5.2 Legal Entity Settings

This section provides information about how to set the Reporting Currency and Unrealized Gain or Loss account for processes such as Currency Translation and Revaluation respectively.

To set the Reporting Currency and Unrealized Gain or Loss account for

processes, follow these steps:

- From OFSBCE Home, select Financial Services Balance Computation Engine, select

Application Setup, and select Legal Entities.

Note:

- Supported special characters in the Search bar :`~!@#$%^&*()_-=+[]{}|;:'<,>./?

Unsupported special characters in the Search bar: \ "

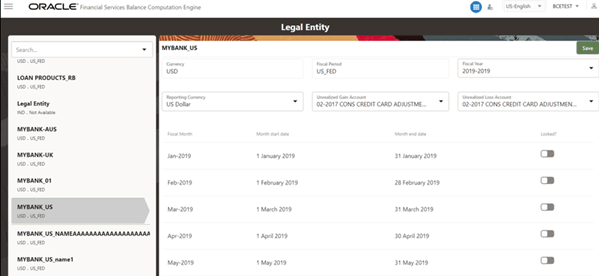

The Legal Entity page is displayed. You can search the Legal Entity using the Search bar.Figure 5-2 Legal Entity Page

- Select the required Fiscal year.

- Set the fiscal period to open for posting entries by disabling or closed for posting entries by enabling the Locked? option. An open posting period is when the selected posting period is set to open and the other posting periods stay closed.

- Set the Reporting Currency to the required standard.

- Select the required value for the Unrealized Gain Account and for the Unrealized Loss Account. Revaluation creates an automatically reversing entry for the difference between the original functional currency equivalent balance and the revalued functional currency equivalent balance in each fiscal period you revalue. As the transactions automatically reverse, the effect of revaluation is completely withdrawn in the fiscal period that follows the last fiscal period you specify for revaluation. Therefore, use the unrealized gain or loss to record the account transactions for the unrealized gains and unrealized losses in each fiscal period you revalue.

- Click Save to save the Legal Entity settings. This

Reporting Currency is used during the Execution process in PMF.

For more information about the Legal Entities, see the Legal Entity Consolidation section in the Oracle Financial Services Data Foundation Application Pack User Guide Release 8.1.1.0.0.