12.1.2 Parity

The Parity exchange rate method derives the exchange rate between the selected currency and the reporting currency based on the forecasted reference interest rates for each respective currency. This enables the user to forecast different interest rates associated with the two currencies and maintain a parity relationship in the Exchange Rate.

The parity method can be used only if both the reporting currency and the selected currency have a Reference IRC (defined through Rate Management).

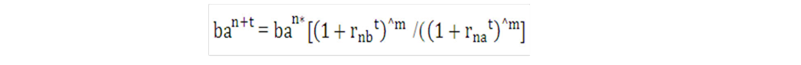

For parity conditions to hold, an investment made at currency a's interest rate should equal an investment made at currency b's interest rate for the same period, taking into account the exchange rate between the two currencies. Interest rates are converted to equal formats of accrual basis and compounding basis. This is achieved by converting the rates to a discount factor. (For complete details on conversion to a discount factor, see the Rate Conversion section) As a simple example, let's use annual compounding. The Parity formula would be:

Figure 12-1 Parity Formula

Description of the formula of Parity Calculation follows:

Where:

Table 12-5 Formula of Parity Calculation

| Variable | Definition |

|---|---|

|

ban+1 |

Exchange rate from currency b (the selected currency) to currency a (the reporting currency) at time n+t. |

|

t |

Modeling bucket term for modeling bucket n+1. |

|

ban |

Exchange rate from currency b to currency a, at time n. |

|

rnbt |

The reference interest rate in currency b for term t, at time n. |

|

rnat |

The reference interest rate in currency a for term t, at time n. |

|

m |

The portion of the year equivalent to t. |

To calculate the exchange rate in each modeling bucket, the process loops through all values of n from zero to the maximum modeling bucket minus 1. The value for t in the calculation for anyone exchange rate is determined by the modeling bucket term for modeling bucket n + 1. For example, consider the following modeling bucket configuration:

Table 12-6 Example of Modeling Bucket Configuration

| Bucket | Term | Start Date | End Date |

|---|---|---|---|

|

1 |

1 Month |

1/1/2011 |

1/31/2011 |

|

2 |

1 Month |

2/1/2011 |

2/28/2011 |

|

3 |

3 Months |

3/1/2011 |

5/31/2011 |

|

4 |

6 Months |

6/1/2011 |

11/30/2011 |

The process will loop from n = 0 to n = 3. Assuming the interest rates listed following, the resulting exchange rates are as follows:

Table 12-7 Example of Exchange Rates

| n | t | ban | rnbt | rnat | ban1 |

|---|---|---|---|---|---|

|

0 |

1 Month (length of Bucket 1) |

2.125 (Actual exchange rate from b to a on As-of-Date 12/31/2010) |

4.25 (Actual 1-month interest rate for currency b on 12/31/2010) |

2.3 (Actual 1-month interest rate for currency a on 12/31/2010) |

2.12841 (Forecast Exchange Rate for Bucket 1) |

|

1 |

1 Month (length of Bucket 2) |

2.12841 (Calculated exchange rate from b to a for first modeling bucket) |

4.375 (Forecast 1-month interest rate in currency b for first modeling bucket) |

2.425 (Forecast 1-month interest rate in currency a for first modeling bucket) |

2.13149 (Forecast Exchange Rate for Bucket 2) |

|

2 |

3 Months (length of Bucket 3) |

2.13149 (Calculated exchange rate from b to a for second modeling bucket) |

4.75 (Forecast 3-month interest rate in currency b for second modeling bucket) |

2.9 (Forecast 3-month interest rate in currency a for second modeling bucket) |

2.14109 (Forecast Exchange Rate for Bucket 3) |

|

3 |

6 Months (length of Bucket 4) |

2.14109 (Calculated exchange rate from b to a for third modeling bucket) |

5.25 (Forecast 6-month interest rate in currency b for third modeling bucket) |

3.275 (Forecast 6-month interest rate in currency a for third modeling bucket) |

2.16152 (Forecast Exchange Rate for Bucket 4) |