8.18.7 Cash Flow: Weighted Term

The Weighted Term method builds on the theoretical concepts of duration. As shown earlier, duration calculates a weighted-average term by weighting each time period, n, with the present value of the cash flow (discounted by the rate on the instrument) in that period.

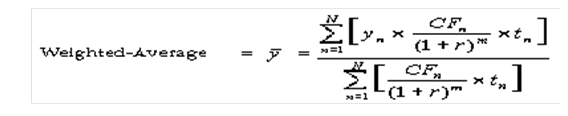

Since the goal of the Weighted Term method is to calculate a weighted average transfer rate, it weights the transfer rate in each period, yn, by the present value for the cash flow of that period. Furthermore, the transfer rates are weighted by an additional component, time, to account for the length of time over which a transfer rate is applicable. The time component accounts for the relative significance of each strip cash flow to the total transfer pricing interest income or expense. The total transfer pricing interest income or expense on any cash flow is a product of that cash flow, the transfer rate, and the term. Hence, longer-term cash flows will have a relatively larger impact on the average transfer rate. The Weighted Term method, with Discounted Cash Flow option selected, can be summarized by the following formula:

Figure 8-8 Weighted Term method

In this formula:

N = Total number of payments from Start Date until the earlier of repricing or maturity. CFn = Cash flow (such as regular principal, prepayments, and interest) in period n.

r = Periodic coupon rate on instrument (current rate or payments per year). m = Remaining term to cash flow n or active payment frequency.

tn = Remaining term to cash flow n, expressed in years. yn = Transfer rate in period n.

Within the Weighted Average Cash Flow method definition screen, users can choose whether or not to discount the cash flows as described earlier.