22.1 Overview

An FX Swap is a bilateral contract where different currencies are exchanged by combining FX Spot and forward contracts. As assets in one currency serve as collateral for securing obligations in the other, FX Swaps are effectively collateralized transactions, although the collateral does not necessarily cover the entire counterparty risk.

Financial Institutions can use FX Swaps to raise foreign currencies from other funding currencies. More specifically, Financial Institutions with a need for Foreign Currency Funds face a choice between borrowing directly in the uncollateralized Cash Market for the Foreign Currency, or borrowing in another (typically the domestic) currency’s uncollateralized Cash Market, and then converting the proceeds into a Foreign Currency obligation through an FX Swap. For instance, when a Financial Institution raises Dollars via an FX swap using the Euro as the funding currency, it exchanges euros for dollars at the FX Spot Rate, while contracting to exchange in the reverse direction at maturity at the FX Forward Rate.

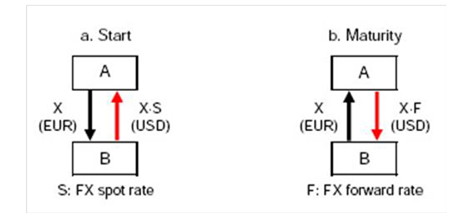

The following figure shows an example, where the fund flows involved in a Euro / US dollar swap. At the start of the contract, A borrows X·S USD from and lends X EUR to, B, where S is the FX spot rate. When the contract expires, A returns X·F USD to B, and B returns X EUR to A, where F is the FX forward rate as of the start.

Figure 22-1 FX Swap

Description of Overview FX Swap is as follows:

In the above example, the Euro is the funding currency and the US Dollar is borrowed currency. In FX Swap, following two exchange contracts packed into one:

- A spot Foreign Exchange transaction

- A forward Foreign Exchange transaction