8.2.38.2 Module Usage

For Standard Amortization types (those that are not non-patterned and non-scheduled), Oracle ALM and Funds Transfer Pricing use the CUR_PAYMENT from the detailed record for the life of the record until a payment re-calculation occurs. A payment re-calculation occurs when the record is an:

- An adjustable record and a reprice date (NEXT_REPRICE_DATE) is reached.

- Adjustable record and the TEASER_END_DATE is reached (if TEASER_END_ DATE < NEXT_REPRICE_DATE, TEASER_END_DATE takes precedence).

- AMRT TYPE = 600 and the PMT_ADJUST_DATE, NEG_AMRT_EQ_DATE, or the NEG_AMRT_LIMIT is reached.

Depending on AMRT_TYPE_CD, CUR_PAYMENT may be composed of principal or interest or both.

AMRT_TYPE_CD 700 (Simple Interest) : CUR_PAYMENT equals interest only. The cash flow engine always calculates the interest component of any payment amount. Therefore, for extracting purposes, a simple interest record's CUR_PAYMENT = 0. If a repricing event (payment recalculation event) occurs, the interest amount of the payment (financial element 430, and if applicable, 435) is recalculated as indicated under the ACCRUAL_BASIS_CD. The only principal payment is made at maturity (Maturity Payment = financial element 195, 197).

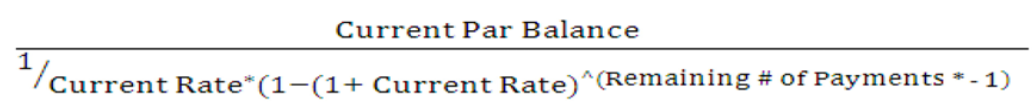

AMRT_TYPE_CD 100, 400, 500, 600 (Conventionally Amortizing) : For extracting purposes, CUR_PAYMENT = principal + interest. If a payment recalculation event occurs, the Cash Flow Engine re-calculates the total CUR_PAYMENT amount using the following formula:

Figure 8-7 Current Par Balance Formula

Description of formula to calculate the Current Payment follows:

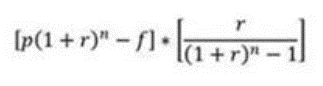

For Leases (AMRT_TYPE_CD = 840), the amortization is conventional and the payment amount includes both principal and interest, but the equation is slightly different because it must incorporate the residual value. The following formula is used to compute the lease payment when re-calculation is required:

Figure 8-8 Lease Payment Formula

Description of formula to calculate the Lease Payment follows:

Where:

p = Remaining Balance or Current Par Balance

f = Maximum (Residual amount of lease, 0)

r = Current interest rate adjusted for accrual basis, compounding basis and adjusted for semi-annual compounding if enabled

n = Remaining number of payments on the day of calculation

These calculations derive the total payment amount, principal, and interest. To determine the interest income (financial element 430) portion and the principal (financial element 190 or 192) portion of this payment amount, the cash flow engine calculates the interest income as indicated under the ACCRUAL_BASIS_CD. This income amount is then subtracted from the calculated total payment amount to determine the principal portion.

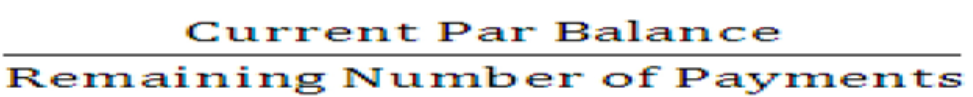

AMRT_TYPE_CD 820 (Level Principal) : For extracting purposes, CUR_PAYMENT = principal only. If a repricing event occurs, the cash flow engine recalculates the total CUR_PAYMENT amount using the following formula:

Figure 8-9 Current Payment Formula

This calculation yields the principal payment amount only (financial element 190 or 192). To derive the total payment amount, the interest amount (financial element 430) calculation is applied and added to the principal portion.

- AMRT_TYPE_CD 800: Conventional payment schedule Payment Amount should contain both principal + interest. Payment recalculation is the same as for conventionally amortizing. The cash flow engine uses the CUR_PAYMENT from the detailed record for the first forecasted payment. Therefore, the CUR_ PAYMENT on the detail record should equal the corresponding payment in the PAYMENT_SCHEDULE table.

- AMRT_TYPE_CD 801: Level principal payment schedule Payment Amount should contain the principal only. Payment re-calculation is the same as under level principal AMRT_TYPE_CD 820. The cash flow engine uses the CUR_ PAYMENT from the detailed record for the first forecasted payment. Therefore, the CUR_PAYMENT on the detail record should equal the corresponding payment in the PAYMENT_SCHEDULE table.

- AMRT_TYPE_CD 802: Simple interest payment schedule Payment Amount should be equal to zero (for simple interest, the engine ignores this field and just looks at the scheduled payment date). Interest recalculation is the same as indicated under simple interest AMRT_TYPE_ CD 700.

AMRT_TYPE_CD 1000 - 69999, User-Defined Payment Patterns: Depending on the payment method defined in the interface, Oracle ALM may or may not reference the CUR_PAYMENT field from the detail record.

Following is a grid that outlines the Oracle ALM use of the CUR_PAYMENT field depending on the payment method.

Table 8-13 Use of the CUR_PAYMENT field

| % Current Payment | % Original Payment | Interest Only | % Original Balance | %Current Balance |

|---|---|---|---|---|

| Never (always calculated) | ALM -Referenced for first cash flow only. | Never (always calculated) | ALM -Referenced for first cash flow only. | ALM -Referenced for first cash flow only. |

Note:

Oracle Funds Transfer Pricing does not reference CUR_PAYMENT when using User-Defined Payment Patterns.The method of re-calculating payments for User-Defined Payment Patterns is dependent on the payment type that is defined for the payment pattern: conventional, level principal, or simple interest. Amortization re-calculations correspond to AMRT_TYPE_CDs 100, 820, and 700 respectively. Each is defined earlier.