Users can define Prepayment dates, irrespective of contractual payment dates,

via User-defined tenors. This is applicable for AMRT_TYPE_CD of 700 (early redemption

and prepayment), 100, 500, 820, and payment schedule.

Note:

The payment schedule is only applicable to the prepayment treatment of

curtailment. User-defined Early Redemption Is applicable only for AMRT_TYPE_CD of

700.

If the Balance Type is selected as ‘Current Balance’, then the prepayment amount

will be calculated using CUR_PAR_BAL on As of Date, i.e. without reducing the balance by

any payment/prepayment that may have occurred between as of the date and Pre-Payment

Date.

If the Balance Type is selected as ‘Reducing Balance’, then the prepayment amount

will be calculated using balance as on Prepayment Date, i.e. after reducing the

CUR_PAR_BAL by any payment/prepayment that may have occurred between as of the date and

prepayment date.

The Prepayment Rate Type can be Annual Prepayment Rate or De-annual Prepayment

Rate. When the Annual Prepayment Rate is selected then the prepayment rate entered in

the screen is directly used. In the other case, the rate entered in the screen is

de-annualized before calculating the prepayment amount.

- For the first case, where the contract starting Maturity date is 01/01/1900 and

Ending Maturity date is 31/12/2016, there will be 12 prepayments at monthly

intervals followed by 24 prepayments at the half-yearly interval.

First Tenor

is relative to As of Date, that is the first prepayment will be on ‘As of

Date + 1 month’ followed by 11 prepayments are 1-month interval each. Thus,

the Engine generates 12 Prepayment Events processing each of the Percentage

for the respective event.

The second Tenor is 6M will start after 12

months, so the actual prepayment tenor will be 18M. Similarly, Engine will

generate 24 Prepayment Events processing each of the Percentage for the

respective event.

- For the second case, where contract start Maturity Date is 01/01/2017 and End

Maturity Date is 31/12/2499, there will be 4 prepayments at quarterly intervals

followed by 15 prepayments every 9 months. In this case. The engine will

generate 4 and 15 events, respectively.

The following logic is performed for

prepayment and early redemption calculation:

- Determine User-defined Prepayment Dates. The user needs to select Tenor and

Multiplier. Prepayment/ Early Redemption will happen on the selected Tenor

Multiplier.

- Determine User-defined Prepayment Rates. The user needs to define Prepayment

rates for each defined Tenor Multiplier that will be used for prepayment amount

calculation. Base Prepayment Rate = Constant Rate defined from UI / 100.

- Adjust for Seasonality Seasonality factors can be applied to adjust the

prepayment rate. The seasonality factors are defined per month. The month of the

current date is used to determine the proper seasonality factor to use.

Prepayment Rate = Seasonality Factor * Base Prepayment Rate

- Check Prepayment in Full Option. If the adjusted prepayment rate is equal to

100%, the instrument is paid off in full.

- Derive Prepayment Factor When Prepayment Rate Type is ‘De-annual’ then:

Prepayment Factor = 1- (1- Prepayment Rate)^(1/Payments per year) Where;

Payments per year = 365 / (Current prepayment date – Previous prepayment date)

When Prepayment Rate Type is ‘Annual’ then: Prepayment Factor = Prepayment Rate

- Determine the prepayment amount. The amount of runoff due to prepayments is

calculated. The prepayment factor is applied to the current par balance or

reducing balance depending on the Balance Type selected. For Dynamic Business it

is applied on Original Balance. Prepayment Runoff = Current Par Balance or

Reduced Par Balance * Prepayment factor. If the prepayment factor is equal to

100%, the instrument is paid off in full.

- Update the current balance. The current balance must be reduced by the amount

of prepayment runoff. Current Balance = Current Balance - Prepayment runoff

- If Prepayment treatment is Refinance, the current payment is recalculated, on

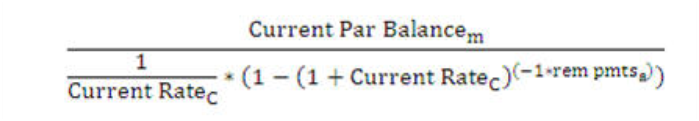

the payment date, depending on AMRT_TYPE_CD. When AMRT_TYPE_CD is 100, 500,

current payment is recalculated using the Current Payment formula (already

detailed in this chapter, subsection: Payment Calculation Steps).

When AMRT_TYPE_CD is 820, the current payment is recalculated using the

current balance and the remaining number of payments.

Current Payment = Current balance/ remaining number of payments.

With User-defined Prepayment Tenors, there can be multiple prepayments within

a payment event. Balance can decrease due to prepayment before the next payment

event. Hence interest is calculated on each prepayment event on the reduced

balance.

For example, a record processed on an as-of-date of 03/31/2011 with the last

payment date of 01/31/2011, and next payment date of 07/31/2011 and payment

frequency of 6M. User-defined Prepayment Tenor of 1M, 2M, 6M is defined. There

will 2 prepayment events between the last payment date to the next payment date

on 4/30/2011 (as of date+1M), 5/31/2011 (as of date +2M). Interest will be

calculated on 4/30/2011 from the last payment date, and 5/31/2011 from

4/30/2011. On payment event date of 7/31/2011 interest will be calculated from

5/31/2011. On 7/31/2011 interest cash flow populated will comprise of interest

from the last payment date till the next payment date.

On the following payment date of 1/31/2012, interest will be calculated from

7/31/2011 till 9/31/2011 (prepayment event). Interest will be calculated on

1/31/2012 from 9/31/2011. On 1/31/2012 populated interest, cash flow will

comprise interest from 7/31/2011 till 1/31/2012.

Note:

INT_TYPE =2 (Interest in Advance) is not supported for User-defined

Prepayment Tenors. Record modeled with User-defined prepayment (early

redemption) with INT_TYPE=2, will be treated as INT_TYPE=1 (Interest in

Arrears).