14.4.2.2 Processing Cash Balance

The Net Incomeb plus the Cash Balance equals the available cash balance at each bucket end date through the modeling horizon.

Two additional events affect the balance of the Cash Account.

The Cash Account itself will earn or pay out interest.

- At the end of each modeling bucket, taxes and dividends will be computed on the

net income and net taxable income and paid out of cash.

The calculation of interest earned or paid out from the cash account must first be simulated, because this value also impacts the net income.

The first step is to derive an initial cash amount for every bucket end date, equal to Cash Balanceb plus Net Incomeb. Let us call this amount Total Cashb. Total Cash0, is equal to the starting cash amount, is equal to just the Cash Balance0. In addition to this variable, there are four additional variables.

- Total Cashb is the Initial Cash Amount for every Bucket End Date, equal to Cash Balanceb plus Net Incomeb. Total Cash0, equal to the Starting Cash Amount, is equal to just the Cash Balance0. This amount does not include adjustments for interest on the Cash Account or taxes and dividends paid out of the Cash Account.

- Daily Cashbn is the Daily Cash Balance for day n in each modeling bucket b. The variable n designates the day into the modeling bucket, for example, n = 1 is the modeling Bucket Start Date.

- Net Interest On Cashb is the total interest earned over the modeling bucket b on the Cash Account.

- Incremental Cash is the Incremental Additional Cash added due to changes in activity on the balance sheet. Since this value is reset for every modeling bucket, it does not require a b subscript.

- To Date, Cash is a running total of cash added from processing the Cash Account in previous modeling buckets. Because this value is a running total for all modeling buckets, it also does not require a b subscript.

- Rateb is the forecasted interest rate for the Interest Rate Code associated with the Autobalancing Asset or Liability Account for the Current Modeling Bucket and scenario. Note that the sign of the Current Balance will determine whether the Interest Rate Code for the Autobalancing Asset or the Autobalancing Liability Account should be used.

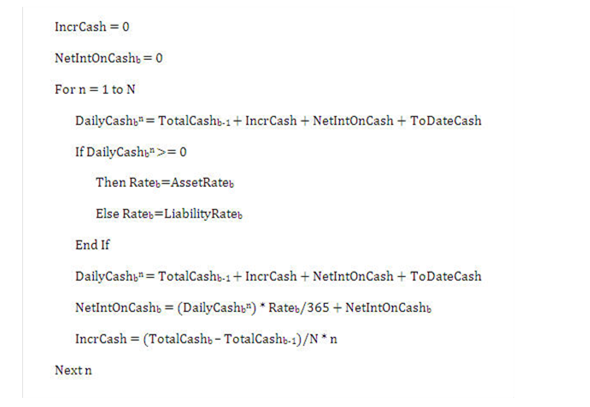

For each Modeling Bucket, interest can be calculated as follows:

N = number of days in the Current Modeling Bucket

Figure 14-1 Interest Calculation

Description of formula to calculate the interest for each Modeling Bucket follows:

After processing of Cash Account, taxes and dividends must be calculated and deducted from the Cash Account before calculation of the Final Cash Balance.

StateTaxesb = StateTaxRateb * (NetTaxIncb + NetIntOnCashb)

FedTaxesb = FedTaxRateb * (NetTaxIncb + NetIntOnCashb)

Dividendsb = DivAmountb + DivRateb * (NetIncb + NetIntOnCashb)

The To Date additional cash must be adjusted for the start of processing of the next modeling bucket:

ToDateCash = ToDateCash + NetIntOnCashb - StateTaxesb - FedTaxesb - Dividendsb

The Ending Balance of the current modeling bucket must be adjusted for the cash paid out for taxes and dividends

DailyCashbN= DailyCashbN - StateTaxesb - FedTaxesb - Dividendsb

For calculation of the financial elements for each modeling bucket,

Beginning Balance = DailyCashb1

Ending Balance = DailyCashbN

Average Balance = For n = 1 to N: ( DailyCashbn) / N

Interest Cash Flow = NetIntOnCashb

Interest Accrued = NetIntOnCashb

Beginning Net Rate = Rateb * DailyCashb1

Ending Net Rate = Rateb * DailyCashbN

Average Net Rate = Rateb * DailyCashbn

Note:

The calculation of the Average Net Rate is slightly more complicated than as shown earlier. The process must track the rate used for each day of the modeling bucket, whether it is an asset or a liability.