31.24 Typical Calculations

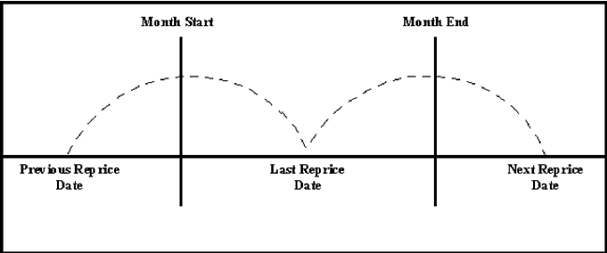

The following diagram depicts a Mid-Period Repricing situation where the instrument reprices during the current processing month.

Figure 31-24 Mid-Period Repricing

If an instrument reprices during the current processing month, then there are multiple Repricing Periods spanning the current month. In this example, there are two Repricing Periods in the current processing month and the computed last Repricing Date > beginning of processing month. Consequently, the Repricing Dates need to be rolled back by the repricing frequency until the Prior Last Repricing Date (Prior LRD) <= Beginning of Month and the Mid-Period Repricing Computation process should be executed as follows:

- Computation of transfer rate for the current Repricing Period.

- Transfer Pricing Term: Next Reprice Date - Last Reprice Date

- Transfer Pricing Date: Last Reprice Date

- Number of Days at that Rate: End of Month + 1- Last Reprice Date

If the Computed Next Reprice Date (the next Repricing Date for a given Repricing Period) is less than or equal to the End of Month, then the Number of Days calculation uses the Computed Next Reprice Date in place of End of Month. In other words, the Number of Days equals the Minimum (End of Month + 1, Computed Next Reprice Date) - Maximum (Beginning of Month, Computed Last Reprice Date). This example assumes the use of the Straight Term Transfer Pricing Method. The following table describes the logic for the computation of the transfer rates for each method.

Table 31-11 Logic of Computation of the Transfer Rates for each method

| Method | Date for Rate Lookup | Terms | Interest Rate Code | Spread |

|---|---|---|---|---|

| Straight Term | Beginning of Reprice Period | Transfer Pricing Term | Specified in Transfer Pricing rule | Not Applicable |

| Spread from Interest Rate Code | Beginning of Reprice Period (adjust by Lag Term in TP Rule) | Specified in Transfer Pricing rule | Specified in Transfer Pricing rule | Specified in Transfer Pricing rule |

| Spread from Note Rate | Beginning of Reprice Period | Transfer Pricing Term | Interest Rate Code from Record | Specified in Transfer Pricing rule |

| Redemption Curve | Beginning of Reprice Period | Specified in Transfer Pricing rule | Specified in Transfer Pricing rule | Not Applicable |

- If the computed last Repricing Date > beginning of processing month, roll back to the Prior Repricing Date.

Since the Last Repricing Date is greater than the Beginning of the Processing month, the Roll Back is done as follows:

Computed Next Reprice Date is reset to Last Reprice Date

Computed Last Repricing Date is reset to Last Repricing Date - Reprice Frequency (Prior LRD)

- Computation of the prior period transfer rate.

- Transfer Pricing Term: Last Reprice Date - Prior LRD

- Transfer Pricing Date: Prior LRD

- Number of Days at that Rate: Last Reprice Date - Beginning of Month

If the Computed Last Reprice Date (the last Repricing Date for a given Repricing Period) is greater than the Beginning of Month, then the Number of Days calculation uses Computed Last Reprice Date in place of the Beginning of Month. In other words, the Number of Days equals Minimum (End of Month + 1, Computed Next Reprice Date) - Maximum (Beginning of Month, Computed Last Reprice Date).

- Repetition of steps 2 and 3 as necessary. In this example, only one iteration is needed because Prior LRD is less than the Beginning of the Month.

- Computation of the final transfer rate by weighting the results (from current and previous repricing periods) by average balances and days.

The calculation makes the following assumptions:

- CUR_TP_PER_ADB is the balance applying since the Last Reprice Date.

- PRIOR_TP_PER_ADB is the balance applying to all prior Repricing Periods.

- Application of the final transfer rate to the instrument record.