5.2.1 Creating an Interest Rate Code

To create an Interest Rate Code, follow these steps:

- Click Add from the Interest Rate Code Summary page.

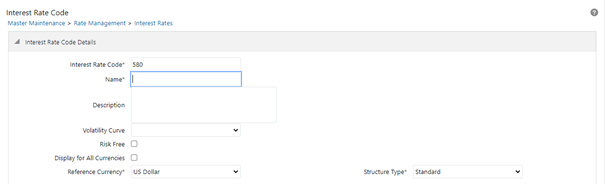

Figure 5-2 Interest Rate Code Details window

- Enter the following information in the Interest Rate Code window.

- Interest Rate Code: When constructing a new yield curve, you must specify an Interest Rate Code between 1 and 9999999. Interest Rate Codes are used internally to uniquely identify yield curves. When working with Rate Management or other OFS Analytical Applications, you reference yield curves by Name, not by Interest Rate Codes. Interest Rate Codes are embedded within your instrument data (for example, the INTEREST_RATE_CD and T_RATE_INT_RATE_CD columns within the instrument data are populated with Interest Rate Codes). After you have saved a yield curve, you cannot renumber its Interest Rate Code.

- Name and Reference Currency: You must provide a Name and Reference Currency for your yield curve. Unlike Interest Rate Codes, you can rename or change the Reference Currency for previously saved yield curves. While you can choose to rename a yield curve, however, it is very unlikely that you will choose to modify a yield curve's Reference Currency. A yield curve's Reference Currency is the currency for which your market rates are valid. For example, the Reference Currency for a Prime Rate yield curve would be US Dollars. LIBOR or other internationally quoted rates are always quoted with respect to an underlying Reference Currency (for example, US Dollar LIBOR, Euro LIBOR, and so on). The Reference Currencies drop-down list displays only Active currencies. For more information on Active and Inactive currencies, see the Currency section.

- Description: You can optionally describe or modify your yield curve's description at any time.

- Structure Type: This attribute is required for each yield curve. Structure Type supports both Standard and Hybrid yield curve definitions. Hybrid yield curves are re-expressions of one or more pre-existing Standard yield curves. For more information, see Hybrid Term Structure Tab under Interest Rate Code Tabs. After you have saved the yield curve, you cannot change the selected Structure Type.

- Volatility Curve: You can select the Volatility Curve option to indicate the curve selected will contain volatility rates. If you select this option, all other curve attributes become disabled and the curve is used exclusively for managing volatility details. For FTP Volatility, both the Terms tab and Historical Rates tab are available with this option. For ALM Volatility, only the Historical Rates tab is available. After you have saved the yield curve, you cannot change the selected Volatility Curve. Volatility curves are used in FTP to calculate the Rate Lock Option Costs. ALM Volatility is used to evaluate embedded options for the Black 76 market valuation.

- Risk-Free: (Optional) This flag is for tagging IRCs as risk-free. That is editable in new and edit modes. It is available for non-hybrid curves and hybrid curves, and not available for Volatility Curves.

- Display for all currencies: This option allows you to designate certain Interest rate curves to make them available for assumption mapping to any currency. Assumption rules filter the list of Interest Rate Codes based on the currency when defining assumptions for a specific product/currency combination. When this option is enabled, the Interest Rate Code appears in assumption rules for all currencies.

- Click Save. To build out the Interest Rate Code, you must enter data within the Interest Rate Code tabs. For more information, see the Interest Rate Code Tabs section.