20.3 Inflation Indexing Logic

If Inflation Adjustment Type (INDEX_ADJ_TYPE) is “Not applicable” then Instrument is NOT treated as Inflation-indexed. Else, if it is “Principal and Interest” or “Principal only” or “Interest only”, the engine determines the instrument as inflation-indexed.

After the instrument is determined as inflation-indexed, the engine calculates Index Factor, and Inflation adjusted Principal, Inflation adjusted Interest, and Adjustment to Principal and Adjustment to Interest.

- Calculation of Index Factor

The logic of calculation is dependent on Capital protection category (CAP_PROTECTION_CATEGORY)

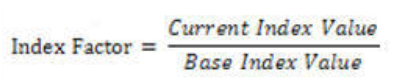

- If Capital Protection Category is ‘0’ (No Floor) then

Figure 20-1 Calculation of Index Factor

Description of the Index Factor Formula follows:

For example, if Base index value given = 100, on a given date, Current Index Value = 98. When capital protection category is “No Floor”, index factor = 98/100 = 0.98.

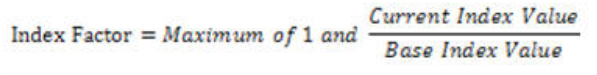

If Capital Protection Category is ‘1’ (Floor of 1) then:

Figure 20-2 Calculation of Index Factor Formula

Description of the Index Factor Formula follows If Base index value given = 100, and current index value = 98, if capital protection category is “Floor of 1”, then index factor = 1, maximum of 1 and calculated index factor of 0.98.

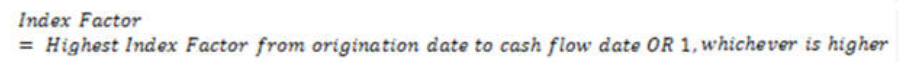

- If Capital Protection Category is ‘2’ (Max during life) then:

Figure 20-3 Index Factor Formula

Description of the Index Factor formula follows:

When the capital protection category = Max during life, the engine would not be able to go back to obtain historical index value for calculation of maximum index value from the origination date till as of date. Hence max index value from origination to as of date needs to be provided in the field- MAX_INDEX_VALUE. The engine will use this value and forecasted Index factor (calculated) to determine Max's Index Value.

- . If Max_index_value given is 101 (index factor =

101/100 = 1.01, assuming base index of 100), index

factor calculated on previous date is 1.03, whereas for

current date it is 0.98. Then Index factor (max) for

current date= 1.03, maximum of 1.01, 1.03, 0.98.

If instead Max_index_value is 104 (index factor = 1.04 assuming base index of 100), then index factor (max) for current date= 1.04, maximum of 1.04, 1.03 and 0.98.

If the Index factor (max) goes below 1, then the floor of 1 is applied:

For dynamic business, this field is not required, as the engine will be able to calculate Index Factor from the New Business Origination date, hence will calculate Max Index Factor from Origination.

If INDEX_ID, given in Instrument data, is NULL or ‘0’ “Current Index Value” is obtained from FSI_ACCOUNT_INDEX_HIST. The engine will match the instrument with Index data using Identity Code, Id Number, and As of Date. The index value for the respective date will be derived from given applicable date ranges.

If Index Value needs to be derived from the forecasted Economic Indicator, INDEX_ID should be populated with Economic Indicator System ID. Index Value for the respective date will be derived from the applicable forecasted Modeling Time Bucket.

“Base Index Value” is available at the instrument record.

Note:

Index Factor is only populated at FSI_O_PROCESS_CASH_FLOWS table, as FE 194. For more information on FE, see Financial Elements. If Economic Indicator is used to set up Index value, the field Value Type in Rate management Economic Indicator UI should be saved as Numeric. - . If Max_index_value given is 101 (index factor =

101/100 = 1.01, assuming base index of 100), index

factor calculated on previous date is 1.03, whereas for

current date it is 0.98. Then Index factor (max) for

current date= 1.03, maximum of 1.01, 1.03, 0.98.

- If Capital Protection Category is ‘0’ (No Floor) then

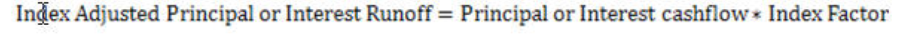

- Calculation of Inflation-adjusted Principal and Interest

- When Inflation Adjustment type is ‘1’ (Principal and Interest), then:

Figure 20-4 Inflation Adjustment Type Formula

Description of the Inflation-adjusted Principal and Interest formula follows:

- When Inflation adjustment type is ‘2’ (Principal only), then:

Figure 20-5 Inflation Adjustment Principal Runoff Formula

Description of the Inflation-adjusted Principal formula follows:

- When Inflation adjustment type is ’3’ (Interest only)

Figure 20-6 Index Adjusted Interest Runoff Formula

Description of the Inflation-adjusted Interest formula follows:

Here Principal or Interest Cash Flow are Index Unadjusted Principal and Interest Cash Flow. For details around how Principal and Interest Cash Flows are calculated, see the Cash Flow Calculations.

Note:

If Inflation adjustment is “Principal only”, Interest cash flow is not inflation-adjusted (remains as is). Similarly when adjustment is “Interest only”, Principal cash flow is not inflation-adjusted (remains as is).

For example, for a Inflation Indexed Instrument, on Payment Date, Unadjusted Principal Cash Flow is 100,000 and Calculated Index Factor is 1.02 (Base index =100 and Current Index on Payment Date is 102), then Index Adjusted Principal Cash Flow = 100,000 * 1.02 = 102,000.

Balances are adjusted using Unadjusted Principal Cash Flow. From the above example, if balance before Principal Cash Flow is 1,000,000 then the balance would be reduced to 900,000 (1,000,000-100,000).

Index Adjusted Principal Runoff is populated in existing Principal Payment FEs. Similarly, Index adjusted Interest Runoff is populated in existing Interest Payment FEs.

- When Inflation adjustment type is ‘2’ (Principal only), then:

- When Inflation Adjustment type is ‘1’ (Principal and Interest), then:

- Calculation of Index adjustment to Principal and Interest

- Index Adjustment to Principal: Difference between Principal Cash Flow before applying Index Adjustment and Index Adjusted Principal Cash Flow.

- Index Adjustment to Interest: Difference between Interest Cash Flow before applying Index Adjustment and Index Adjusted Interest Cash Flow.

Index Adjustment to Principal Cash Flows is populated in FE 178. Index Adjustment to Interest Cash Flow is populated in FE 179. For IR Gap FE 665 and FE 669 are populated, respectively. For LR Gap FE 1665 and 1669 are populated.

If Index Adjusted Principal Cash Flow = 100,000 * 1.02 = 102,000, and Unadjusted Principal Cash Flow is 100,000, then Index Adjustment to Principal Cash Flow will be = -2,000 (100,000 – 102,000).

Note:

For more information on FE in which Inflation Adjustment to Principal, Inflation Adjustment to Interest, see the Financial Elements. When instrument reprices multiple times, interest in reprices event calculated gets adjusted with Index Factor. If within a payment event there are multiple reprice events, interest on each event gets adjusted with each respective Index Factor.