4.3.10.4.1 Defining Pricing Margins Using Node Level Assumptions

Node Level Assumptions allow you to define assumptions at any level of the Multi Dimensional Balance Sheet Structure (MDBSS) hierarchy. The MDBSS supports a hierarchical representation of your chart of accounts, so you can take advantage of the parent-child relationships defined for the various nodes of your MDBSS hierarchies while defining rules. Children of parent nodes on an MDBSS automatically inherit the assumptions defined for the parent nodes. However, assumptions directly defined for a child take precedence over those at the parent level. In an income simulation scenario, you may want to price new business for an account at a margin above or below a market interest rate code. For example, you can model a premium paid on CDs in relation to a market yield curve by adding a pricing margin to the interest rate code assigned to the product in the Product Characteristics rule. If you want a rate that is 25 bps above the market yield curve, you will type "0.25" as the pricing margin for the appropriate modeling period. The Pricing Margin rule uses the modeling period defined in the "active" Time Bucket rule. You should always verify that your modeling horizon and related assumptions are consistent with the As of Date and active Time Bucket rule before processing.

Prerequisites

Performing basic steps for creating or editing a Pricing Margin Rule.

Procedure

To define Pricing Margin Rule, follow these steps:

- Navigate to Pricing Margin Rule page.

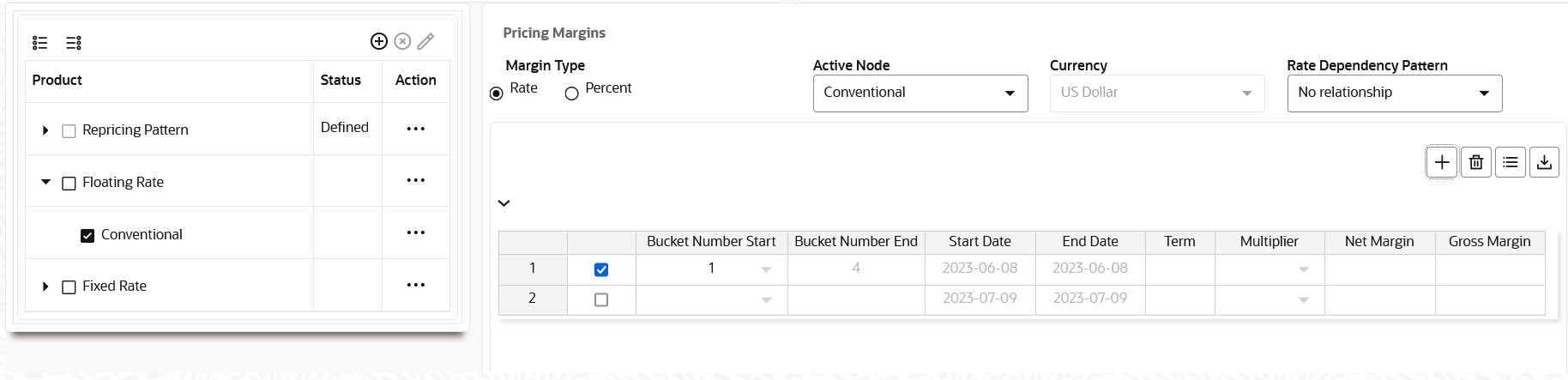

Figure 4-109 Pricing Margin Rule section

- Enter following details:

Table 4-65 Pricing Margin

Fields Description Margin Type Select Margin Type as Rate or Percent. Active Node Shows the name of the selected Active Node Rate Dependency Pattern Rate Dependency Patterns allow you to establish relationships between the level of interest rates, economic indicators or rate spreads and ALM forecast assumption rules. There are four rate dependency options to choose from: - No Relationship

- Rate Level Dependent

- Rate Spread Dependent

- Economic Indicator Dependent

Bucket Number Start and Bucket Number End The bucket number input allows you to select a range of buckets over which the pricing margin assumption will apply. Start Date and End Date values are updated automatically based on the Bucket Number input for each row. Start Date and End Date When the Pricing Margins detail page opens, the Start Date (min value) and End Date (max value) columns are automatically populated and are read-only values. The date ranges represent the Income Simulation Date buckets as defined in the "active" Time Bucket rule. Any new business originated within these dates is modeled using the pricing margins defined in the Pricing Margin rule. New business added for each date bucket will have the same net and gross margin for its life. The margins for a particular instrument will not change as the instrument ages. Term In conjunction with the Multiplier, this field allows you to specify the value for the Term, for a given lookup tier. Multiplier The unit of time applied to the Term. The choices are: Days, Months, Years. Net Margin The Net Rate is affected by setting the Net Margin Flag in the Product Characteristics rule. If Net Margin Flag is set to Floating Net Rate, then Net Rate is equal to the Interest Rate Code plus the Net Margin specified here. If the Net Margin Flag is set to Fixed Net Rate, then Net Rate is equal to Net Margin. Gross Margin The Gross Margin you define is added to the Interest Rate Code specified in the Product Characteristics rule to define the gross rate on new business. - You can add more Rows using the Add Row icon. You can add multiple rows at a time using the Add Multiple Row icon.

- Click Apply.

You can also use the Excel Export feature to download the data in Excel format.