5.3.2.6.2.1.1 Core Attributes

This section describes the new business fields used in the Core Attributes section of the Transaction Strategy Rule.

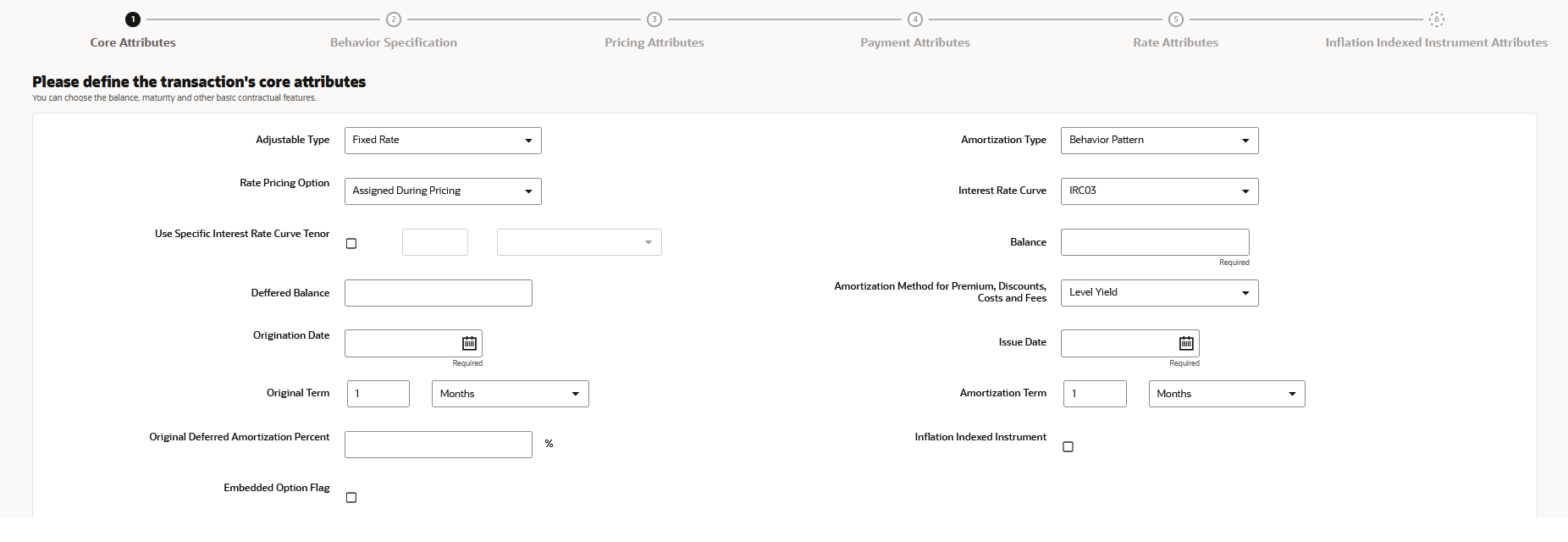

Figure 5-193 Core Attributes

Table 5-51 Fields to add the Core Attributes for Transaction Strategy Rule and their Descriptions

| Field | Description |

|---|---|

|

Adjustable Type |

Determines the repricing characteristics of the new business record. The standard OFSAA codes are as follows: Fixed-Rate Floating Rate Other Adjustable Repricing Pattern Tired Balance Interest Rate |

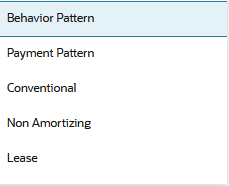

| Amortization Type |

Method of amortizing principal and interest. The choices consist of all standard OFSAA codes and all additional user-defined codes created through the Payment Pattern and Behavior Pattern interfaces, as follows: Figure 5-194 Amortization Type  |

| Rate Pricing Option | This drop-down list has following two Rate Pricing options:

Direct Input: This option allows you to input rates for new business in the Transaction Strategy. Assign During Processing: This option uses the Origination Date and Interest Rate Code (IRC) specified in the Transaction Strategy and pulls the corresponding rate from the Forecast Rates Assumption, that is, it is priced dynamically during the simulation |

|

Interest Rate Curve |

Defines the pricing index to which the instrument interest rate is contractually tied. The interest rate codes that appear as a selection option depending on the choice of currency. The interest rate code list is restricted to codes that have the selected currency as the Reference Currency. If the default currency is chosen, all interest rate codes are available as a selection. |

| Use Specific Interest Rate Curve Tenor | Allows you to select a specific Interest Rate Curve Tenor |

| Balance | Enter the Balance Amount. |

| Deferred Balance | Current Unamortized Deferred Balance associated with Instrument (such as, Premium, Discount, Fees, and so on.) |

| Amortization Method for Premiums, Discounts, Costs and Fees |

Determines the method used for amortizing premiums, discounts, or fees. The available codes are: Level Yield Straight Line |

| Origination Date | The date of the origination for the transaction account. This day can be in the future or the past |

| Issue Date | The Issue date for the transaction account. |

| Original Term | The contractual term at origination date in units (days, months, or years). |

| Amortization Term | Term upon which amortization is based in units (days, months, years). This field is not editable if the Derivative Type is selected as FX Contract and subtype is selected as Spot or Forward |

| Original Deferred Amortization Percent | The initial deferred balance expressed as a percent of original par balance. |

| Inflation Indexed Instrument | Select this check box to enable the Inflation Indexed tab |