5.3.3.7.2.2 Attribute Source As Product Characteristics

Prerequisites

Performing basic steps for creating or editing a Transaction Strategy rule.

Procedure

To define Transaction Strategy Rule, follow these steps:

- Follow the steps mentioned in Defining Transaction Strategy rule section.

- After selecting Transaction Template and clicking Define

Transaction Attribute, the Define Transaction Attribute window is

displayed. The Define Transaction Attribute window has

following sections:

- Derivative Type

- Core Attribute

- Receive Leg/IR Cap

- Pay Leg/IR Floor

Derivative Type

Figure 5-232 Derivative Type

- In the Derivatives section, select the followings:

Table 5-59 Derivative Type

Field Description Derivative Type The following derivative types are available in Derivative Types drop-down list: - Swap

- Option

- FX Contracts

Derivative Subtype The following derivative subtypes are available: - If the Derivative Type is Swap, select one of the seven swap types: Vanilla, Basis, Set in Arrears, Forward, Asset, Amortizing, or Cross Currency.

- If the Derivative Type is Option, select one of the three types: Interest Rate Cap, Interest Rate Floor, and Interest Rate Collar.

- If the Derivative Type is FX Contracts, select subtype Spot or Forward.

- Click Next.

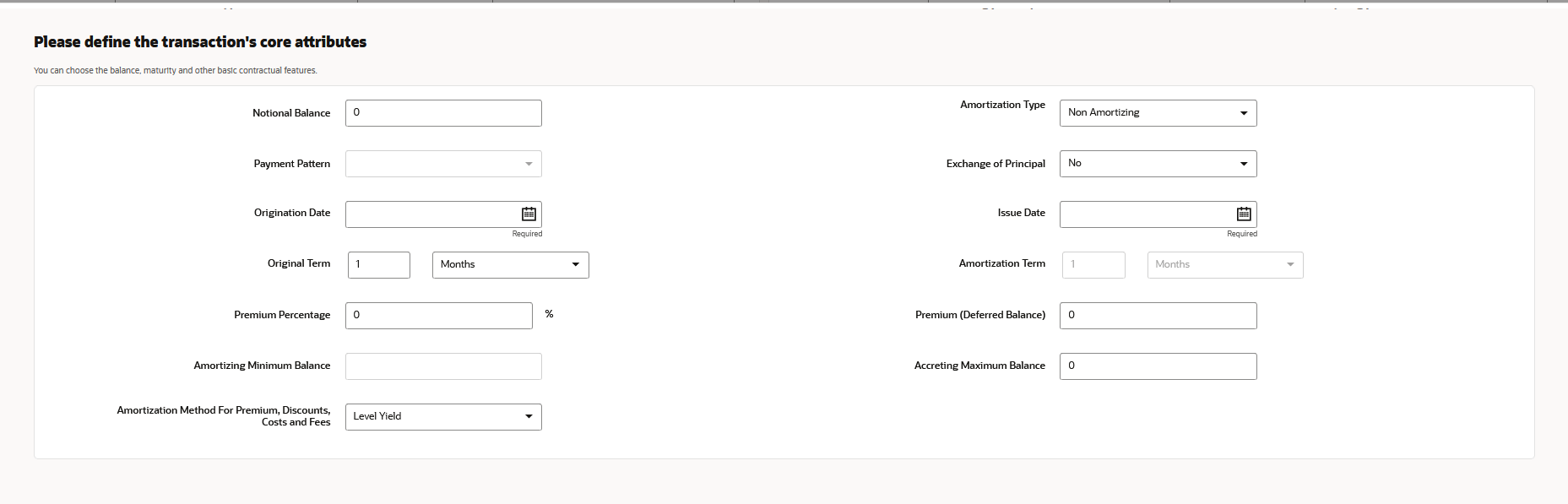

Core Attributes

This section describes the fields used in the Core Attributes section of the Transaction Strategy Rule.

Figure 5-233 Core Attributes

- Enter details in the following details in Core Attributes tab.

Table 5-60 Core Attributes

Field Description Notional Balance Enter the balance amount. Amortization Type Method of amortizing principal and interest. The choices consist of all standard OFSAA codes and all additional user-defined codes created through the Payment Pattern and Behavior Pattern interfaces. Payment Pattern Lists all user-defined payment patterns defined through the user interface. Exchange of Principal Select Exchange of Principal as Yes or No. Origination Date The date of the origination for the transaction account. This day can be in the future or the past Issue Date The Issue date for the transaction account. Origination Term The contractual term at origination date in units (days, months, or years). Amortization Term Term upon which amortization is based in units (days, months, years). This field is not editable if the Derivative Type is selected as FX Contract and subtype is selected as Spot or Forward. Premium Percentage Enter premium percentage. Premium(Deferred Balance) Current Unamortized Deferred Balance associated with Instrument (such as, Premium, Discount, Fees, and so on.) Amortizing Minimum Balance Enter Amortizing Minimum Balance. Accreting Maximum Balance Enter Accreting Maximum Balance. Amortization Method for Premiums, Discounts, Costs and Fees Determines the method used for amortizing premiums, discounts, or fees. The available codes are: Level Yield Straight Line - Click Next.

Receive Leg/IR Cap

Use this section to define the Receiving Leg or the Cap Characteristics. The fields are editable based on the relationship triggers of the Derivative Type and Derivative Subtype. For FX Contracts Derivative type, Receive Principal, pay Principal, Receive Currency, and Pay Currency are mandatory fields

Figure 5-234 Receive Leg/IR Cap

This tab has following sections:

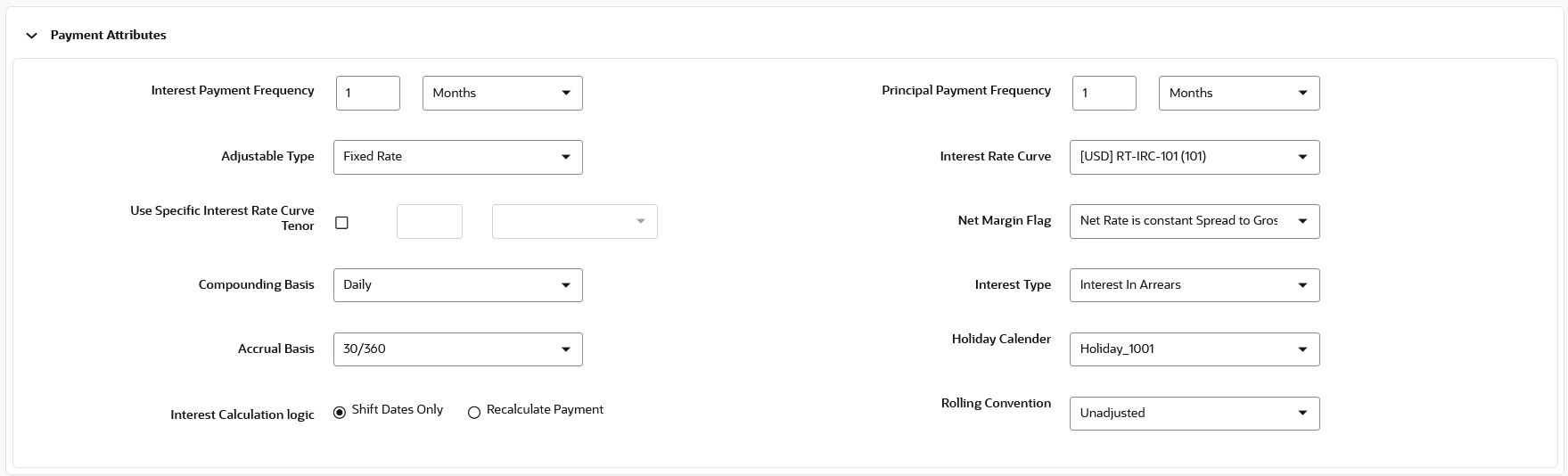

Payment Attribute

This section describes the new business fields used in the Payment Attributes section of the Transaction Strategy Rule.

Figure 5-235 Payment Attribute

- Enter the following details:

Table 5-61 Fields to add the Payment Attributes for Transaction Strategy Rule and their Descriptions

Field Description Interest Payment Frequency Frequency of Interest payment. Principal Payment Frequency Frequency of Principal payment. Adjustable Type Determines the repricing characteristics of the new business record. The standard OFSAA codes are as follows: - Fixed-Rate

- Floating Rate

- Other Adjustable

- Repricing Pattern

Interest Rate Curve Defines the pricing index to which the instrument interest rate is contractually tied. The interest rate codes that appear as a selection option depending on the choice of currency. The interest rate code list is restricted to codes that have the selected currency as the Reference Currency. If the default currency is chosen, all interest rate codes are available as a selection Use Specific Interest Rate Curve Tenor Allows you to select a specific Interest Rate Curve Tenor Net Margin Flag The setting of the net margin flag affects the calculation of the Net Rate. This drop-down is activated only when Model with Gross Rates check-box is enabled. The settings are: - Net Rate is constant Spread to Gross - the net rate reprices in conjunction with the gross rate, at a value net of fees.

- Net Rate is Fixed - the net rate equals a fixed fee equal to the net margin.

- None

Compounding Basis Determines the number of compounding periods per payment period. The choices are as follows:

- Annual

- Continuous

- Daily

- Monthly

- Quarterly

- Semiannual

- Simple

Interest Type The Cash Flow Interest Type determines which interest component is included in the cash flow definition. The Cash Flow Interest Type can be one of three values: - Net Rate

- Gross Rate

Accrual Basis The basis on which the interest accrual on an account is calculated. The choices are as follows:

- 30/360

- 30/365

- 30/Actual

- Actual/360

- Actual/365

- Actual/Actual

- Business/252 *

Holiday Calender The default value is Blank and is Enabled. This drop-down list contains the list of all holiday calendar definitions defined in the Holiday Calendar window. Interest Calculation Logic There are two options:

Shift Dates Only

Recalculate Payment

Rolling Convention The default value is Unadjusted and is Enabled, only when Holiday Calendar is selected in the preceding field. This drop-down list contains the following values:

Unadjusted

Payment on an actual day, even if it is a non-business day.

Following business day

The payment date is rolled to the next business day.

Modified following business day*

The payment date is rolled to the next business day unless doing so would cause the payment to be in the next calendar month, in which case the payment date is rolled to the previous business day.

Previous business day

The payment date is rolled to the previous business day.

Modified previous business day*

The payment date is rolled to the previous business day unless doing so would cause the payment to be in the previous calendar month, in which case the payment date is rolled to the next business day.

*Many institutions have month-end accounting procedures that necessitate this.

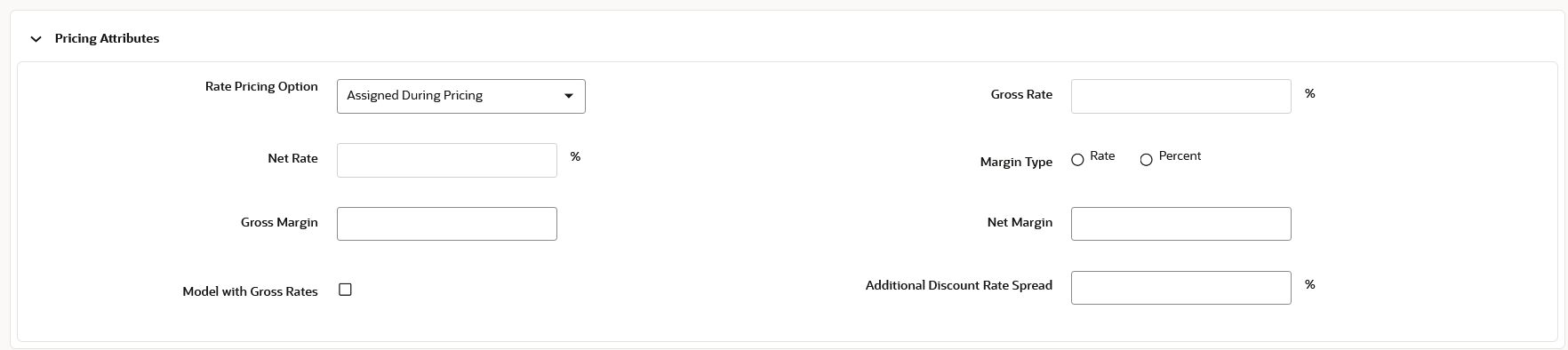

Pricing Attributes Section

This section describes the new business fields used in the Pricing Attributes section of the Transaction Strategy Rule.

Figure 5-236 Pricing Attributes

- Enter the following details:

Table 5-62 Fields to add the Pricing Attributes for Transaction Strategy Rule and their Descriptions

Field Description Rate Pricing Option This drop-down list has following two Rate Pricing options: - Direct Input: This option allows you to input rates for new business in the Transaction Strategy.

- Assign During Processing: This option uses the Origination Date and Interest Rate Code (IRC) specified in the Transaction Strategy and pulls the corresponding rate from the Forecast Rates Assumption, that is, it is priced dynamically during the simulation

Gross Rate Gross rate on the instrument (such as, paid by the customer). Net Rate The nominal interest rate on instrument owed to or paid by, the financial institution. Margin Type The Margin Type can be selected as Rate or Percentage. Rate- By default, Rate is selected. This is a fixed spread.

Percent- Margin is calculated using the provided margin (as percent) and forecast rate. For example, if the forecast rate is 5% and the margin is 10%, then the margin calculated will be 10% of the forecasted rate.

Gross Margin

Contractual spread over interest rate code used in the calculation of the gross rate Net Margin The contractual margin over the interest rate code used in computing net rate. Gross margin minus any fees. Model with Gross Rates If the institution has outsourced loan serving rights for some of the assets (most typically mortgages), the rates paid by customers on those assets (gross rates) will be greater than the rates received by the bank (net rates). For these instruments, both a net and gross rate will be calculated within the cash flow engine and both gross and net rate financial elements will be output. The gross rate is used for prepayment and amortization calculations. The net rate is used for income simulation and the calculation of retained earnings in the auto-balancing process Additional Discount Rate Spread Enter Additional Discount Rate Spread in percentage.

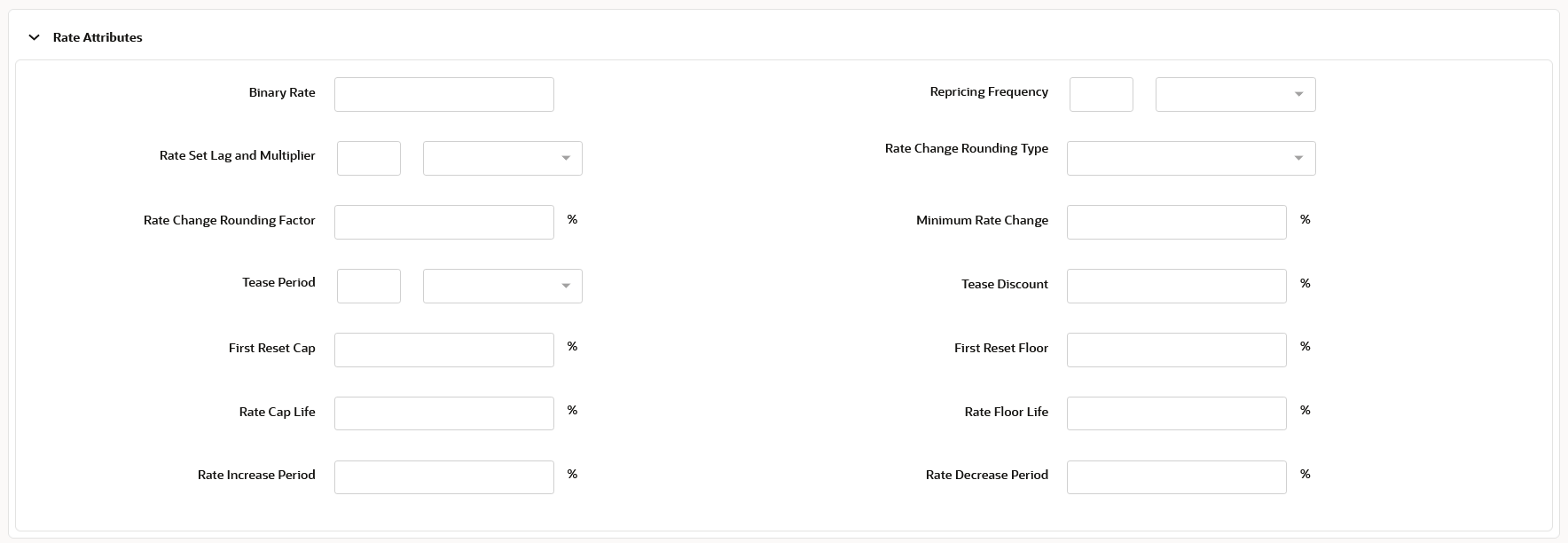

Rate Attributes Section

This section describes the new business fields used in the Rate Attributes section of the Transaction Strategy Rule.

Figure 5-237 Rate Attributes Section

- Enter the following details:

Table 5-63 Fields to add the Rate Attributes for Transaction Strategy Rule and their Descriptions

Field Description Binary Rate Repricing Frequency Contractual frequency of rate adjustment. Rate Set Lag and Multipler Period by which the rate lookup lags the repricing event date Rate Change Rounding Type The method used for rounding of interest rate codes. The choices are as follows:

- No Rounding

- Truncate

- Round Up

- Round Down

- Round Nearest

Rate Change Rounding Factor Percent to which the rate change on an adjustable instrument is rounded. Minimum Rate Change The minimum required change in rate on a repricing date. Tease Period The tease period is used to determine the length of the tease period. Tease Discount The tease discount is used in conjunction with the original rate to calculate the tease rate. The tease rate is the original rate less than the tease discount. First Reset Cap This indicates the maximum delta between the initial rate and the first reset for mortgage instruments that have a tease period. This rate will be applicable at the tease end period, before the first reset. After this, the periodic and lifetime cap value will be applied. The value of this field will be automatically populated from the Product Profile window if the product is mapped to Product Profile and value is defined for First Reset Cap.

For example:

Current Rate = 3.5% (from the instrument record)

Margin = 0.3 %

First Reset Cap = 0.5% (from the instrument record)

First Reset Floor = 0.1% (from the instrument record)

Scenario 1: If New Forecasted Rate = 5.1% (Forecast Rates Assumption)

The fully indexed rate (after applying minimum rate change, rounding effects) is higher than the (Current Rate + First Reset Cap). So, the new rate assigned will be 3.5% + 0.5% = 4.0%

First Reset Floor This is the initial minimum value for mortgage instruments that have a tease period. This floor rate will be applicable at the tease end period, before the first reset. After this, the periodic and lifetime floor value will be applied. The value of this field will be automatically populated from the Product Profile window if the product is mapped to Product Profile and value is defined for First Reset Floor. Rate Cap Life The maximum rate for the life of the instrument. Rate Floor Life The minimum rate for the life of the instrument. Rate Increase Period The maximum interest rate increase allowed during the cycle on an Adjustable Rate instrument. Rate Decrease Period The maximum amount rate can decrease during the repricing period of an Adjustable Rate instrument.

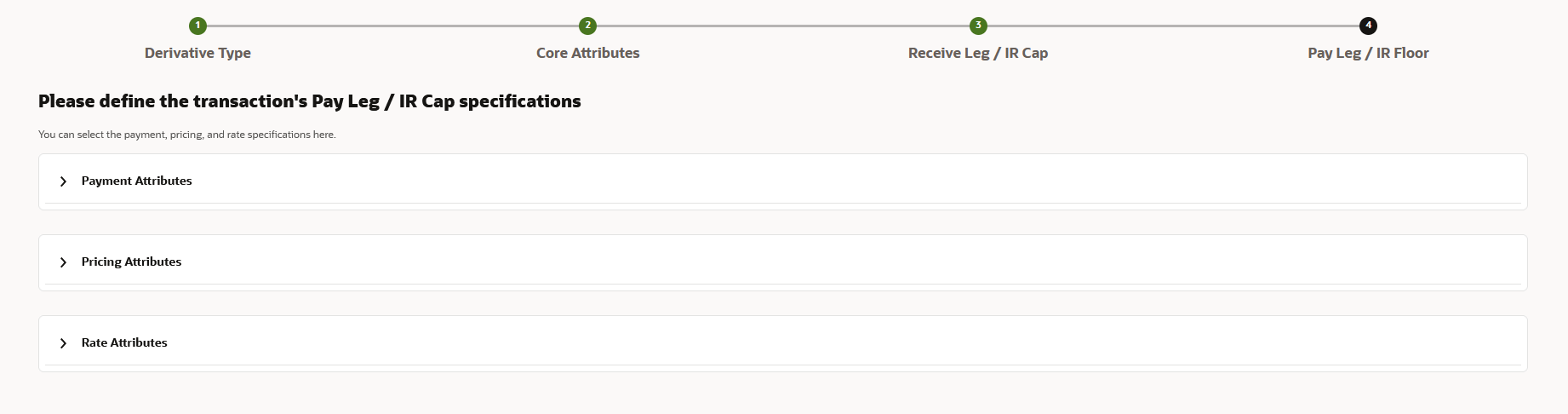

Pay Leg/IR Floor

Use this section to define the pay side, or the interest rate floor. The fields are editable based on the relationship triggers of the Derivative Type and Derivative Subtype

Figure 5-238 Pay Leg/IR Floor

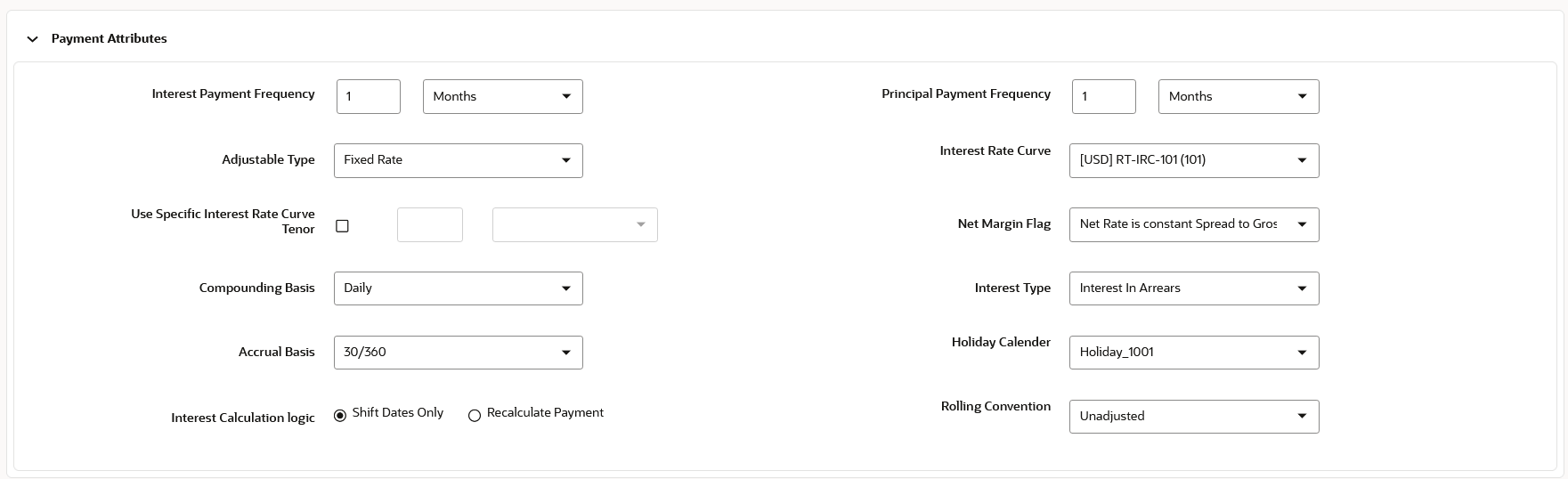

Payment Attributes Section

This section describes the new business fields used in the Payment Attributes section of the Transaction Strategy Rule.

Figure 5-239 Payment Attributes

Table 5-64 Fields to add the Payment Attributes for Transaction Strategy Rule and their Descriptions

| Field | Description |

|---|---|

| Interest Payment Frequency | Frequency of Interest payment. |

| Principal Payment Frequency | Frequency of Principal payment. |

| Adjustable Type | Determines the repricing characteristics of the new

business record. The standard OFSAA codes are as follows:

|

| Interest Rate Curve | Defines the pricing index to which the instrument interest rate is contractually tied. The interest rate codes that appear as a selection option depending on the choice of currency. The interest rate code list is restricted to codes that have the selected currency as the Reference Currency. If the default currency is chosen, all interest rate codes are available as a selection |

| Use Specific Interest Rate Curve Tenor | Allows you to select a specific Interest Rate Curve Tenor |

| Net Margin Flag | The setting of the net margin flag affects the calculation of the Net Rate. This drop-down is activated only when Model with Gross Rates check-box is enabled. The settings are: Net Rate is constant Spread to Gross - the net rate reprices in conjunction with the gross rate, at a value net of fees. Net Rate is Fixed - the net rate equals a fixed fee equal to the net margin. None |

| Compounding Basis |

Determines the number of compounding periods per payment period. The choices are as follows:

|

| Interest Type | The Cash Flow Interest Type determines which

interest component is included in the cash flow definition. The Cash

Flow Interest Type can be one of three values:

|

| Accrual Basis |

The basis on which the interest accrual on an account is calculated. The choices are as follows:

|

| Holiday Calender | The default value is Blank and is Enabled. This drop-down list contains the list of all holiday calendar definitions defined in the Holiday Calendar window. |

| Interest Calculation Logic |

There are two options: Shift Dates Only Recalculate Payment |

| Rolling Convention |

The default value is Unadjusted and is Enabled, only when Holiday Calendar is selected in the preceding field. This drop-down list contains the following values: Unadjusted Payment on an actual day, even if it is a non-business day. Following business day The payment date is rolled to the next business day. Modified following business day* The payment date is rolled to the next business day unless doing so would cause the payment to be in the next calendar month, in which case the payment date is rolled to the previous business day. Previous business day The payment date is rolled to the previous business day. Modified previous business day* The payment date is rolled to the previous business day unless doing so would cause the payment to be in the previous calendar month, in which case the payment date is rolled to the next business day. *Many institutions have month-end accounting procedures that necessitate this. |

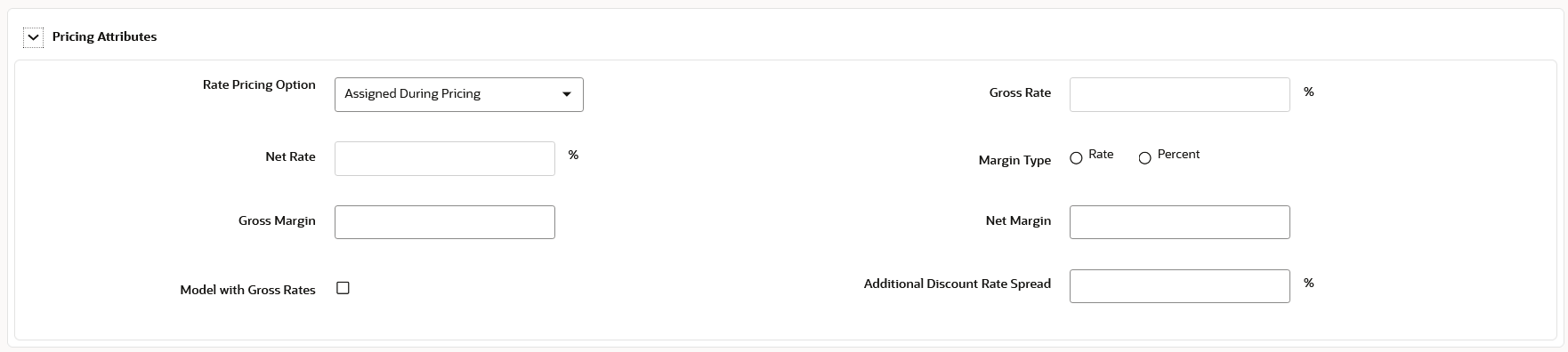

Pricing Attributes Section

This section describes the new business fields used in the Pricing Attributes section of the Transaction Strategy Rule.

Figure 5-240 Pricing Attributes

- Enter the following details:

Table 5-65 Fields to add the Pricing Attributes for Transaction Strategy Rule and their Descriptions

Field Description Rate Pricing Option This drop-down list has following two Rate Pricing options: - Direct Input: This option allows you to input rates for new business in the Transaction Strategy.

- Assign During Processing: This option uses the Origination Date and Interest Rate Code (IRC) specified in the Transaction Strategy and pulls the corresponding rate from the Forecast Rates Assumption, that is, it is priced dynamically during the simulation

Gross Rate Gross rate on the instrument (such as, paid by the customer). Net Rate The nominal interest rate on instrument owed to or paid by, the financial institution. Margin Type The Margin Type can be selected as Rate or Percentage. - Rate: By default, Rate is selected. This is a fixed spread.

- Percent: Margin is calculated using the provided margin (as percent) and forecast rate. For example, if the forecast rate is 5% and the margin is 10%, then the margin calculated will be 10% of the forecasted rate.

Gross Margin

Contractual spread over interest rate code used in the calculation of the gross rate Net Margin The contractual margin over the interest rate code used in computing net rate. Gross margin minus any fees. Model with Gross Rates If the institution has outsourced loan serving rights for some of the assets (most typically mortgages), the rates paid by customers on those assets (gross rates) will be greater than the rates received by the bank (net rates). For these instruments, both a net and gross rate will be calculated within the cash flow engine and both gross and net rate financial elements will be output. The gross rate is used for prepayment and amortization calculations. The net rate is used for income simulation and the calculation of retained earnings in the auto-balancing process Additional Discount Rate Spread Enter Additional Discount Rate Spread in percentage.

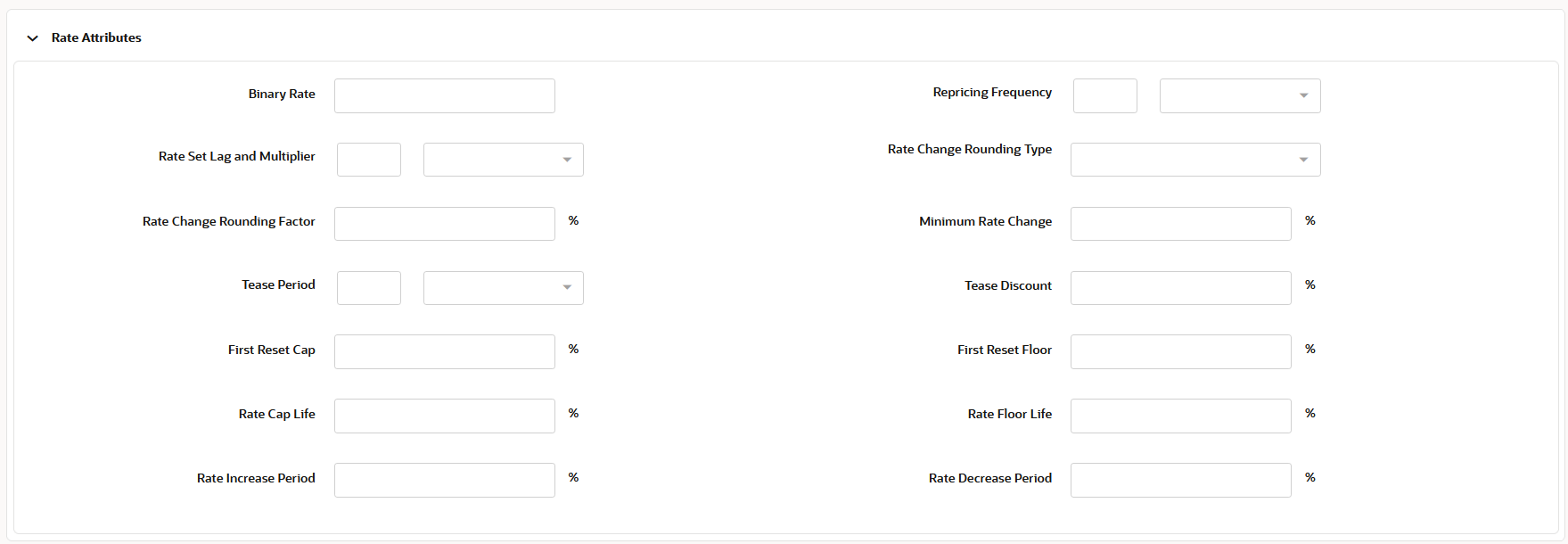

Rate Attributes Section

This section describes the new business fields used in the Rate Attributes section of the Transaction Strategy Rule.

Figure 5-241 Rate Attributes

- Enter the following details:

Table 5-66 Fields to add the Rate Attributes for Transaction Strategy Rule and their Descriptions

Field Description Binary Rate Repricing Frequency Contractual frequency of rate adjustment. Rate Set Lag and Multipler Period by which the rate lookup lags the repricing event date Rate Change Rounding Type The method used for rounding of interest rate codes. The choices are as follows:

- No Rounding

- Truncate

- Round Up

- Round Down

- Round Nearest

Rate Change Rounding Factor Percent to which the rate change on an adjustable instrument is rounded. Minimum Rate Change The minimum required change in rate on a repricing date. Tease Period The tease period is used to determine the length of the tease period. Tease Discount The tease discount is used in conjunction with the original rate to calculate the tease rate. The tease rate is the original rate less than the tease discount. First Reset Cap This indicates the maximum delta between the initial rate and the first reset for mortgage instruments that have a tease period. This rate will be applicable at the tease end period, before the first reset. After this, the periodic and lifetime cap value will be applied. The value of this field will be automatically populated from the Product Profile window if the product is mapped to Product Profile and value is defined for First Reset Cap.

For example:

Current Rate = 3.5% (from the instrument record)

Margin = 0.3 %

First Reset Cap = 0.5% (from the instrument record)

First Reset Floor = 0.1% (from the instrument record)

Scenario 1: If New Forecasted Rate = 5.1% (Forecast Rates Assumption)

The fully indexed rate (after applying minimum rate change, rounding effects) is higher than the (Current Rate + First Reset Cap). So, the new rate assigned will be 3.5% + 0.5% = 4.0%

First Reset Floor This is the initial minimum value for mortgage instruments that have a tease period. This floor rate will be applicable at the tease end period, before the first reset. After this, the periodic and lifetime floor value will be applied. The value of this field will be automatically populated from the Product Profile window if the product is mapped to Product Profile and value is defined for First Reset Floor. Rate Cap Life The maximum rate for the life of the instrument. Rate Floor Life The minimum rate for the life of the instrument. Rate Increase Period The maximum interest rate increase allowed during the cycle on an Adjustable Rate instrument. Rate Decrease Period The maximum amount rate can decrease during the repricing period of an Adjustable Rate instrument.