4.3.3.3.1.4 Defining the Arctangent Calculation Method

The Arctangent Calculation Method uses the Arctangent Mathematical Function to describe the relationship between Prepayment Rates and spreads (coupon rate less Market Rate). Use this procedure to define Prepayment Assumptions using the Arctangent Calculation Method.

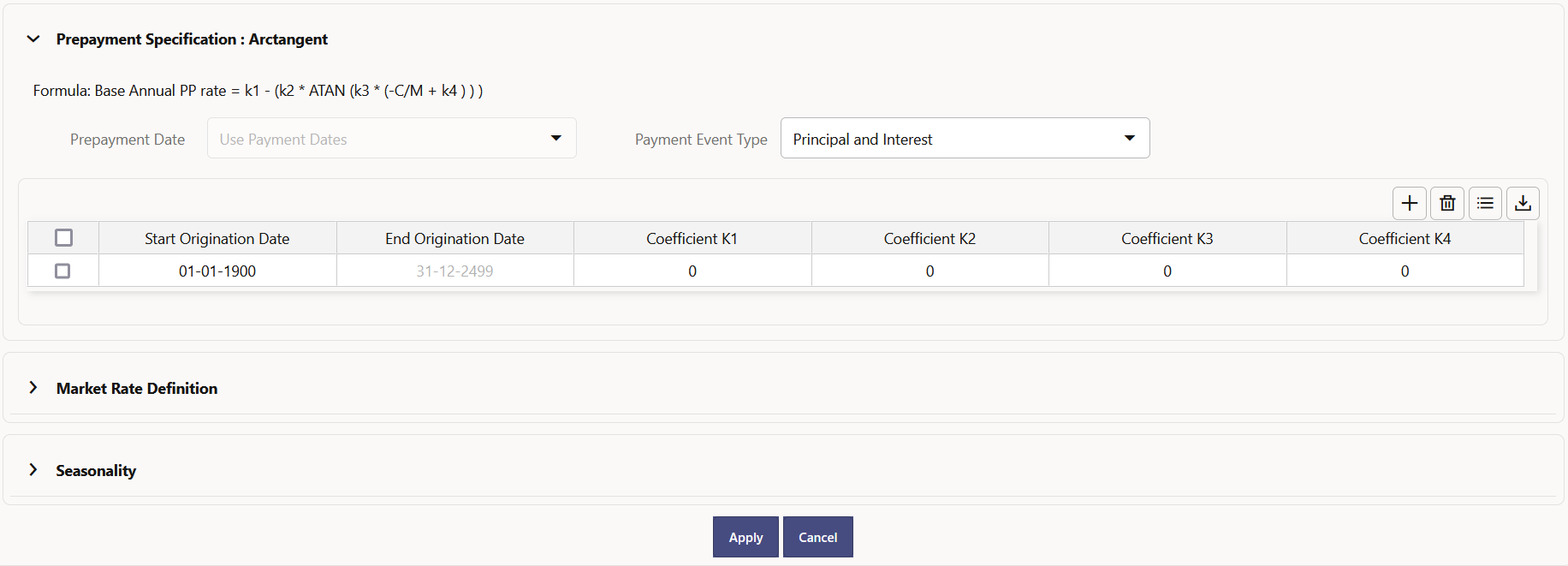

Figure 4-61 Arctangent Calculation Method

Prerequisites

Performing basic steps for creating or updating a Prepayment Rule.

Procedure

Prepayment under this method occurs on Payment Dates only.

- Select the Payment Event Type Option.

- Select the Start Origination Date using the date picker. Alternatively, you can enter the Start Origination Date in the space provided.

- Enter the values for the Arctangent Parameters (columns K1 through K4) for each Start Origination Date in the table. The valid range for each parameter is -99.9999 to 99.9999.

- Click Add Another Row.

You can add as many rows as possible in this table using Add Multiple Row Option. However, you need to enter relevant parameters for each new row.

- You can also use the Download Excel Feature to export the Prepayment Rate Information that is displayed on screen, modify, and copy-paste it back in the grid.

- Define the source for the Market Rate by Selecting an Index (Interest Rate Code) from the list of values.

- Enter the Spread.

The spread is added to the rate from the underlying Interest Rate Curve to determine the Market Rate.

- Select an Associated Term as Original Term, Reprice Frequency, or Remaining Term.

- Define the Seasonality Assumptions as required to model date specific adjustments to the Annual Prepayment Rate. Inputs act as a multiplier, For example, an input of 2 will double the prepayment rate in the indicated month.