5.2.2.3 Hybrid Term Structure Tab

Hybrid Term Structures allows you to specify the following three types of Hybrid yield curves:

- Spread

- Moving Average

- Merge

Note:

Minimum and Maximum Hybrid IRC types from the Hybrid IRC type selection are intended for future enhancement and must be ignored in the current release.The Parameters and Hybrid Term Structure tabs are disabled if the Volatility Curve is checked.

Hybrid yield curves are built up from either one or more standard yield curves. When

you add, modify, or delete any historical rate data from a standard yield curve, the

data associated with any related hybrid yield curve must be updated. After defining, the

Hybrid yield curves can be used like any other interest rate curve in the system. You

can reference these curves within the OFSAA application business rules that allow the

selection of an Interest Rate Code.

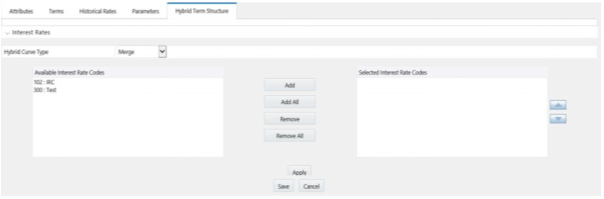

Figure 5-9 Hybrid Curve tab on Interest Rate Code window

Hybrid Curve Type: Spread: A Spread hybrid yield curve is defined as the difference between two standard yield curves. The Spread type of hybrid yield curve is useful in establishing liquidity risk or basis risk yield curves.

- Moving Average: Moving average hybrid yield curves represent moving average data of a single underlying standard yield curve. These curves are used in Funds Transfer Pricing.

- Merge: Merge hybrid yield curves represent a blending of two or more underlying yield curves. In constructing a Merge type of hybrid yield curve, specify the percentage weighting applied to each of the underlying standard hybrid yield curves.