8.2.134.2 Module Usage

Oracle Funds Transfer Pricing derives the Macaulay Duration (in Years) based on the Cash Flows of each instrument as determined by the characteristics specified in the Instrument table and using any applicable Prepayment Rate. The Macaulay Duration Formula calculates a single term, that is, a point on the yield curve used to Transfer Price the instrument.

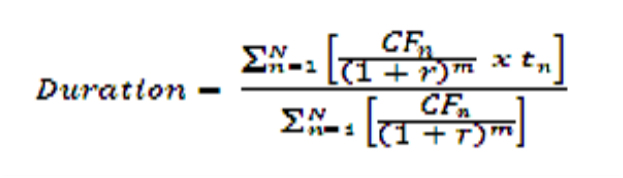

Figure 8-12 Macaulay Duration Formula

Description of the_Macaulay_Duration_formula_follows:

Where:

N = Total number of payments from Start Date until the earlier of Repricing or Maturity

CFn = Cash Flow (such as regular principal, prepayments, and interest) in period n

r = Periodic Rate (current rate/payments per year)

m = Remaining Term to Cash Flow/Active Payment Frequency

tn = Remaining Term to Cash Flow n, expressed in years

Within the Macaulay Duration calculation, the discount rate or current rate, r, is defined in the Transfer Pricing rule in one of three ways:

- The current rate is defined as the current net rate if the processing option, Model with Gross Rates is not selected and the current gross rate if the option is selected. The current rate is used as a Constant Discount Rate for each Cash Flow.

- The user may directly input while defining the TP rule, a constant rate to use for discounts. If specified, this rate is used as a Constant Discount Rate for each Cash Flow.

- The user can select to discount the Cash Flows using spot rates from a selected interest rate curve. With this approach, a discount rate is read from the selected Interest Rate Curve corresponding to the term of each Cash Flow.