19.3.1 European Expiry

A European Expiry may be exercised only at the Expiry Date of the option, that is, at a single pre-defined point in time.

Call Option

- Firstly, the underlying bond has to be priced for the given 'As of Date'.

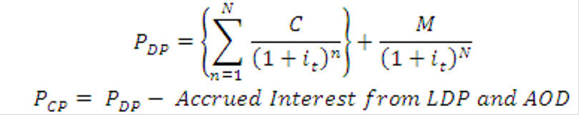

Figure 19-1 PCP Formula

Description of PCP Formula follows:

Where:

it= Interest Rate at time t

C = F * c = Coupon Payment

Where F = Face Value of the bond

c = Coupon Rate

N = Number of Payments

M = Maturity Value of the bond

PCP= Clean Price of the bond

PDP= Dirty Price of the bond

LDP = Last Payment Date

AOD = As of Date

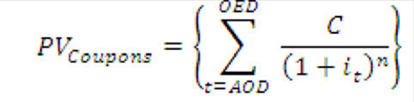

- Calculate the present value of the coupon payments during the life of the

option. ( Coupon payments between the As of Date and the Option Expiry Date(OED))

Figure 19-2 Formula to Calculate the PDP

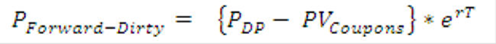

- Calculate the Bond Forward Price as of the Option Expiry Date

Figure 19-3 Formula to Calculate the P Forward-Dirty

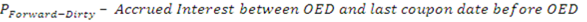

- Calculate the P Forward-Clean as equal to

Figure 19-4 Formula to Calculate the P Forward-Clean

- If Strike Price is less than PForward - Clean then the Call Option can be exercised.

- Market Value when the option on the instrument is exercised is as follows:

- Market Value when the option is not exercised: will be the Market Value of the underlying instrument.

Note:

If Strike Price is greater than PForward - Clean then the Put Option can be exercised. The rest of the procedure for calculating Put Option is the same as that for Call Option.