10.1.6 Calculate Static Spread

The static spread is calculated using the Newton-Raphson algorithm. If the Newton-Raphson algorithm does not converge, we revert to a brute search algorithm, which is much slower.

Note:

This can happen if cash flows alternately in sign.The user can control the convergence speed of the algorithm by adjusting the value of the variable Option Cost Speed Factor. This variable is defined in the Oracle FTP Application Preferences screen.

The default value is equal to one. A lower speed factor results in better accuracy of the results:

Note:

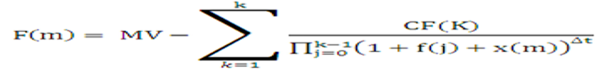

In all our experiments, a speed factor equal to one resulted in a maximum error (on the static spread and OAS) lower than half a basis point.For convenience, we recap hereafter Newton's algorithm. Let x be the static spread. At each iteration m we define the function F(m) by the following equation:

Equation 8

Figure 10-9 Equation 8

Description of the Transfer Pricing Option Cost Equation 8 follows:

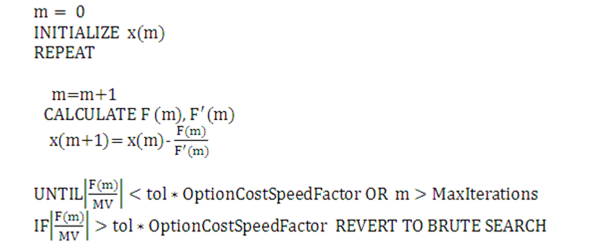

The algorithm is:

Equation 9

Figure 10-10 Equation 9

Description of the Transfer Pricing Option Cost Equation 9 follows:

For performance reasons, the code uses a more complicated algorithm albeit similar in spirit than the one described earlier. This is the reason why we did not give specific values for tol (tolerance) and Max Iterations or details on the brute search.