18.1.1 Features of Forecast Rates

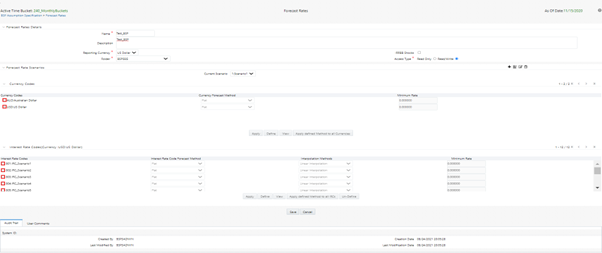

The reporting currency you selected when creating the Forecast Rates assumption rule appears in the title bar. Each forecast scenario you create, up to ninety nine will appear under Current Scenarios. Forecast scenarios use the date buckets specified in the active Time Bucket Rule. You can also set minimum rates (or floors) on any rule created for Currency, Economic, or Interest Rate. For example, if you want to run a -200bp rate scenario, with short-term rates < 2%, you can set the minimum rate to the floor at 0%, although negative rates are allowed if desired.

Here, you have the following options available for defining Forecast Rate Scenario:

- Standardized Approach

- Enhanced Approach

IRRBB Standardized Approach Shocks allows users to select one of the six Standardized Approach Shocks (SAS) in a forecast rates scenario for certain currency IRCs. You can select the following shock scenarios:

- Standardized Approach Shock - Parallel UP

- Standardized Approach Shock - Parallel DOWN

- Standardized Approach Shock - Short UP

- Standardized Approach Shock - Short DOWN

- Standardized Approach Shock - Flattener

- Standardized Approach Shock - Steppener

These options will be available for supported currencies. If an IRC is for a non-supported currency, then these would not display.

For more information, see the Cash Flow Engine Reference Guide.

The active currencies defined under Rate Management > Currencies, are listed under the Currency Codes section. The selection under Currency Codes defaults to the reporting currency when you are not forecasting exchange rates. The list of IRCs under the Interest Rate Codes section is dependent on the selected currency. The IRCs, including a reference IRC for each currency, are loaded from Rate Management. When you select a currency other than the reporting currency, the options under Currency Forecast Method provide several ways to model relationships between exchange rates and interest rates.

The Economic Indicators for all active indices are listed in the Economic Indicator section. These indices are not dependent upon the currency selected. Use these indicators to set up scenarios around changing economic conditions that will affect the forecast outcome of another variable. For example, if you forecast a higher GDP, you may have a scenario where new business volume is tied to that GDP outcome, which could be different than a lower GDP scenario. The Economic Indicators are created and maintained from Rate Management.

The IRCs for all active currencies (and reporting currencies, a subset of the active currencies) are listed under Interest Rate Codes. The options under Interest Rate Code Forecast Method provide several ways to model the effects on portfolio cash flows due to interest rate changes.

Figure 18-1 Forecast Rates Features