4.3.12.3 Create Static Deterministic Process

To create a new Static Deterministic Process, perform the following steps:

- Navigate to the Static Deterministic Process Summary page.

- Click Add . The Create Static Deterministic Process page is displayed.

- Enter the details in the Process Details section.

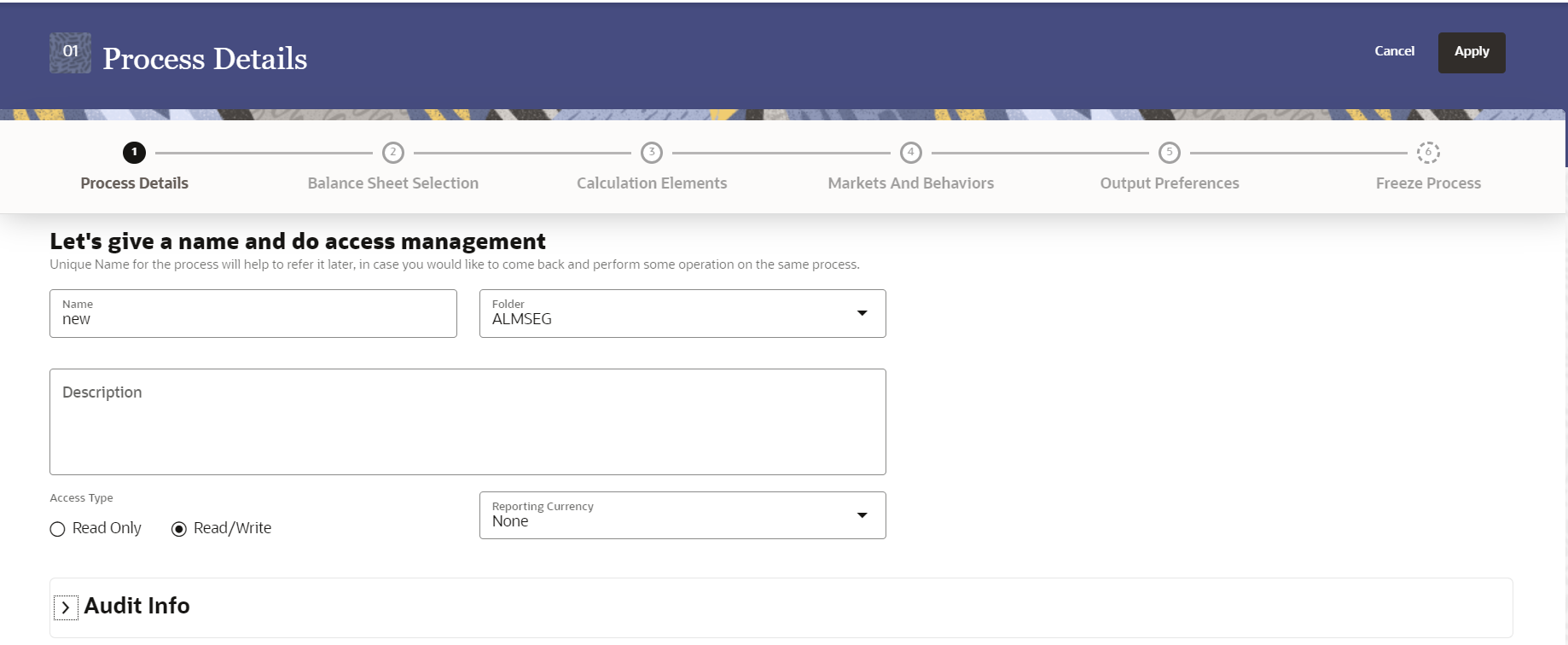

Figure 4-114 Static Deterministic Process

Table 4-71 List of process details used for Creating Static Deterministic Process

Parameter Description Name Enter the name of the Static Deterministic Process. Folder Select the Folder where the Static Deterministic Process needs to be saved. Description Enter the description of the Static Deterministic Process. Access Type Select the Access Type as Read-Only or Read/Write. Reporting Currency Select the currency for consolidation of results Currency Provider This field will be active once you select Reporting Currency. Select the Currency Provider as Default. - Click Apply to navigate to the Balance Sheet Selection section.

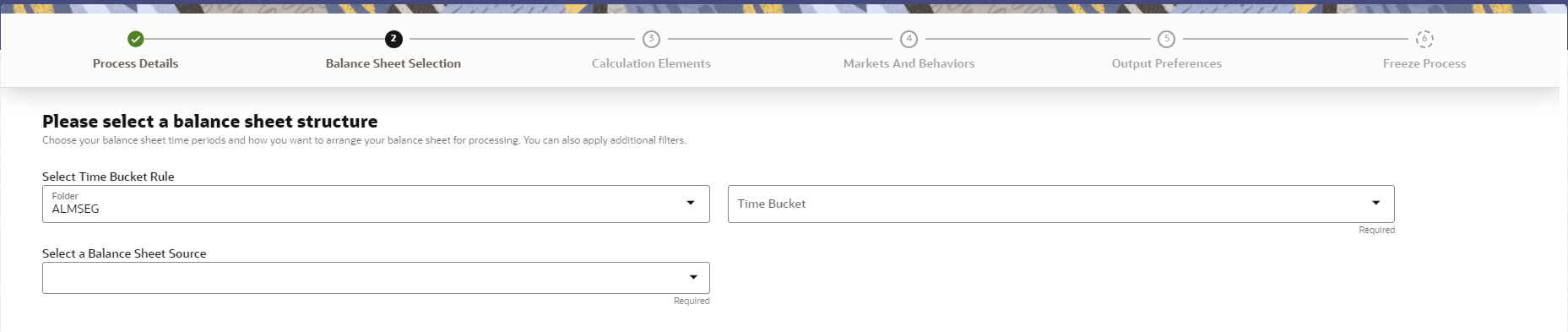

Figure 4-115 Balance Sheet Selection

- Enter the Balance Sheet Structure details as shown in the following table:

Table 4-72 List of Balance Sheet Structure details used for Creating Static Deterministic Process

Parameter Description Time Bucket Rule Folder Select the Folder from which you want to apply Time Bucket Rule. Time Bucket Rule Select the time horizon/aggregation for process Balance Sheet Source Select the Balance Sheet Source from Balance Sheet Source drop-down list. After selecting the Balance Sheet Source, Data Source details block is activated.Figure 4-116 Data Source details of Balance Sheet Selection

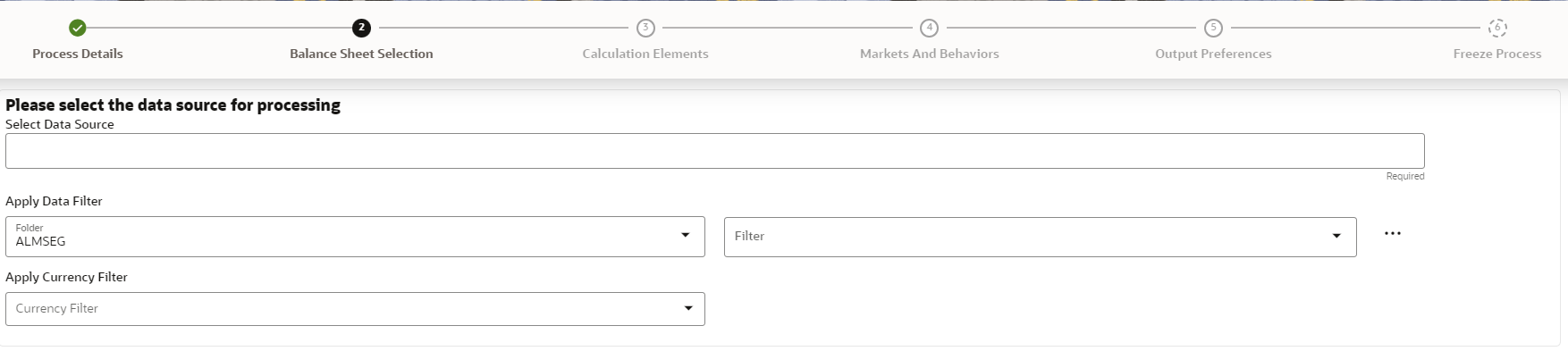

Enter the Data Source details of Balance Sheet.

Table 4-73 Data Source details used for Creating Static Deterministic Process

Parameter Description Data Source This field allows you to select the Instrument tables that must be included in a Static Deterministic Process. For example, Asset, Derivative, and so on. Data Filter Folder Select the Folder from which you want to apply Data Filter. Data Filter This field allows you to select a subset of data for processing by selecting a filter. You can select a filter that was previously created, or define a new filter on the fly. Currency Filter Optionally apply a currency filter on the selected data. - Click Apply to navigate to the Calculation Elements section.

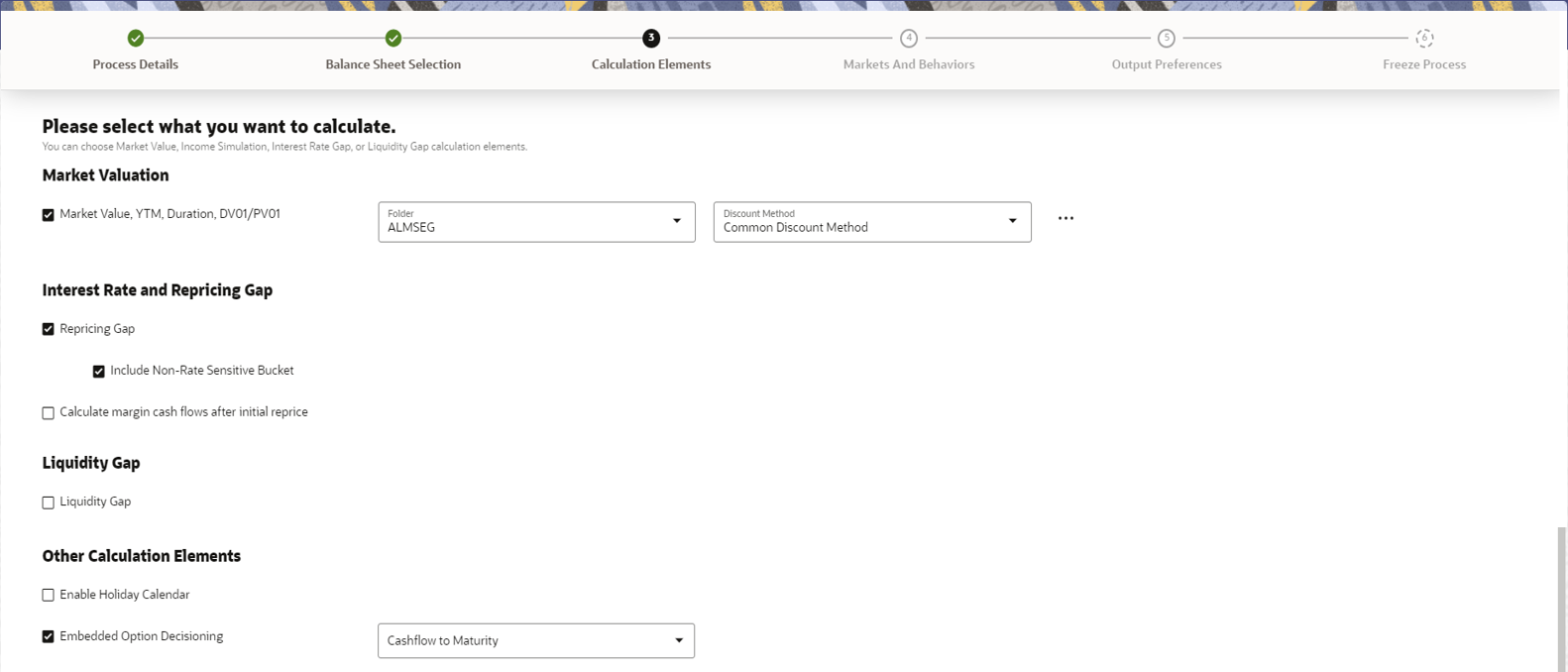

Figure 4-117 Calculation Elements

- Enter the Calculation Elements details as shown in the following table:

Table 4-74 List of Calculation Elements details used for Creating Static Deterministic Process

Parameter Description Market Valuation Select the Market Value, YTM, Duration, DV01/PV01 option if you want to perform present value (MV) calculations. Discount method is required. You can select from predefined rules, or create one on the fly. Discount Method Folder Select the folder from where discount rules are saved. Discount Method Select Discount Method you want to be applied to the process. refer to Discount Method section to set up Discount Method Rules. Also, following options are available when you click Action button next to Discount Method.Figure 4-118 Discount Method

Repricing Gap Select Repricing Gap check-box if you want to include Interest Rate gap risk measures. Note, this requires a time bucket with IR Gap buckets defined. Include Non- Rate Sensitive Bucket Include Non Rate Sensitive Bucket check-box gets enabled when ‘Repricing Gap’ is selected. The Attribute of product dimension ‘Interest Rate Sensitivity Category’ identifies products as Interest Rate sensitive or Non Interest Rate sensitive. Once ‘Include Non Rate Sensitive Bucket’ is enabled, reprice gap output of Products which are mapped as Non Interest Rate sensitive, would move into Non Interest Rate Sensitive bucket.

For more information on Non Interest Rate Sensitive Bucket, see Time Buckets. If ‘Include Non Rate Sensitive Bucket’ is not enabled, engine will ignore ‘Interest Rate Sensitivity Category’ product attribute, and would treat all products as Interest Rate Sensitive. Reprice Gap output would move into respective Reprice Gap buckets.

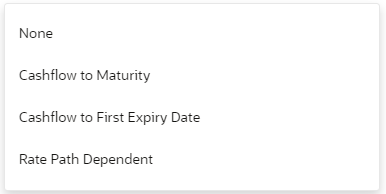

Calculate Margin Cash Flow After Initial Reprice If 'Calculate Margin casflows as After Initial Reprice' is enabled, the engine will use the margin of adjustable rate instruments to continue generating interest cash flows after a gap repricing event up until total runoff occurs. Liquidity Gap Select the Liquidity Gap if you want to include liquidity gap risk measures. Note, this requires a time bucket with LR gap buckets defined. Enable Holiday Calendar If you enable Holiday Calendar cash flow dates falling on a holiday, it gets adjusted as per defined conventions. Holiday calendar criteria is defined on the instruments. Embedded Option Decisioning If your processed data contains fixed rate bonds with embedded options, you can select the behavior of the option to force it to maturity of the instrument, force it to first option expiry date, or let it be rate path dependent. This drop-down has following options:

Figure 4-119 Embedded Option Decisioning

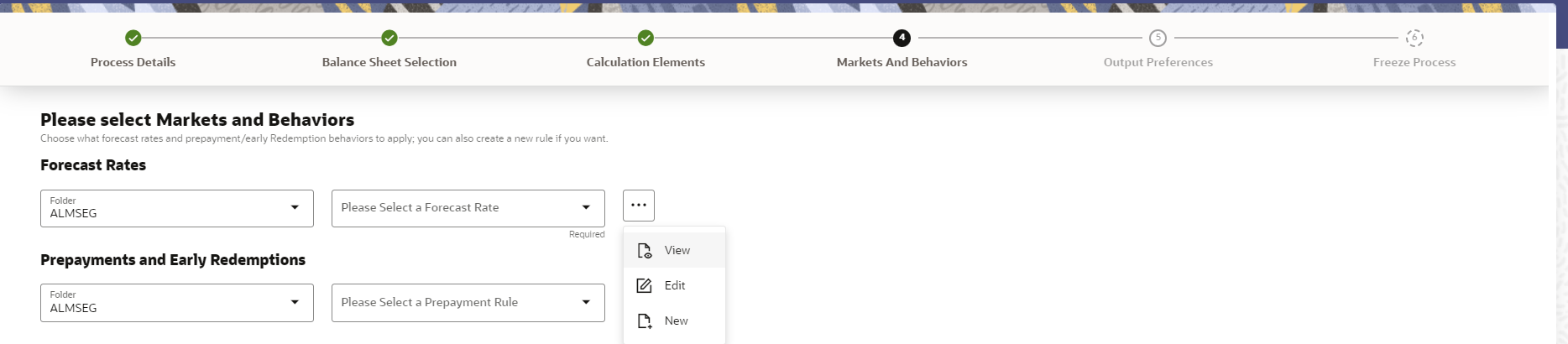

- Click Apply to navigate to the Markets and Behaviors section.

Figure 4-120 Markets and Behaviors

- Enter the Calculation Elements details as shown in the following table:

Table 4-75 List of Market and Behavior details used for Creating Static Deterministic Process

Parameter Description Forecast Rates Select the Folder and Forecast Rates Rule you want to be applied to the process. See Forecast Rate Scenarios to define rate scenarios. Figure 4-121 Forecast Rates

Prepayment Rules and Early Redemptions Select the Folder and Prepayment Rule you want to be applied during cash flow calculation. See Prepayment, to set up Prepayment Methods. This is an optional step. Figure 4-122 Prepayment Rules

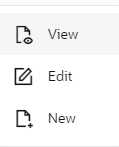

- Enter the following details in Other Behavioral Characteristics sub-section

of Market and Behaviors section.

Figure 4-123 Other Behavioral Characteristics

Table 4-76 Product Characteristics details used for Creating Static Deterministic Process

Parameter Description Product Hierarchy Folder You can specify additional processing parameters at a product-currency level.

Select the Folder from the Product Hierarchy Folder list.

Product Hierarchy Select the Product Hierarchy on which you want to specify parameters. To add a Product Hierarchy, follow these steps:

- Click Open Hierarchy Browser button next to the Hierarchy field.

- Select one or more products using the corresponding check-box and click Done.

- After clicking Add, the list of product is displayed with the following

details:

Table 4-77 Product details used for Creating Static Deterministic Process

Parameter Description Product Shows the selected product details. Currency Shows the currency of the selected product. Interest Credited Yes or No status of Interest Credited. This option shows the interest payments to be capitalized as principal on simple or non-amortizing instruments. Model With Gross Rates If the institution has outsourced loan serving rights for some of the assets (most typically mortgages), the rates paid by customers on those assets (gross rates) are greater than the rates received by the bank (net rates). For these instruments, both a net and gross rate is calculated within the cash flow engine and both gross and net rate financial elements are the output. The gross rate is used for prepayment and amortization calculations. The net rate is used for income simulation and the calculation of retained earnings in the auto-balancing process. Currency Gain/Loss If you are consolidating to a reporting currency, select one of the following methods. - Historical

- Temporal

- Currency Rate

- Click Apply to navigate to the Output Preferences

section.

.

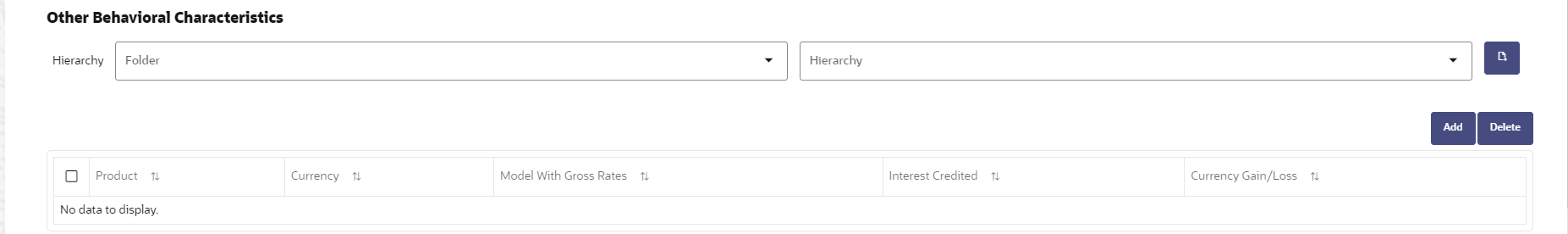

Figure 4-124 Output Preferences

- Enter the Output Preferences details shown in the following table.

Table 4-78 List of Output Preferences details used for Creating Static Deterministic Process

Parameter Description Output Dimensions Start by typing any key processing dimension in the text box. A list of KPD's will appear and you can select up to 10 for consolidation. Detailed Cash Flow Check the box to record the instrument detail cash flows occurring for the desired number of records processed. For each record, daily cashflow and market value results are written to the

FSI_ALM_CASHFLOW_OUTPUT_HISTandFSI_ALM_CASHFLOW_DYN_MV_OUTPUT_HISTtables.Select the desired number of Records in the dialog box or select all records to be output.

Note:

The number of records output directly impact processing time. It is recommend to use this as an audit function only, with few records chosen.Forecast Interest Rates Select the Interest Rate Curves for which you want the engine to write forecasted interest rates in the database table. Forecast Exchange Rate Select the Exchange Rates for which you want the engine to write forecasted exchange rates in the database table. Forecast Economic Indicators Select the Economic Indicators for which you want the engine to write forecasted interest rates in the database table. - Click Apply to navigate to the Freeze Process section.

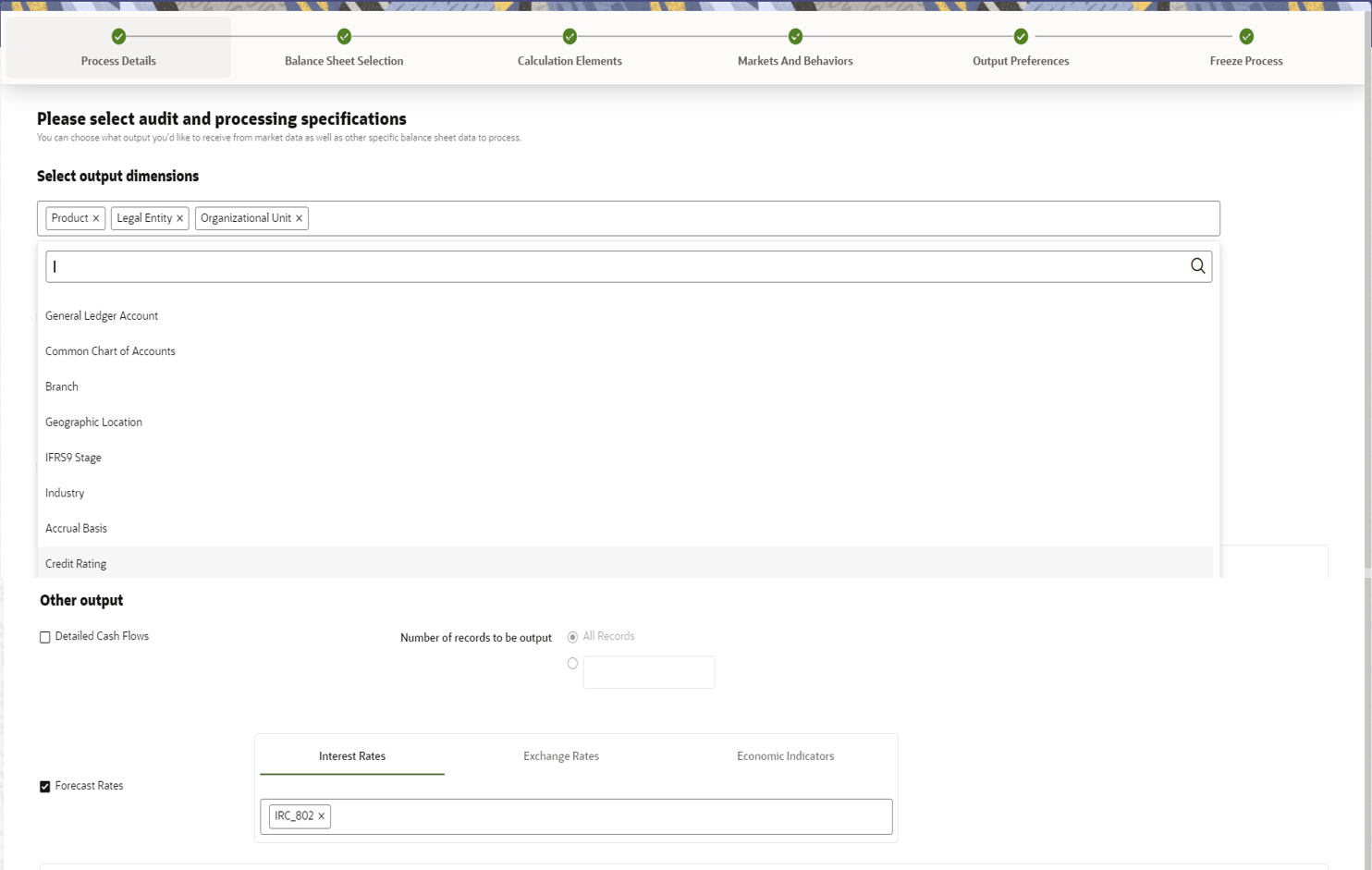

Figure 4-125 Freeze Process

- Verify the changes and click Save.