21.3 Process Flow

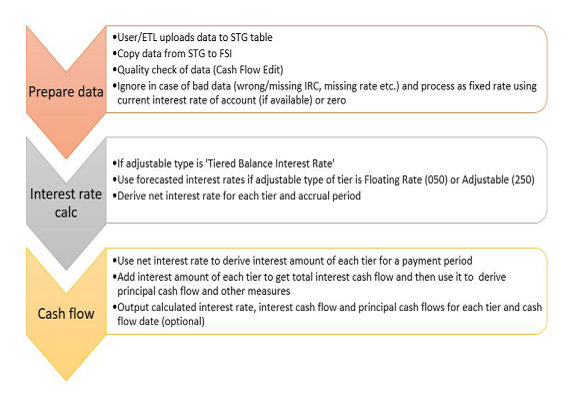

Figure 21-3 Process Flow

Description of Tiered Balance Interest Rate Process Flow as follows:

Tiered Balance Interest Rate is calculated as below for Liquidity gap, Repricing gap, Market Value, Duration, YTM, DV01, Average Life, and Income Simulation.

- Liquidity gap

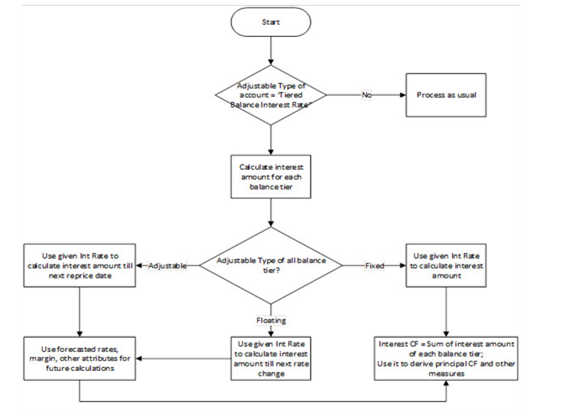

Figure 21-4 Tiered Balance Interest Rate Chart

Description of Tiered Balance Interest Rate Process Flow for Liquidity gap is as follows:

Principal Payments are first reduced from balance tier with the highest rank.

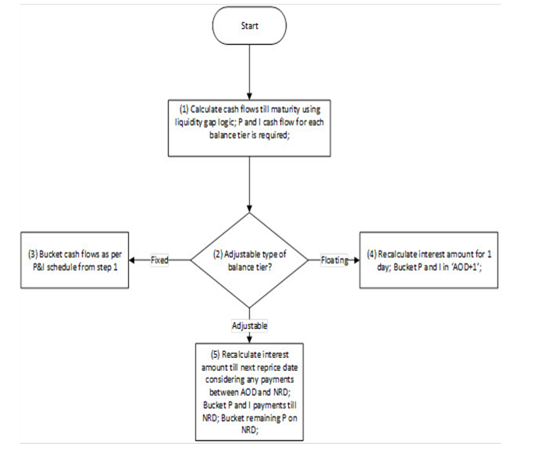

- Repricing gap

Tiered balance interest rate is calculated for the repricing gap as follows:

- If the adjustable type of tier is ‘Fixed (000)’, then runoff as per schedule.

- If the adjustable type of tier is ‘Floating (050)’ then runoff on ‘As of date + 1’ i.e. first-time bucket.

- If the adjustable type of tier is ‘Adjustable (250)’ then:

- Runoff as per schedule till Next Reprice Date

- Remaining Principal after scheduled payments will Runoff on Next Reprice Date

Figure 21-5 Process Flow for Repricing gap

Description of Tiered Balance Interest Rate Process Flow for Repricing gap as follows:

- Market Value

This is calculated for each balance tier separately and then the weighted average market value is calculated for the account. The current par balance of the tier is used as a weight.

- Duration

This is calculated for each balance range separately and then the weighted average duration is calculated for the account. MARKET_VALUE_C * CUR_PAR_BAL / 100 of the tier is used as a weight.

- Current Yield (YTM)

This is calculated for each balance range separately and then weighted average YTM is calculated for the account. The current par balance of the tier is used as a weight.

- Convexity

This is calculated for each balance range separately and then weighted average convexity is calculated for the account. MARKET_VALUE_C * CUR_PAR_BAL / 100 of the tier is used as a weight.

- Modified Duration

This is calculated for each balance range separately and then weighted average modified duration is calculated for the account. MARKET_VALUE_C * CUR_PAR_BAL / 100 of the tier is used as a weight.

- DV01

This is calculated for each balance range separately and then weighted average DV01 is calculated for the account. MARKET_VALUE_C * CUR_PAR_BAL / 100 of the tier is used as a weight.

- Average Life

This is calculated for each balance range separately and then weighted average life is calculated for the account. The current balance of the tier is used as a weight.

- Income Simulation

This is calculated at the tier level and then aggregated.

Transfer Rates and TP Adjustment Rates

The FTP Application will run directly against the FSI_D_ACCOUNT_RATE_TIERS table and will treat each tier record as an independent instrument record. Transfer Rates and TP Adjustment rates will be calculated based on the details of each rate tier record. Aggregation of tier level results and posting back to the parent record is not yet supported but can be handled by a custom procedure.