31.8 Caterpillar

The Caterpillar Method extends the concept of Strip Funding to instruments that do not have contractual Cash Flows. These products are known as Perpetual or Non-Maturity Products and therefore do not generate contractual Cash Flows. The process of determining Transfer Rates requires adopting the 'Strip Funding Approach' by splitting these products into 'Core' and 'Volatile' portions based on statistically established Behavioral Profiles. With this approach, the volatile portion may be considered as an overnight funding strip and the core portion can be dealt with by an assumed maturity structure defined through a Behavior Pattern. For example, statistical analysis may imply that the Savings Account portfolio behaves 20% as volatile and 80% as the core of which the maturity is likely to be 3 months. Therefore, the Funding Strips that would get created are 20% 1 month, and 80% 3 months.

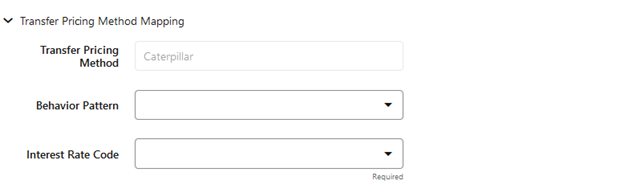

Figure 31-15 Caterpiller

Table 31-5 BEHAVIORAL PATTERN: 20% 1 Month; 80% 3 Months

| Production | IRC | |||||||

|---|---|---|---|---|---|---|---|---|

| Period | EOP Balance | 1M | 2M | 3M | 1M | 2M | 3M | TP Rate |

| Month 1 | 4000 | 800 | 3200 | 4.00% | 4.25% | 4.50% | 4.40% | |

| Month 2 | 7000 | 760 | 3200 | 3040 | 4.50% | 4.75% | 5.00% | 4.72% |

| Month 3 | 8500 | 3652 | 3040 | 1808 | 5.00% | 5.25% | 5.50% | 4.92% |

| Month 4 | 9000 | 3870 | 1808 | 3322 | 5.50% | 5.75% | 6.00% | 5.52% |

| Month 5 | 8000 | 2382 | 3322 | 2296 | 6.00% | 6.25% | 6.50% | 6.03% |

In the example, we assume that once a funding strip is assigned a certain Transfer Rate based on its original term, the rate remains constant until the strip matures. Each strip is funded for the original term based on the yield curve in effect at the start of the strip. In month 4, when the balance is 9000, the strips still outstanding from earlier months are 3040 as a 3-month term strip, created in month 2 at 5% having a remaining term 1-month; (3870-3040) 1-month term strip created in month 4, 1808 3-month term strip created in month 3 with the 2-month remaining term, and 3322 3-month term strip created in month 4. The weighted average rate of these strips comes to 5.52% as the example shows.

In summary:

Month 4 Transfer Rate = (3040*5% + (3870-3040)*5.5% + 1808*5.5% + 3322*6%) / 9000 = 5.52%

Note:

The Caterpillar Method must not be run more than once for a given date as this may corrupt the historical data. The strip data for this method is stored in the database in the CATERPILLAR_INTER_NEXTGEN table.