10.3.1 Non-Unicity of the Static Spread

In some very rare cases, there is more than one value that solves the static spread equation. This section describes one of these cases.

The market value of the instrument is $0.445495. It has 2 cash flows. The following table shows the value of the cash flows and corresponding discount factors (assuming a static spread of zero).

Table 10-3 Cash Flows and Corresponding Discount Factors

| aa | Firstevent | Secondevent |

|---|---|---|

|

Time |

1 |

2 |

|

Cash flow value |

1 |

-0.505025 |

|

Discount factor(static spread=0) |

0.9 |

0.8 |

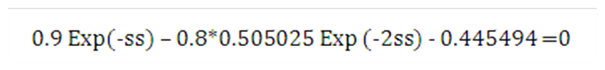

The continuously compounded static spread solves the following equation:

Equation 42

Figure 10-43 Equation 42

Description of the Transfer Pricing Option Cost Equation 42 follows:

There are two possible solutions for the static spread:

Static Spread =0.19%

Static Spread =1.81$