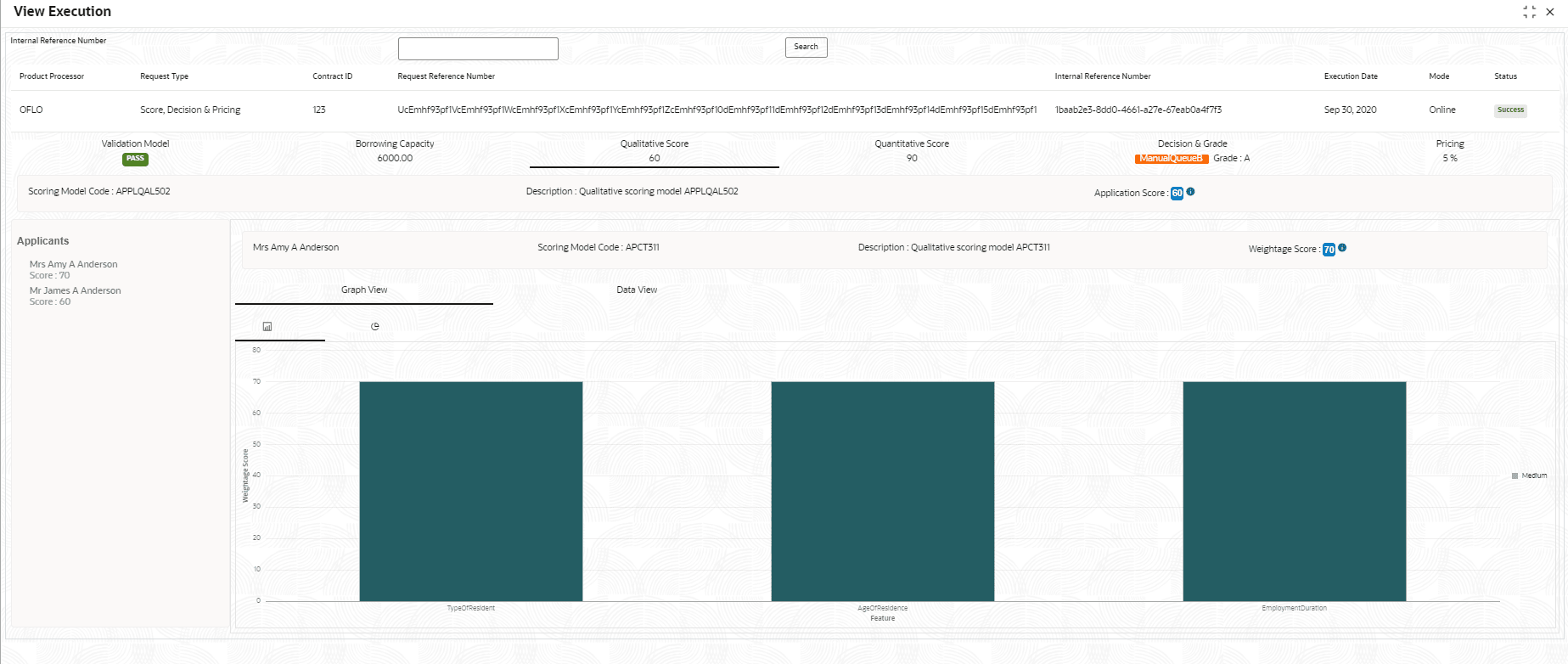

Figure 3-101 Qualitative Score Widget – Bar Graph View

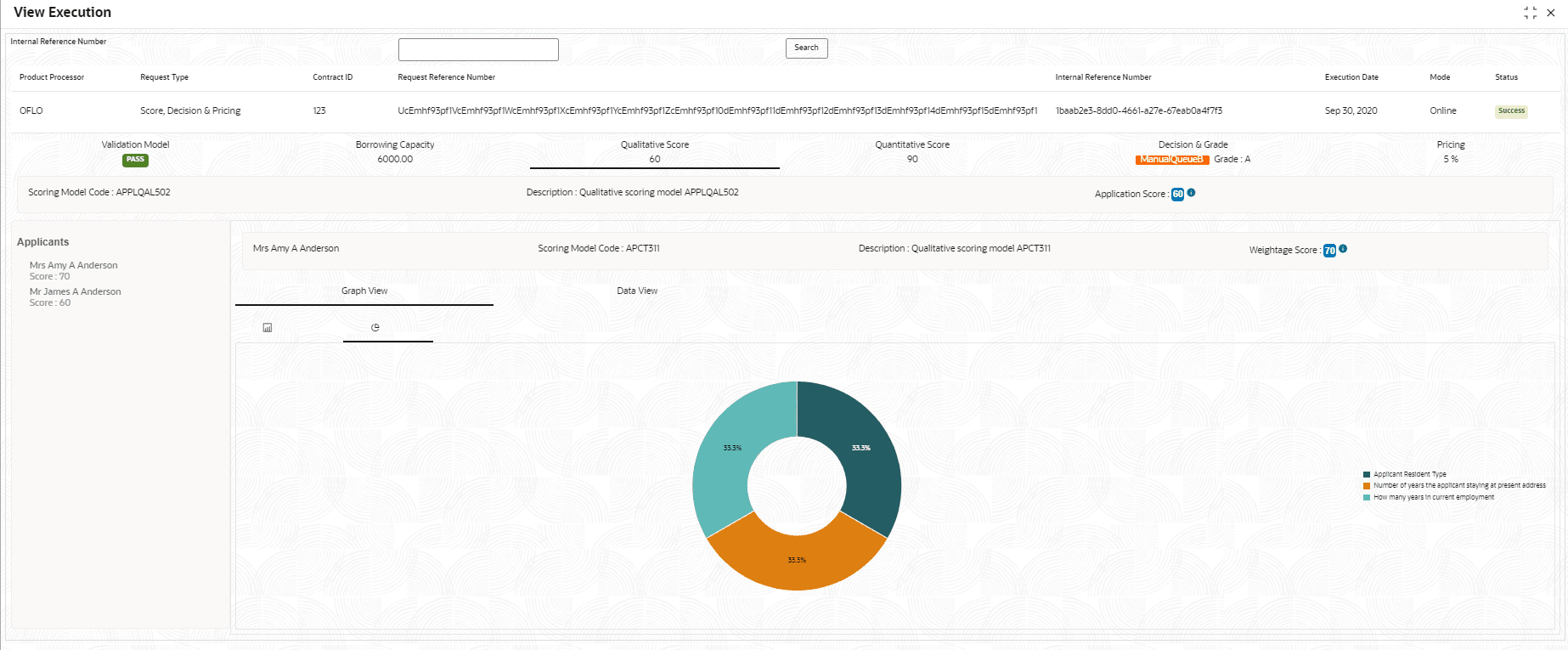

Figure 3-102 Qualitative Score Widget – Pie Graph View

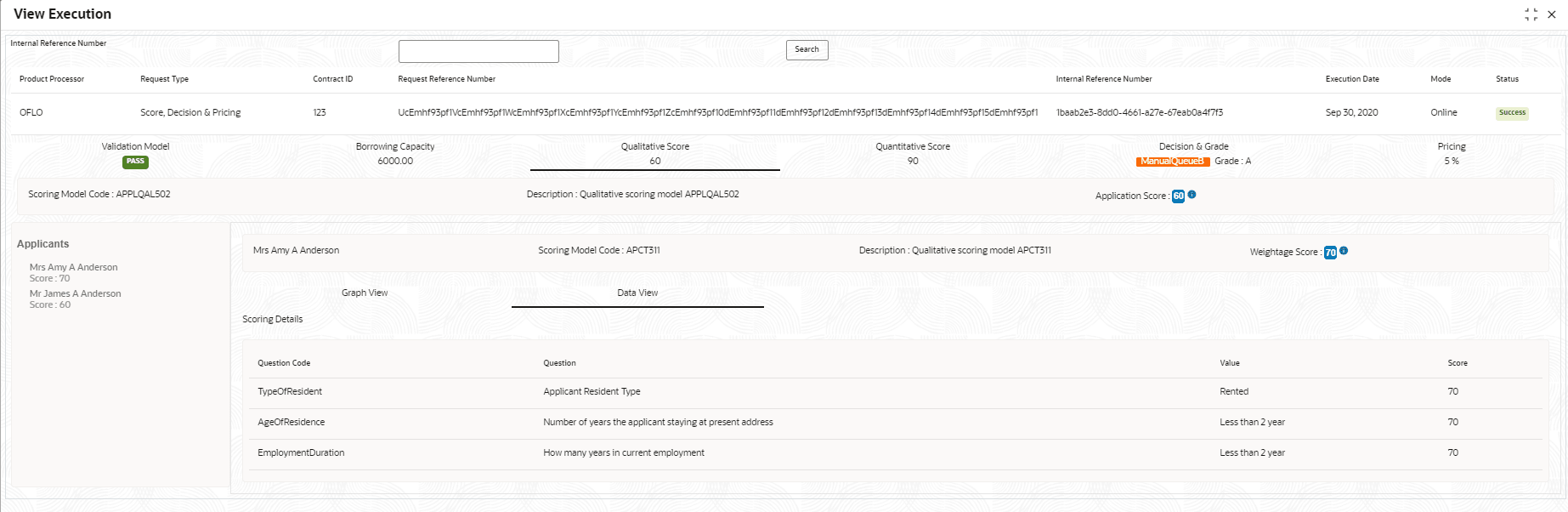

Figure 3-103 Qualitative Score Widget – Data View

For more information on fields, refer to the field description table.

Table 3-105 Qualitative Score Widget - Field Description

Field Description <Scoring Model Code> Displays the scoring model code resolved for credit decision.

- When Is Application Decision Required is Yes, the application level decision scoring code is displayed.

- When Is Application Decision Required is No, the applicant level decision scoring code is displayed.

- When Is Application Decision Required is No and Is Primary Applicant is No, the application level scoring code is displayed.

Description Displays the scoring model description resolved for credit decision. Weightage Score/Application Score Displays the qualitative credit score post credit decision of the application.

- When Is Application Decision Required is Yes, the field name is displayed as Application Score. The system performs the aggregation, which can be minimum, maximum or average of all applicant’s score. The aggregation performed is defined as rules and linked at the application level scoring model and this aggregated score is displayed.

- When Is Application Decision Required is No, the field name is displayed as Weightage Score. The score is displayed by resolving the applicant level scoring model.

- When Is Application Decision Required is No, and Is Primary Applicant is No, the field name is displayed as Application Score. The system performs the aggregation, which can be minimum, maximum or average of all applicant’s score. The aggregation performed is defined as rules and linked at the application level scoring model and this aggregated score is displayed.

Hover this icon to get the information about the formula for calculation of score. <Applicant Name> Displays the applicant names present in the application. <Score> Displays the weighted credit score post credit decision of the application.

The score is calculated for each applicant by resolving the applicant level scoring model.<Applicant Name> Displays the applicant names present in the application. Scoring Model Code Displays the applicant level scoring model code resolved for credit decision. Description Displays the applicant scoring model description. Weightage Score Displays the weighted credit score post credit decision of the application.

Hover this icon to get the information about the formula for calculation of score. Graph View Two graphical views are available.

- Bar Graphs

The details are shown as a graphical representation as bar charts.

- List of question ID on the X-axis

- Score on the Y-axis.

Based on the evaluation of the category, the questions are shown in a particular color based on the maintenance done in the lookups screen.

- Pie Charts

The details are shown as a graphical representation as pie charts.

The calculation logic for the question is (Score of the question/ Weightage score of the applicant)*100. The pis is shown from a pool of colors available/defined in the code.Data View The scoring details are shown as mentioned below in data view. Question Code Displays the question code resolved for the applicant in the scoring model. Question Displays the question description resolved for the applicant in the scoring model. Value Displays the response received for the question in the payload. Score Displays the score calculated for the question based on the range and the response.

In case any question was optional for which the response was not received, NA will be displayed.The following fields are displayed once you click the Quantitative Score widget.

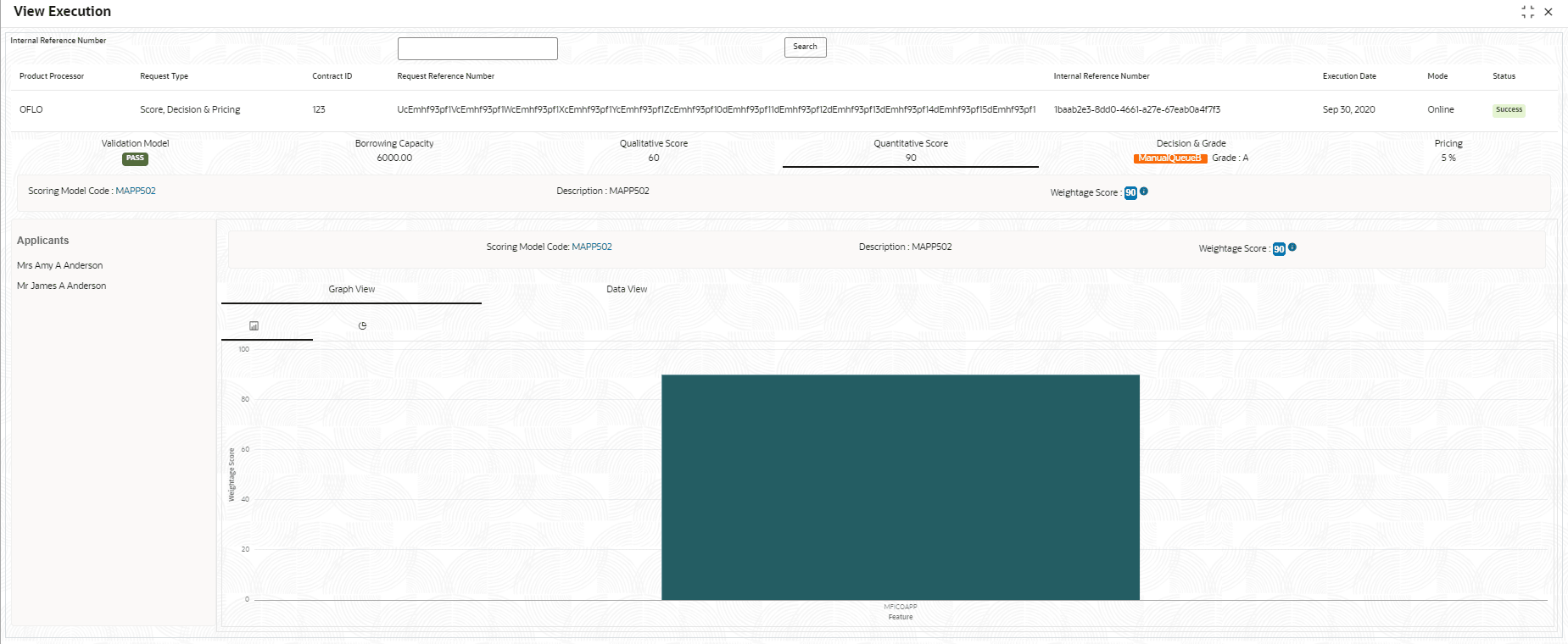

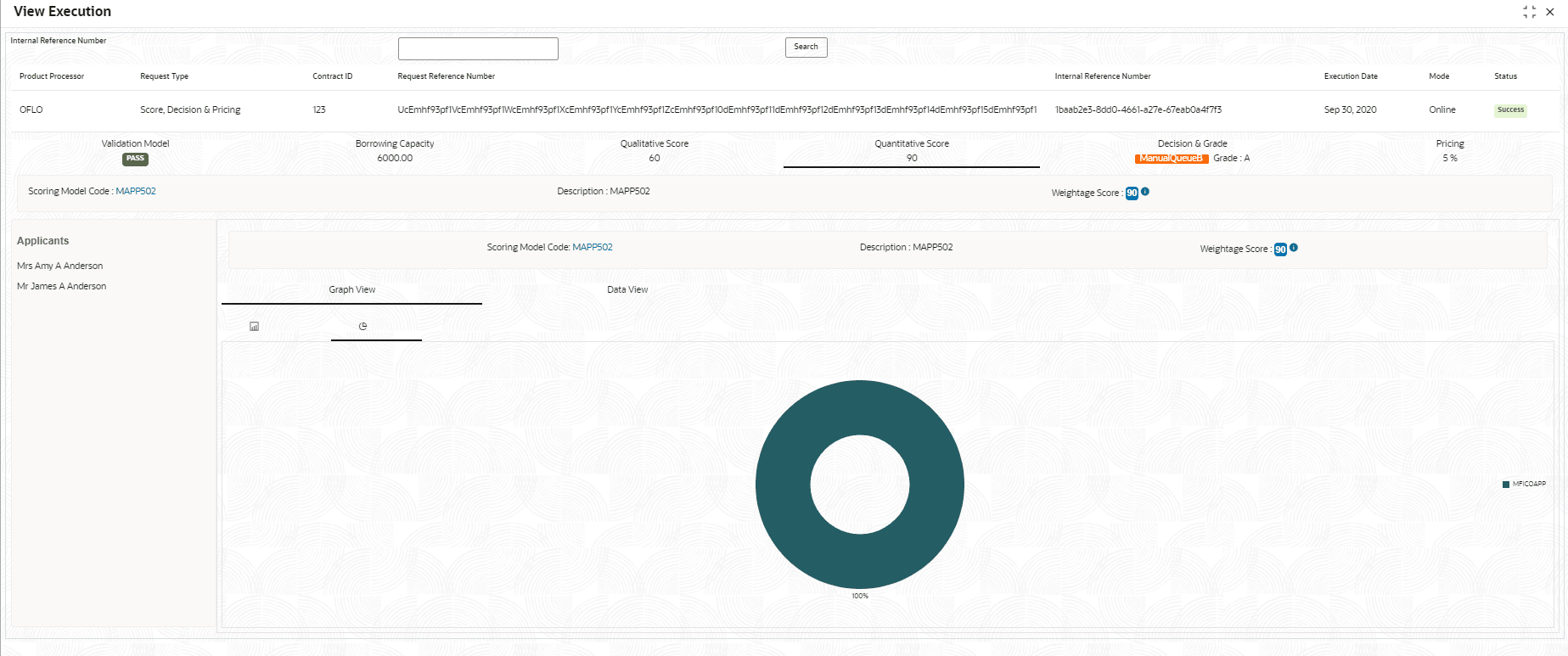

Figure 3-104 Quantitative Score Widget – Bar Graph View

Figure 3-105 Quantitative Score Widget – Pie Graph View

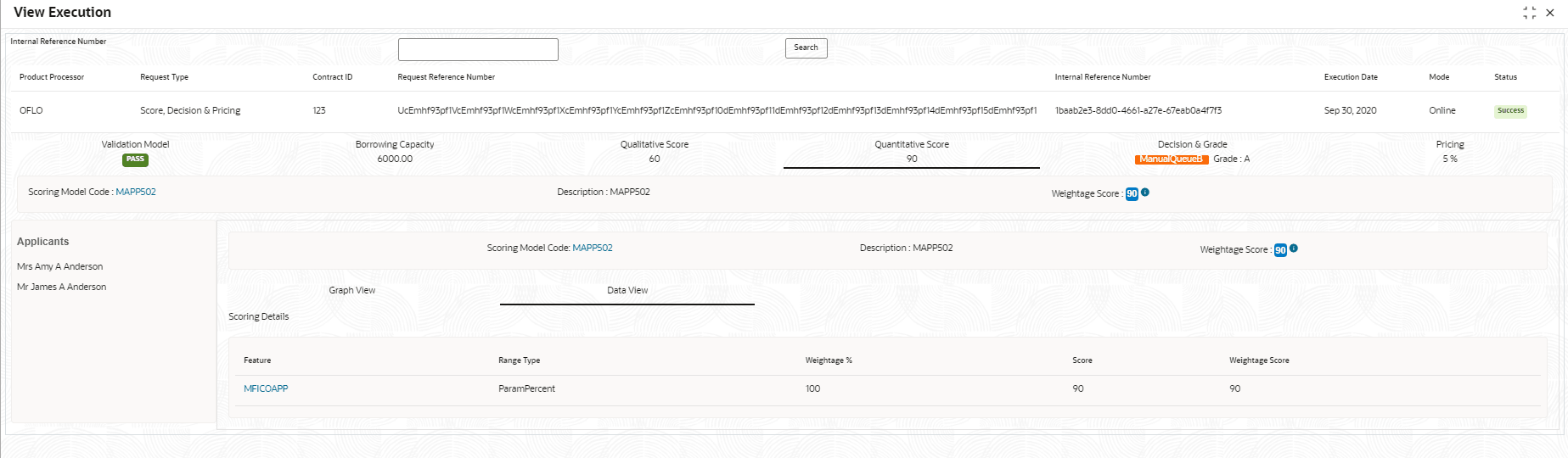

Figure 3-106 Quantitative Score Widget – Data View

For more information on fields, refer to the field description table.

Table 3-106 Quantitative Score Widget - Field Description

Field Description <Scoring Model Code> Displays the scoring model code resolved for credit decision.

- When Is Application Decision Required is Yes, the applicationlevel decision scoring code is displayed.

- When Is Application Decision Required is No, the applicant level decision scoring code is displayed.

- When Is Application Decision Required is No and Is Primary Applicant is No, the multi applicant level scoring code is displayed.

Click the hyperlink to view the rule executed to resolve the quantitative score.

Show Rule Log Click to see the rule log.

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Description Displays the scoring model description resolved for credit decision. Weightage Score Displays the weightage score post credit decision of the application.

- When Is Application Decision Required is Yes, the system performs the aggregation, which can be minimum, maximum or average of all applicant’s score. The aggregation performed is defined as rules and linked at the application level scoring model and this aggregated score is displayed.

- When Is Application Decision Required is No, the score is displayed by resolving the applicant level scoring model.

- When Is Application Decision Required is No and Is Primary Applicant is No, the score is displayed by resolving multi applicant level scoring model.

In case of Is Application Decision Required is Yes, the system displays the hyperlink on the weightage score value. It shows the aggregate rule details.

<Applicant Name> Displays the applicant names present in the application. <Score> Displays the weighted credit score post credit decision of the application.

The score is calculated for each applicant by resolving the applicant level scoring model.

In case of multi applicant scenario, weightage score per applicant is not shown.<Applicant Name> Displays the applicant names present in the application. Scoring Model Code Displays the applicant level scoring model code resolved for credit decision.

Applicant level scoring model is applicable for the below case.

- If Is Application Decision required is Yes

- If Is Application Decision Required is No, and Is Primary Applicant is Yes

Multi applicant level scoring model is applicable in the below case.

If Is Application Decision Required is No, and Is Primary Applicant is No.Click the hyperlink to view the rule executed to resolve the quantitative score.

Show Rule Log Click to see the rule log.

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Description Displays the applicant scoring model description. Weightage Score Displays the weighted credit score post credit decision of the application.

The weightage score is calculated for each applicant by resolving the applicant scoring model.

In case of multi applicant scoring model, for both the applicant the same score is shown since the score is not calculated per applicant.

Hover this icon to get the information about the formula for calculation of score. Graph View Two graphical views are available.

- Bar Graphs

The details are shown as a graphical representation as bar charts.

- List of features on the X-axis

- Weightage Score on the Y-axis.

Based on the evaluation of the category, the feature are shown in a particular color based on the maintenance done in the lookups screen.

Note:

For Multi Applicant scoring model all graphs is shown in the same color, as category evaluation is not applicable.- Pie Charts

The details are shown as a graphical representation as pie charts.

The calculation logic for the feature is (Weighted score of the feature/ Weightage score of the applicant)*100. The pie is shown from a pool of colors available/defined in the code.Data View The scoring details are shown as mentioned below in data view. Feature Displays the features resolved for the applicant in the scoring model. Click the hyperlink to view the rule executed to resolve the quantitative score.

Show Rule Log Click to see the rule log.

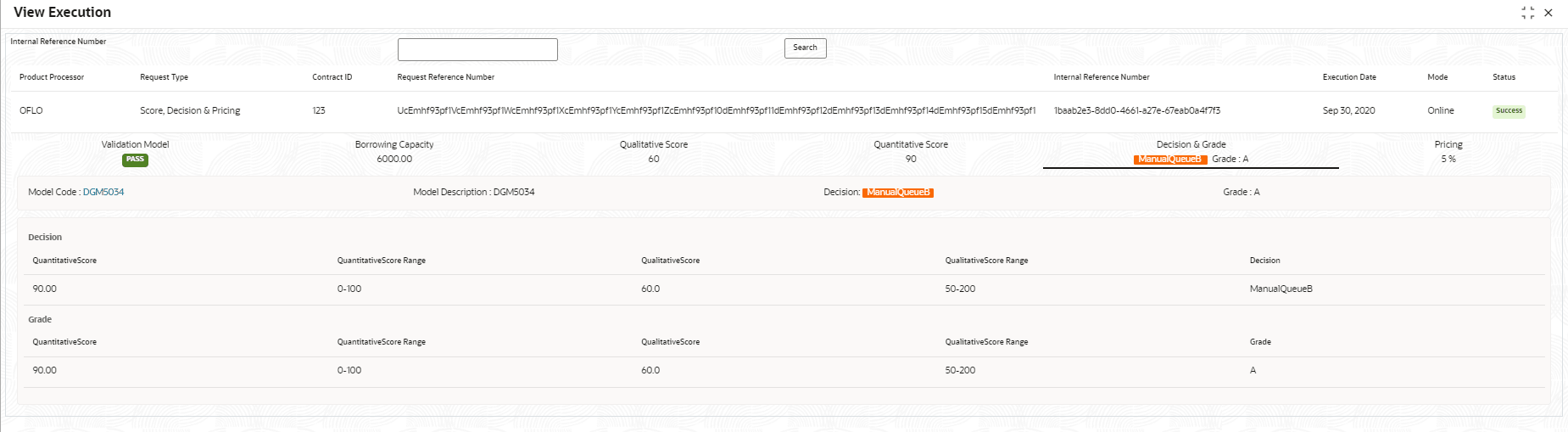

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Value Displays the value of the feature. Range Type Displays the range type for the feature. Range Displays the range resolved for the feature value for score resolution. Weightage % Displays the weightage defined for the feature in the scoring model. Score Displays the score calculated for the feature based on the range and feature value. Weightage Score Displays the weighed credit score post credit decision of the application. The following fields are displayed once you click the Decision and Grade widget.

For more information on fields, refer to the field description table.

Table 3-107 Decision and Grade Widget - Field Description

Field Description <Model Code> Displays the model code resolved for credit decision and grade. Show Rule Log Click to see the rule log.

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Model Description Displays the model description resolved for credit decision and grade. Decision Displays the credit decision taken for the application. Grade Displays the scoring grade post credit decision of the application. Quantitative Score Displays the quantitative score calculated for the application. If the feature is rule based, system displays the hyperlink.

Show Rule Log Click to see the rule log.

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Quantitative Score Range Displays the range resolved for the quantitative score value for score resolution. Qualitative Score Displays the qualitative score calculated for the application. Qualitative Score Range Displays the range resolved for the qualitative score value for score resolution. Decision Displays the credit decision taken for the application. Rule ID Displays the decision taken for the application. Click the hyperlink to view the rule executed.

Show Rule Log Click to see the rule log.

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Qualitative Score Displays the qualitative score calculated for the application. If the feature is rule based, system displays the hyperlink.

Show Rule Log Click to see the rule log.

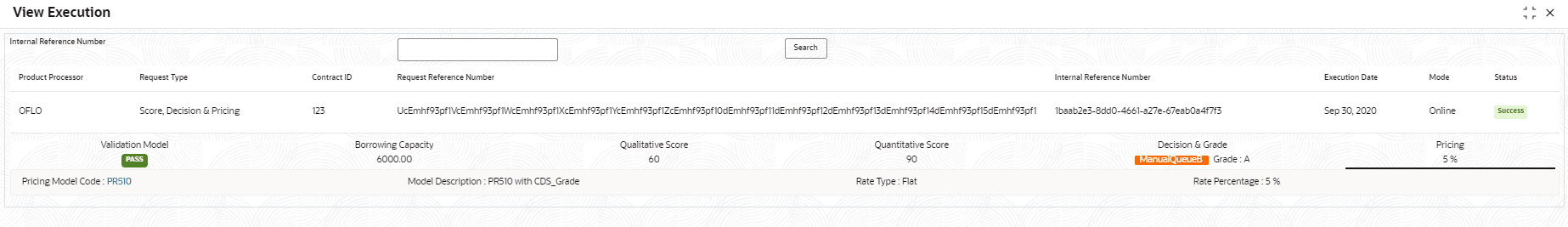

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Qualitative Score Range Displays the range resolved for the qualitative score value for score resolution. Quantitative Score Displays the quantitative score calculated for the application. Quantitative Score Range Displays the range resolved for the quantitative score value for score resolution. Grade Displays the scoring grade taken for the application. The following fields are displayed once you click the Pricing widget.

For more information on fields, refer to the field description table.

Table 3-108 Pricing Widget - Field Description

Field Description <Pricing Model Code> Displays the pricing model code resolved for credit decision. Click the hyperlink to view the rule executed to resolve the pricing model.

Show Rule Log Click to see the rule log.

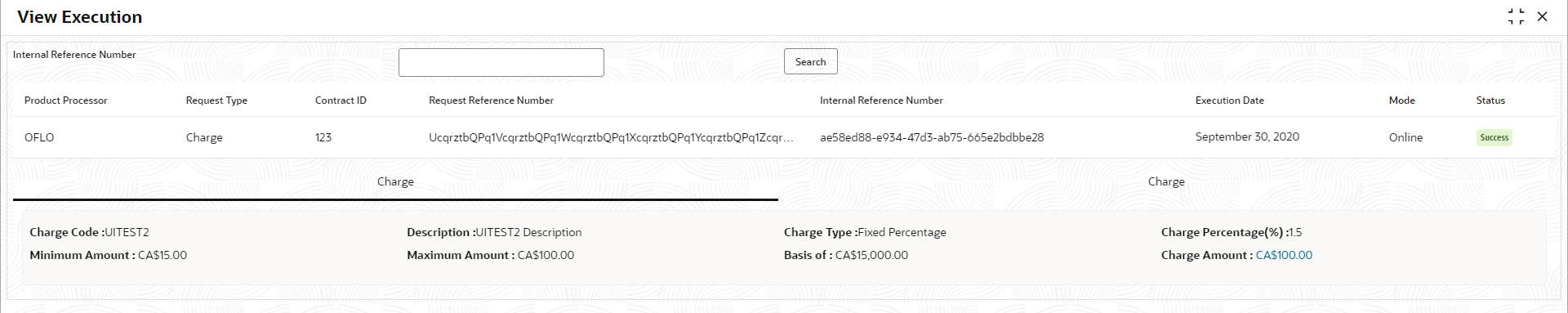

Click to expand the rule. Expression Displays the expression of the rule. Input Displays the input of the rule. Value Displays the value of the rule. Model Description View the pricing model description resolved for credit decision. Rate Type View the rate type applicable post credit decision. Rate Percentage View the rate applicable post credit decision. Loan Amount View the eligible loan amount for the application. Loan Tenure View the loan tenure for the application. Loan Amount Range View the range resolved for the loan amount value. Loan Tenure Range View the range resolved for the loan tenure value. Rate % View the rate applicable post credit decision. The following fields are displayed once you click the Charge widget.

For more information on fields, refer to the field description table.Table 3-109 Charge Widget - Field Description

Field Description <Charge Code> Displays the Charge code evaluated for credit decision. Description Displays the description of the charge code. Charge Type Displays the type of the charge code. Charge Percentage(%) Displays of percentage of the charge code. Minimum Amount Displays the minimum amount. Maximum Amount Displays the maximum amount. Basis of Displays the attribute on which the percentage is applied Charge Amount Displays the charge amount computated. Click the hyperlink to view the rule executed to resolve the pricing model.

Logic Displays the logic on which the charge amount has been calculated. Amount Displays the amount. Charge Amount Displays the charge amount calculated. Charge to be Applied Displays the charge applied.

Parent topic: Execution Summary