5.1.3.1.2 Parameters Tab

Fixed income instruments are used for forecasting and simulating the Cash Flows. The Cash Flow Engine needs interest rate models to simulate the evolution of interest rates. The Cash Flow Engine uses these models as part of the stochastic engine. You can enter the parameters for these models in the following ways:

- System-generated calculations through Parameter Estimation

- Direct input into the UI

- Excel Import

- Data Loader

The following interest rate models are available:

- Extended Vasicek

- Ho and Lee

- Merton

- Vasicek

Parameter Estimation

This section explains the procedure to calculate the estimated parameters.

Conditions for Parameter Estimation

- Term point: Underlying historical rates must be available for a 30-Day or 1-Month term point.

- Minimum Number of historical rates: A total of at least 10 historical rates (observations) are required, on appropriate look-back dates.

- Lookback Dates: Historical rates must be

available on dates looking back from the Parameter's Effective Date (the End

Date), in 30-day intervals moving backward from End Date to Start Date, for

a minimum of 10 intervals.

For example: If the first rate's Effective Date is 1 Jan. 2013, then the second rate's date must be 2 Dec. 2012 (1 Jan. 2013, 30 days = 2 Dec. 2012), and so on. If a rate is not found for the required date, the engine looks for a rate within the neighborhood of 5 days up or down (therefore a total range of 10 days), searching iteratively starting with Date -1, then Date +1, through Date +5, then Date -5. The next rate lookup would be 60 days before the End Date, and so on.

The minimum relative term for all lookbacks must be at least 300 Days (that is, to accommodate a minimum of ten 30-day intervals). Using the above logic, if a rate is not found for the lookup date (or date within the neighboring range), an error will be logged, user can check the error in the 'view logs'.

To define the Parameter Estimation, follow these steps:

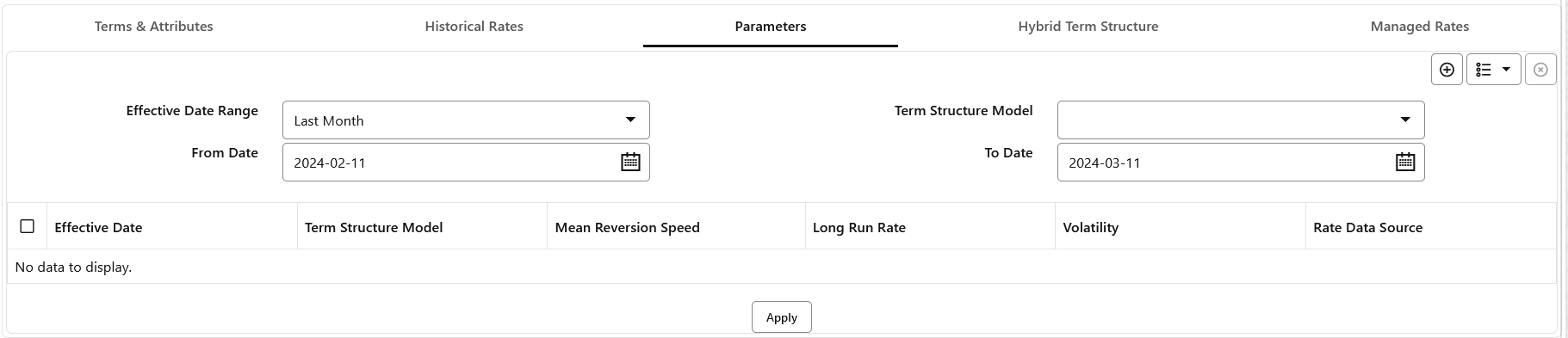

- Navigate to Parameters tab of Interest Rate Curve.

Figure 5-7 Parameters Tab on Interest Rate Curve window

- Enter the Effective Date Range filter.

- After clicking Add, default parameters for the Extended Vasicek Model are displayed for one Effective Date (the System Date on which the Interest Rate Code was created). You can edit these parameters or add new parameters using Add.

- Enter the Effective Date. Note that the Effective Date cannot be greater than the Current System Date.

- Select the Model from the Term Structure Model drop-down list. Effective Date and Term Structure Model combination must be unique within this IRC.

- The following term structure models of interest rates:

- Extended Vasicek

- Ho and Lee

- Merton

- Vasicek

- The following parameters needed by the models:

Table 5-8 List of supported parameters for Models Term structure models in Interest Rate

Model Parameter 1 Parameter 2 Parameter 3 Extended Vasicek Volatility Mean Reversion Speed Ho and Lee Volatility Merton Volatility Vasicek Volatility Mean Reversion Speed Long Run Rate - Enter values for Long Run Rate and

Volatility in percentages.

For example, a Long Run Rate of 5% is displayed as 5.000. To maintain the integrity of data, Rate Management restricts the accepted input values. The valid range and the default setting for each parameter.

Table 5-9 Valid Range and Default Values of Interest Rate Parameters

Parameter Valid Range Default Value Volatility 0% to 500% 0.01 Mean reversion speed 0.00 to 500 0.0 Long run rate 0.00% to 500% 0.0 - Click Apply.