12.2.2 Implied Forward

Implied Forward Rates are calculated by looking at today's yield curve and inferring the future rate value.

- Retrieve Yield Curve

The Implied Forward Calculation starts with the Current Yield Curve. The Yield Curve is retrieved from the historical rates database.

- Calculate equal-month terms from the Yield Curve

The terms of the Yield Curve must be translated into equal-month values. For daily terms, the system must calculate the portion of a month the daily value represents. For monthly terms, the exact unit of the term point is used. For yearly terms, the unit of the term point is multiplied by 12.

- Calculate equal-month time for the Modeling Buckets

The Modeling Buckets are also translated into equal-month time. The same process can be followed as mentioned earlier.

- Apply formula calling the Cubic Spline Function

To determine the Implied Forward Rates, the process must step through each modeling bucket and each term on the Yield Curve.

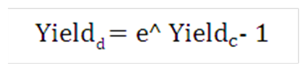

The process will loop as follows:

Figure 12-4 Implied Forward Rate Formula

Description of the process to determine the Implied Forward Rates follows In the earlier formula, cubic spline refers to the cubic spline function. This function, currently used in the Rate Generator for Monte Carlo, takes a term as an argument and returns the smoothed yield for that term.

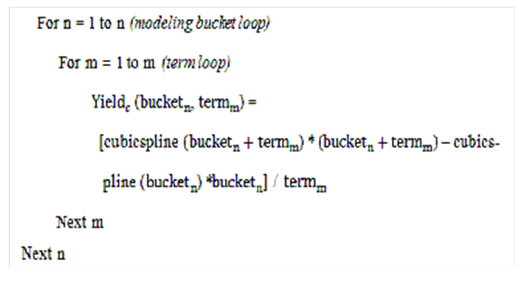

- Translate Continuous Yields to Discrete Yields

The output of the formula mentioned earlier produces a Continuous Yield, referred to as Yieldc. The required format for yield is a Discrete Yield. To translate from the Continuous Yield to the Discrete Yield (Yieldd), the following formula must be applied:

Figure 12-5 Formula for Continuous Yield to the Discrete Yield