5.3.1.1 Prepayment Rules

One of the major business risks faced by financial institutions engaged in the business of lending and borrowing is prepayment and early redemption risk. Prepayment risk is the possibility that borrowers might choose to repay part or all their loan obligations before the scheduled due dates. Prepayments can be made by either accelerating principal payments or refinancing. Prepayments cause the actual cash flows from a loan to a financial institution to be different from the cash flow schedule drawn at the time of loan origination. A prepayment rule contains methodologies to model the prepayment behavior of various amortizing instruments and quantifies the associated prepayment risk.

Search Prepayment Rule

Prerequisites: Predefined Prepayment Rule

To search for a Prepayment Rule:

On the Prepayment Summary, enter your search criteria in the search box and click Search. The Prepayment Rules meeting your search criteria are displayed.

Or

An alternative method to search a Prepayment Rule is through the Field Search option. This is an inline wildcard UI search that allows you to enter a search value (such as code, name, etc.) partially or fully. Rows that contain the string you are searching for are fetched and displayed in the Prepayment rule Summary. You can enter the Code, Name, Description, Dimension, Hierarchy, and Folder of the Prepayment Rule, partially or fully, and click Search.

Prepayment Rule Summary

Prepayment Rules allow you to specify methodologies to model the loan prepayment and deposit, early redemption behavior of products in your portfolio, and quantify the associated prepayment risk in monetary terms.

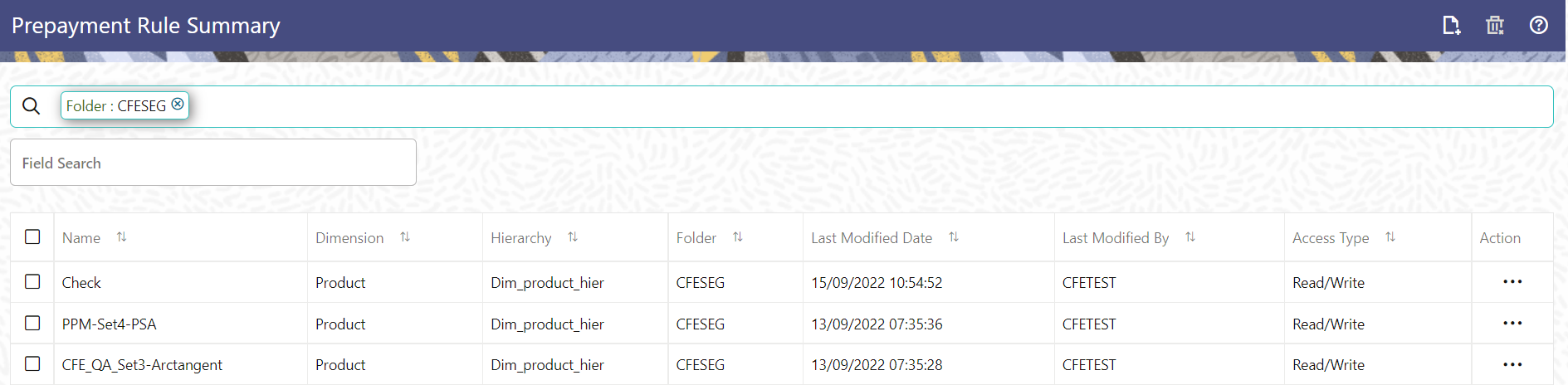

Figure 5-59 Prepayment Rule Summary

The Prepayment Rule Summary displays the following information:

Add: Click the Add icon on the page header to build a new prepayment rule.

Multiple Delete: Enables you to select and delete one or multiple rules in the table simultaneously.

- Name: The Prepayment Rule's short name.

- Dimension: The Dimension to which the Prepayment Rule belongs.

- Hierarchy: Name of the hierarchy that is used to define the prepayment rule.

- Folder: The folder where the prepayment rule is saved.

- Last Modified By: The user who last modified the prepayment rule.

- Last Modified Date: The Date and Time when the prepayment rule was last modified.

- Access Type: The access type of the rule. It can be Read-Only or Read/Write.

- Action: Click this icon to view a list of

actions that you can perform on the prepayment rule.

- View/Edit: Based on the user privilege assigned, you can either only view or edit existing prepayment rules. To edit a rule, you must have Read/Write privilege.

- Save As: You can reuse a prepayment rule by saving it under a new name thus saving time and effort in entering data multiple times; it also leads to reduced data entry errors.

- Delete: You can delete prepayment rules that you no longer require. Note that only prepayment rule owners and those with Read/Write privileges can delete prepayment rules. A Prepayment Rule that has a dependency cannot be deleted. A rule cannot be retrieved after deletion.

- Dependency Check: You can perform a dependency check to know where a particular prepayment rule has been used. Before deleting a rule, it is always a good practice to do a dependency check to ensure you are not deleting prepayment rules that have dependencies. A report of all rules that utilize the selected prepayment rule is generated.

You can totally or selectively copy product assumptions within a prepayment rule from one currency to another currency or a set of currencies, or from one product to another product or a set of products.