6.1.6.1.6 Interest Rate Risk Rates & Term

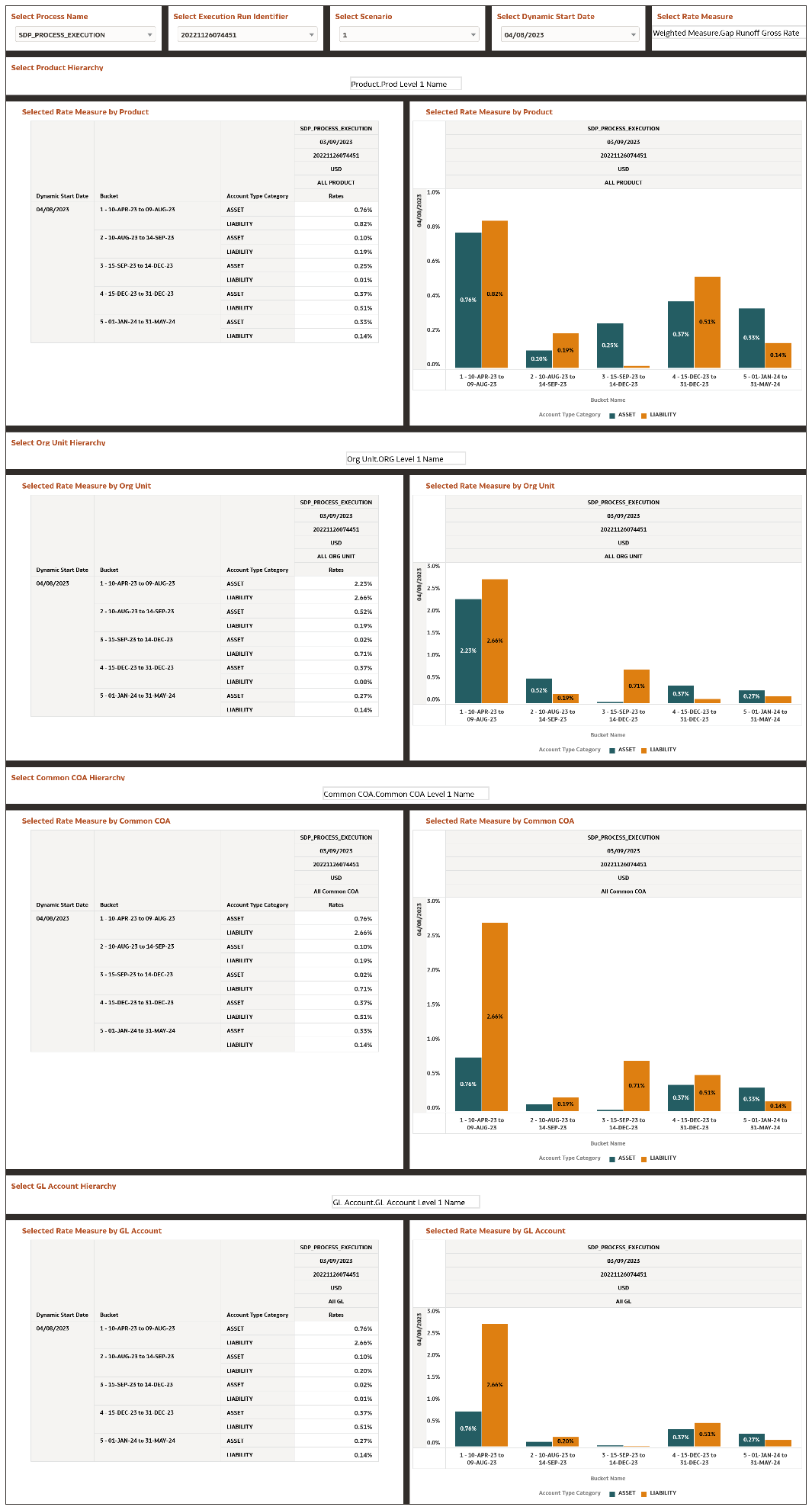

The “Interest Rate Risk Runoff” Report shows interest rate and term related measures that get calculated as part of Interest Rate Risk process.

You can use a series of Report Prompts, as previously described, to filter the data according to key attributes pertaining to the underlying Interest Rate Risk Output results.

The report displays the underlying data according to the following Chart’ logic:

- Select Process Name

The List box filter provides you with a selection capability on the desired Process Name utilized by the Interest Rate Risk Output processes.

- Select Execution Run Identifier

The List box filter provides you with a selection capability on the desired Execution Run Identifier utilized by the Interest Rate Risk Output processes. This filter is dependent on the values selected in the Process Name filter.

- Select Scenario

The List box filter provides you with a selection capability on the desired Scenario utilized by the Interest Rate Risk Output processes. This filter is dependent on the values selected in the Process Name, Execution Run Identifier filter.

- Select Dynamic Start Date

The List box filter provides you with a selection capability on the desired Dynamic Start Date utilized by the Interest Rate Risk Output processes. This filter is dependent on the values selected in the Process Name, Execution Run Identifier, and Scenario filter.

- Select Runoff Measure

The chart provides you with a selection capability on the desired Interest Rate Risk Runoff measurement.

- Select Org Unit Hierarchy

The chart provides you with a selection capability for the desired Org Unit Hierarchical level.

- Select Product Hierarchy

The chart provides you with a selection capability for the desired Product Hierarchical level.

- Select GL Account Hierarchy

The chart provides you with a selection capability for the desired GL Account Hierarchical level.

- Select COA Hierarchy

The chart provides you with a selection capability for the desired Common COA Hierarchical level.

- Selected Rate Measure by Product

The table and chart reports the generated Interest Rate Risk output Rate Measure by Product for each Interest Rate Risk Output execution with respect to As of Date and Bucket Name.

The columns displayed in the chart are the following:

- Dynamic Start Date

- Bucket Name

- Account Type Category

- Process Name

- As of Date (Day)

- Execution Run Identifier

- Currency Code

- Product Hierarchy

- Rate Measure

- Selected Rate Measure by Org Unit

The table and chart reports the generated Interest Rate Risk output Rate Measure by Org Unit for each Interest Rate Risk Output execution with respect to As of Date and Bucket Name.

The columns displayed in the chart are the following:

- Dynamic Start Date

- Bucket Name

- Account Type Category

- Process Name

- As of Date (Day)

- Execution Run Identifier

- Currency Code

- Org Unit Hierarchy

- Rate Measure

- Selected Rate Measure by GL Account

The table and chart reports the generated Interest Rate Risk output Rate Measure by GL Account for each Interest Rate Risk Output execution with respect to As of Date and Bucket Name.

The columns displayed in the chart are the following:

- Dynamic Start Date

- Bucket Name

- Account Type Category

- Process Name

- As of Date (Day)

- Execution Run Identifier

- Currency Code

- GL Account Hierarchy

- Rate Measure

- Selected Rate Measure by Common COA

The chart reports the generated Interest Rate Risk output Rate Measure by Product for each Interest Rate Risk Output execution with respect to As of Date and Bucket Name.

The columns displayed in the chart are the following:

- Dynamic Start Date

- Bucket Name

- Account Type Category

- Process Name

- As of Date (Day)

- Execution Run Identifier

- Currency Code

- Common COA Hierarchy

- Rate Measure

Figure 6-121 Interest Rate Risk Rates and Term Report