8.14 Prepayment Model Method

The Prepayment Model method allows you to define more complex prepayment assumptions compared to the other prepayment methods. Under this method, prepayment assumptions are assigned using a custom Prepayment model.

You can build a Prepayment model using a combination of up to three prepayment drivers and define prepayment rates for various values of these drivers. Each driver maps to an attribute of the underlying transaction (age/term or rate) so that the cash flow engine can apply a different prepayment rate based on the specific characteristics of the record.

All prepayment rates should be input as annual amounts.

Prepayment Model Structure

A typical Prepayment model structure includes the following:

- Prepayment Drivers: You can build a Prepayment model using one to three prepaymentdrivers. A driver influences the prepayment behavior of an instrument and is either an instrument characteristic or a measure of interest rates.

- The Prepayment Driver Nodes: You can specify one or more node values for each ofthe prepayment drivers that you select.

- Interpolation or Range method: Interpolation or Range methods are used to calculate prepayment rates for the prepayment driver values that do not fall on the definedprepayment driver nodes.

Types of Prepayment Drivers

The Prepayment Drivers are designed to allow the calculation of prepayment rates at runtime depending on the specific characteristics of the instruments for which cash flows are being generated. Although nine prepayment drivers are available, a particular prepayment model can contain only up to three prepayment drivers.

Prepayment drivers can be divided into the following two categories:

- Age/Term Drivers: The Age/Term drivers define term and repricing parameters in a Prepayment model. All such prepayment drivers are input in units of months. Thesedrivers include:

- Original Term: You can vary your prepayment assumptions based on the contractual term of the instrument. For example, you could model faster prepayment speeds for longer-term loans, such as a 10-year loan, than for short-term loans, such as a 5-year loan. You would then select the Original Term prepayment driver and specify two node values: 60 months and 120months.

- Repricing Frequency: You can vary your prepayment assumptions based on the repricing nature of the instrument being analyzed. Again, you could specify different prepaymentspeeds for different repricing frequencies and the system would decide which one to apply at runtime on a record-by-record basis.

- Remaining Term: You can specify prepayment speeds based on the remaining term to maturity. For example, loans with few months to go until maturity tend to experiencefaster prepayments than loans with longer remaining terms.

- Expired Term: This is similar to the previous driver but instead of looking at the term to maturity, you base your assumptions on the elapsed time. Prepayments show some aging effects such as the loans originated recently experiencing more prepayments than olderones.

- Term to Repricing: You can also define prepayment speeds based on the number ofmonths until the next repricing of the instrument.

- Interest Rate Drivers: The Interest Rate drivers allow the forecasted interest rates to drive prepayment behavior to establish the rate-sensitive prepayment Run-off. Interest Rate Drivers include:

- Coupon Rate: You can base your prepayment assumptions on the current gross rate on the instrument.

- Market Rate: This driver allows you to specify prepayment speeds based on the market rate prevalent at the time the cash flows occur. This way, you can incorporate your future expectations on the levels of interest rates in the prepayment rate estimation. For example, you can increase prepayment speeds during periods of decreasing rates and decreaseprepayments when the rates go up.

- Rate Difference: You can base your prepayments on the spread between the current grossrate and the market rate.

- Rate Ratio: You can also base your prepayments on the ratio of current gross rate tomarket rate.

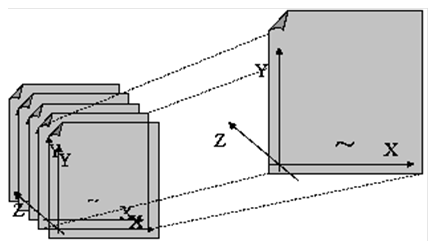

Figure 8-1 Three-driver Prepayment Model

The ~ signifies a point on the X-Y-Z plane. In this example, it is on the second node of the Z- plane. The Z -plane behaves like layers.

Oracle Asset Liability Management allows you to build prepayment models using the Prepayment Model rule. The Prepayment Model rule can then be referenced by a Prepayment Rule. See the Prepayment Models section.