11.1 Definitions

The following characteristics define an Interest Rate Code:

- Accrual Basis

- Compound Basis

- Rate Format

The accrual basis can be:

- 30/360

- 30/365

- 30/Actual

- Actual/Actual

- Actual/365

- Actual/360

- Business/252

Note:

See Stigum, M, and Robinson Money Market and Bond Calculations, Irwin, 1981, for definition.The compound basis can be:

- Daily

- Monthly

- Quarterly

- Semi-annual

- Annual

- Simple

The Rate Format can be:

- Zero-coupon Yield

- Yield-to-Maturity

- Discount Factor

The discount factor is used only internally and cannot be specified as an input rate format in the Rate Management Interest Rate setup. For bonds issued at par with payment frequency equal to the compound basis, the yield-to-maturity at origination is equal to the coupon. There are several definitions of yield-to-maturity. The unconventional true yield definition of Stigum is not used. Instead, the Street convention is preferred.

Table 11-1 Discount factor Example

| Symbol | Name | Notes |

|---|---|---|

|

AI(Ti) |

Accrued interest for the i-th security. |

|

|

C(Ti) |

Coupon value of the i-th security. |

This is the true $value of the cash flow (not annualized) |

|

m |

Compounding frequency (per year). |

Possible values are: 12 – monthly 2 – semi-annual 1- annual 0- Simple. |

|

ni |

Number of full compounding periods from As of Date up to term Ti |

|

|

P(T) |

The discount factor with term Ti |

Value of a zero-coupon bond with term Ti and par=$1. |

|

r |

The total number of securities. |

|

|

Ti |

The term in Act/Act years of the i-th security. |

Sorted in ascending order. |

|

L(i,k) |

Time in Act/Act years of the start of the k-th (k=0…ni) compounding period for security i. |

|

|

wi |

Residual, that is, the number of compounding periods between the current date and the next compounding date for i-th security. |

|

|

yTM(Ti) |

Yield-to-maturity of the i-th security |

|

|

yzc(Ti) |

The zero-coupon yield of the i-th security |

|

Note:

See Fabozzi, F. The Handbook of Fixed Income Securities. McGraw Hill, 1977.The yield curve is composed of r par bonds with different terms. Par value is equal to $1.

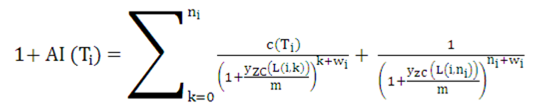

The zero-coupon yield is the vector of r values yzc(Ti) that solve the following set of r equations:

Equation1

Figure 11-1 Equation1

Description of Rate Conversion Equation 1 follows If compounding is simple, OR:

Equation 2

Figure 11-2 Equation 2

Description of Rate Conversion Equation 2 follows:

otherwise

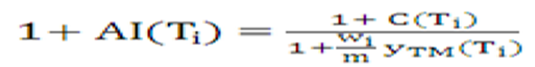

The yield-to-maturity for the i-th security is the value yTM(Ti) that solves the equation.

Equation 3

Figure 11-3 Equation 3

Description of Rate Conversion Equation 3 follows:

If compounding is simple, or

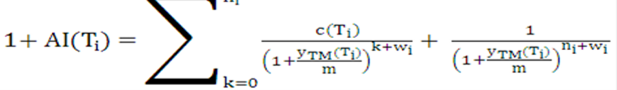

Equation 4

Figure 11-4 Equation 4

Description of Rate Conversion Equation 4 follows

otherwise: