7.8.10 Payment Calculation Steps

- Calculate the New Current Payment

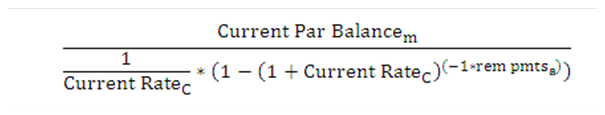

Conventionally Amortizing Payment =

Figure 7-1 Amortizing Payment in a conventional manner

Where:

Current RateC = Current compounded customer rate per payment.

rem pmtsa = remaining number of payments based on amortization.

Current Par Balancem = current balance at the time of payment recalculation.

For conventional schedules that reprice, payment recalculation does not occur. For patterns that reprice, payment recalculation does not occur during the repricing event. For these instruments, the payment is calculated at the time of payment.

- Current Compounded Customer Rate per Payment

The customer rate must be adjusted to a rate per payment. If no compounding occurs, the rate can be divided by the payments per year. Example: current customer rate: 7.5%.

Table 7-5 Example of Current Compounded Customer Rate per Payment

Example: current customer rate: 7.5% Payment Frequency Calculation Rate per Payment Monthly 7.5 ÷12 0.625 Quarterly 7.5 ÷ 4 1.875 Yearly 7.5 ÷ 1 7.5 If the instrument compounds, the rate must be adjusted for compounding. For monthly rates that compound daily, an average number of days assumption of 30.412 is used.

Remaining Number of Payments Based on Amortization

If the Amortization term is equal to the original term, then the remaining number of payments is used. If the amortization term <> original term, the remaining number of amortized payments are calculated by adding the amortization term to the origination date to determine the amortization end date. The remaining number of payments is calculated by determining how many payments can be made from and including the next payment date and this date.

The remaining number of payments is calculated for patterns based on the payment frequency at the time of repricing. As with conventional instruments, the amortization end date is used for payment recalculation. The remaining term is calculated using the difference between this date and the next payment date. This term is divided by the active payment frequency and one additional payment is added to it for the payment on the next payment date.

- Apply Periodic Payment Change Limits

Periodic payment change limits restrict the amount the payment can increase over its previous value. These limits are applied only when the payment recalculation is triggered by a payment adjustment date or a negative amortization limit. Because of these limits, the principal may continue to negatively amortize when the negative amortization limit has been reached.

Table 7-6 Example of Periodic Payment Change Limits

Increasing Payment Decreasing Payment Condition Newly Calculated Payment > (1 + (Payment Increase Lifer / 100)) * Original Paymentr Newly Calculated Payment < (1 + (Payment Decrease Lifer / 100)) * Original Paymentr Adjustment if True Current Paymentm = (1 + (Payment Increase Lifer / 100)) * Original Paymentr Current Paymentm = ( 1 + (Payment Decrease Lifer / 100)) * Original Paymentr - Apply Lifetime Payment Change Limits

Lifetime payment caps and floor set a maximum and a minimum amount for the payment. These limits are applied only when the payment recalculation is triggered by a payment adjustment date or a negative amortization limit. Because of these limits, the principal may continue to negatively amortize when the negative amortization limit has been reached.

Table 7-7 Example of Lifetime Payment Change Limits

Increasing Payment Decreasing Payment Condition Newly Calculated Payment > (1 + (Payment Increase Lifer / 100)) * Original Paymentr Newly Calculated Payment< (1+ (Payment Decrease Lifer / 100)) * Original Paymentr Adjustment if True Current Paymentm = (1 + Payment Increase Lifer / 100)) * Original Paymentr Current Paymentm = (1 + Payment Decrease Lifer / 100)) * Original Paymentr - NGAM Equalization Event

If the payment recalculation is triggered by an NGAM equalization date, payment change limits do not apply. If the newly calculated payment is greater than the lifetime payment cap or less than the lifetime payment floor, the appropriate lifetime payment limit (cap/floor) is set equal to the newly calculated payment.

- Update the Current Payment Field

Once all payment limits have been applied, the New Current Payment is updated in memory for processing of future events.