18.1 Overview

OFSAA includes the ability to calculate the market value of certain Interest Rate options, namely caps and floors, and their variations. These options may be embedded in another instrument or maybe stand-alone (i.e. bare) options.

These embedded options are given a market value based on the Black-76 option market value model, where the value of a call option (or interest rate floor) c, is given by:

Figure 18-1 Market Value Formula

Description of the value of a Call Option Formula follows:

Conversely, the value of a Put Option (or an interest rate cap) p, is given by:

Figure 18-2 Call Option Formula

Description of the value of a Put Option Formula follows:

Where:

Figure 18-3 Put Option Formula

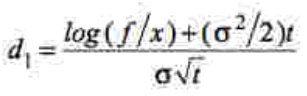

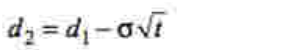

Description of d1 Formula used in Call Option and Put Option follows:

Figure 18-4 d1 Formula used in Call Option and Put Option

Description of d2 formula used in call option and put option follows:

Log denotes the natural logarithm

f = the current underlying forward price

x = the strike price

r = the continuously compounded risk-free interest rate

t = the time in years until the expiration of the option

a = the implied volatility for the underlying forward price

= the standard normal cumulative distribution function