- Cash Flow Engine Reference Guide

- Cash Flow Calculations

- Additional Processing Events

- Deferred Amortization Calculation Steps

7.9.1 Deferred Amortization Calculation Steps

- Determine the Flat Rate scenario.

- The process may already have a flat rate scenario. If the change from the base rates is zero for all buckets and all interest rate codes, then there is a flat rate scenario.

- If there is not a flat rate scenario, then a flat rate scenario is created. This scenario is created by reading in the base rates and applying a zero change for all buckets.

- Determine if a record needs to have deferred amortization records calculation

applied to it.Deferred Amortization Records are instruments or new business records where the column Deferred_cur_bal is not equal to zero.

- Calculate Cash Flows for the instrument from As-of-Date until maturity using

the flat rate scenario.

- If one of the scenarios within the process is a flat rate scenario, further cash flows do not need to be generated. The cash flows from the flat rate scenario can be used.

- If the instrument is not rate-sensitive, further cash flows do not need to be generated. The cash flows from any scenario can be used.

- In all other cases, cash flows in a flat rate scenario must be generated.

- Calculate the internal rate of return (IRR)Internal Rate of Return is calculated as follows:The calculation starts with the CUR_NET_RATE in the instrument record and iteratively calculates the IRR to a precision of 0.001%. Pseudocode follows:

- Step-1: Initial Value: Internal Rate of Return

(IRR) = Current Net Rate Delta = 0.0 Total MV = 0 Total Derivative = 0

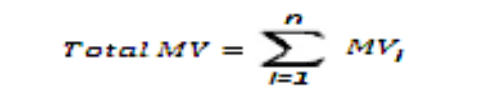

Figure 7-3 MV Calculation Flow

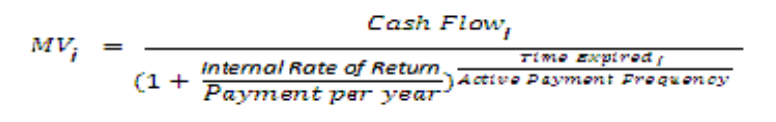

Figure 7-4 MV Cash Flow Calculation

- Step-2:

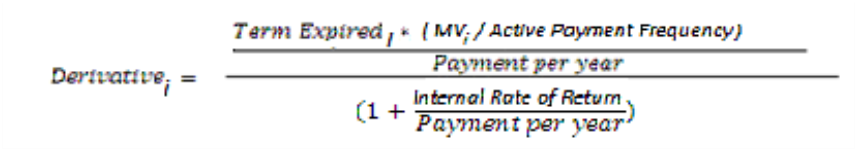

Loop through each Cash Flow (calculated using Flat rates, as mentioned in point 3) and calculate Total MV, Total Derivative. At the end of the loop, Delta is calculated. These will be calculated for each iteration. Conditions for iteration: absolute of Delta > 0.000001 and Iteration > Max Iterations. If Delta goes below 0.000001 or Max Iteration of 500 is reached, iteration stops.

Formula:

- Total MV is the summation of MV of each Cash Flow.

- Total Derivative is the summation of Derivative of each MV.

- After the loop through the Cash Flow ends, the delta is calculated using Total MV and Total Derivative.

- Internal Rate Return is then updated as IRR - Delta.

If the engine loops into the next iteration, this updated IRR will be used for Total MV and Total Derivative calculation in the next iteration. If there is no further iteration, then updated IRR is used for Deferred Runoff calculation.

Figure 7-5 Derivative of MV

- Step-3:

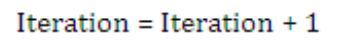

If absolute of delta > 0.000001 and Max iteration < 500, the engine moves to next iteration, andTotal MV, Total Derivative, Delta, and IRR get calculated again as mentioned in Step-2.

Figure 7-6 Iteration Formula

Note:

Payment per year is calculated as follows:If Payment Frequency Multiplier is DAY then = 365.0 / Payment Frequency, If Payment Frequency Multiplier is MONTH then = 12.0 / Payment Frequency.

If Payment Frequency Multiplier is YEAR then = 1.0 / Payment Frequency.

Where Payment Frequency is data given in PMT_FREQ in the Instrument Record

Expired Term is calculated as follows:

When Payment Frequency Multiplier is DAY, then = Cash flow date - As of Date.

When Payment Frequency Multiplier is MONTH then = (Cash Flow Date – As of Date) / Days in the month. Here Days in month= 365/12.

When Payment Frequency Multiplier is YEAR then = (Cash flow date - As of date) / 365

- Step-1: Initial Value: Internal Rate of Return

(IRR) = Current Net Rate Delta = 0.0 Total MV = 0 Total Derivative = 0

- Calculate the Spread to use in each scenarioThe calculation is: Spread = (IRR -c), where ‘c’ is cur_net_rate when the instrument is not rated sensitive (fixed rate). If the instrument is rate sensitive, the repriced rate on the next reprice event is considered for calculation. If the instrument is rate sensitive and in tease, the next reprice rate after the tease period is considered for calculation. Once the repriced rate is derived, the system uses this rate for calculating spread, for that instrument.

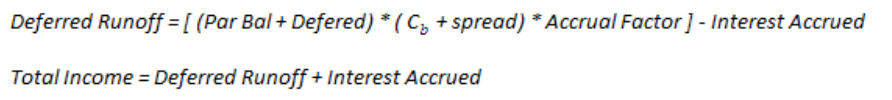

- Calculate the deferred runoff financial elements in each bucket and for each

scenario.The deferred runoff must be calculated first.For each modeling bucket, calculate the amount of total income to be recognized as:

Figure 7-7 Deferred Runoff Formula

Where:Par Bal = Average Balance for Current Bucket, Scenario.Cb = Average Rate/ Average Balance for Current Bucket, Scenario.Deferred = Deferred End Balance in the previous bucket, Deferred_cur_bal in bucket 1Interest Accrued = Interest Accrual Net for Current Bucket, ScenarioAccrual Factor is the portion of the year that the modeling bucket represents. This calculation varies according to the accrual basis code associated with the instrument. The financial element 140, Average Balance should be used for ParBal in the formula mentioned earlier.In the bucket in which the instrument matures, if this bucket falls within the modeling horizon, the deferred runoff should be set equal to the remaining deferred balance. This is to ensure that the entire deferred balance is run off by the maturity date.The financial element 160, Average Rate should be used for Cb calculation in the formula mentioned earlier.Calculate the change in the deferred balance as:Deferred Balance End = (Deferred Balance beginning- Deferred Runoff).

Where:Par Bal = Average Balance for Current Bucket, Scenario.Cb = Average Rate/ Average Balance for Current Bucket, Scenario.Deferred = Deferred End Balance in the previous bucket, Deferred_cur_bal in bucket 1Interest Accrued = Interest Accrual Net for Current Bucket, ScenarioAccrual Factor is the portion of the year that the modeling bucket represents. This calculation varies according to the accrual basis code associated with the instrument. The financial element 140, Average Balance should be used for ParBal in the formula mentioned earlier.In the bucket in which the instrument matures, if this bucket falls within the modeling horizon, the deferred runoff should be set equal to the remaining deferred balance. This is to ensure that the entire deferred balance is run off by the maturity date.The financial element 160, Average Rate should be used for Cb calculation in the formula mentioned earlier.Calculate the change in the deferred balance as:Deferred Balance End = (Deferred Balance beginning- Deferred Runoff).