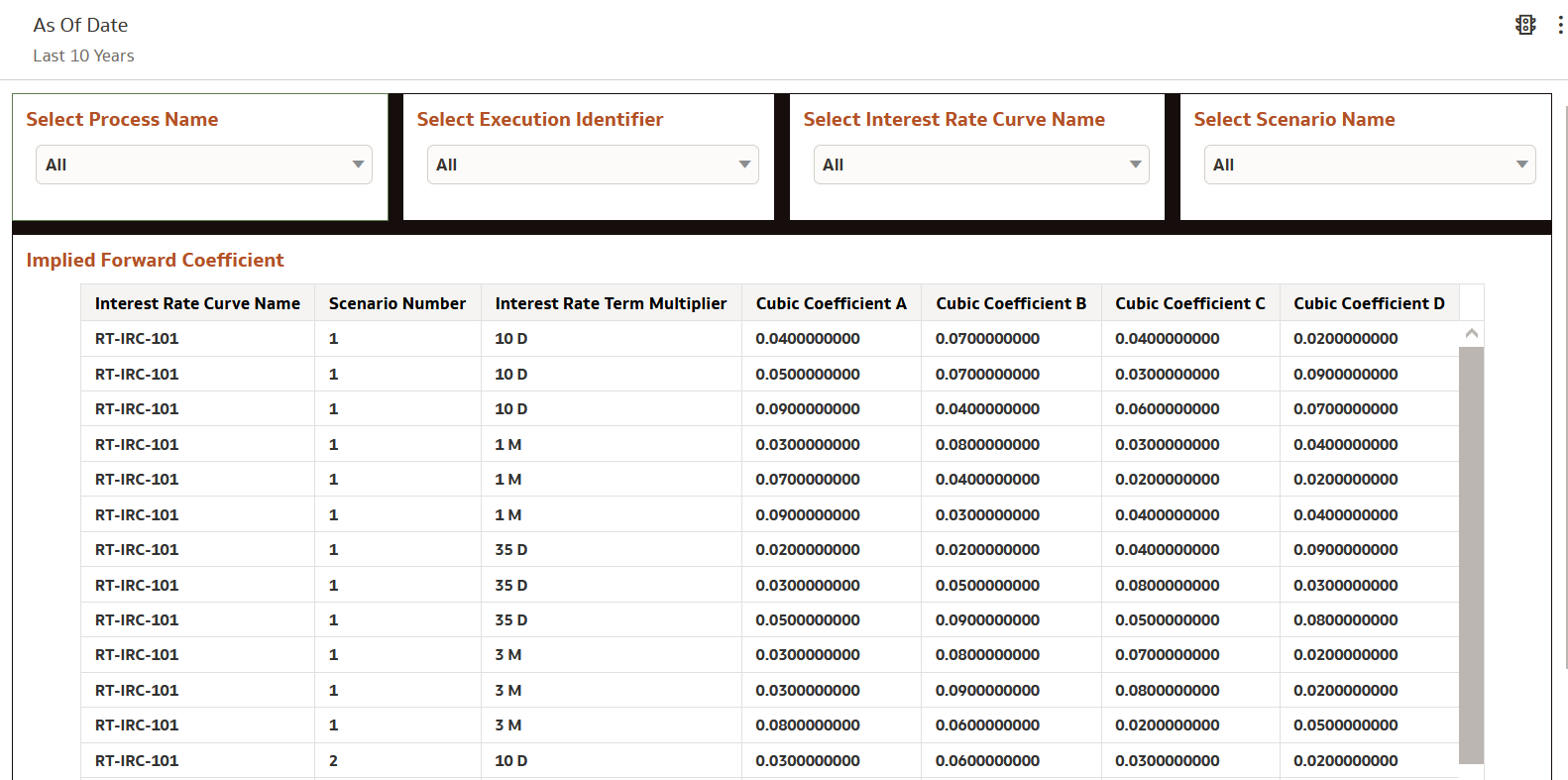

6.1.7.1.2 Implied Forward Coefficient

Forecast interest rates based implied rate is an interest rate equal to the difference between the spot rate and the forward or futures rate.

You can use a series of Report Prompts, as previously described, to filter the data according to key attributes pertaining to the underlying Interest Rate Output results.

The report displays the underlying data according to the following Chart’ logic:

- As of Date:

The Execution Period for the output results. You can use this filter to isolate a selected timeframe for the analysis. The following screenshot displays the possible options that this filter provides against the Time Dimension.

- Select Process Name

The List box filter provides you with a selection capability on the desired Process Name utilized by the Interest Rate Output processes. This is a Single select filter, without any selection the reports will not fetch any meaningful results.

- Select Execution Run Identifier

The List box filter provides you with a selection capability on the desired Execution Run Identifier utilized by the Interest Rate Output processes. This filter is dependent on the values selected in the Process Name filter. This is a Single select filter, without any selection the reports will not fetch any meaningful results.

- Select Scenario

The List box filter provides you with a selection capability on the desired Scenario utilized by the Interest Rate Output processes. This filter is dependent on the values selected in the Process Name, Execution Run Identifier filter. This is a Single select filter, without any selection the reports will not fetch any meaningful results.

Figure 6-161 Implied Forward Coefficient