17.2.3.3.1 New Business Fields

Following is a listing of new business fields used in the Product Characteristics rule > Core Product Attributes tab.

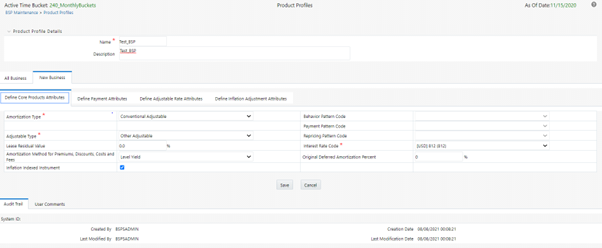

Figure 17-4 Core Product Attributes Tab

Table 17-3 Core Product Attributes Tab Fields and Descriptions

| Field | Description |

|---|---|

| Amortization Type |

Method of amortizing principal and interest. The choices consist of all standard OFSAA codes and all additional user-defined codes created through the Payment Pattern and Behavior Pattern interfaces, as given below:

|

| Adjustable Type |

Determines the repricing characteristics of the new business record. The choices consist of all standard OFSAA codes plus a Repricing Pattern. The standard OFSAA codes are as follows:

|

| Lease Residual Value | For Lease instruments, this value specifies the residual amount as a percent of the par balance. |

| Amortization Method for Premiums, Discounts, and Fees |

Determines the method used for amortizing premiums, discounts, or fees. The available codes are:

|

| Behavior Pattern Code | Lists all user-defined behavior patterns created through the user interface. |

| Payment Pattern Code | Lists all user-defined payment patterns defined through the user interface. |

| Repricing Pattern Code | Lists all user-defined reprice patterns created through the user interface. |

| Interest Rate Code | Defines the pricing index to which the instrument interest rate is contractually tied. The interest rate codes appear as a selection option depending on the choice of currency. The interest rate code list is restricted to codes that have the selected currency as the reference currency. If the default currency is chosen, all interest rate codes are available as a selection. |

| Original Deferred Amortization Percent | The initial deferred balance is expressed as a percent of the original par balance. |

| Inflation-Indexed Instrument | Check box to model instrument as Inflation-Indexed. |

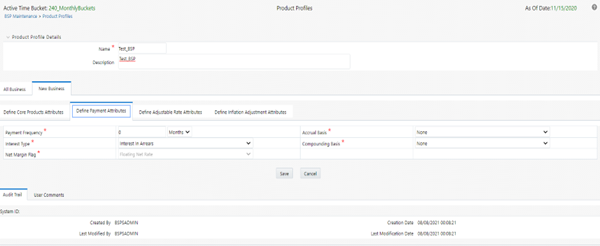

Figure 17-5 Payment Attribute Tab

Table 17-4 Payment Attributes Tab Field and Descriptions

| Field | Description |

|---|---|

| Payment Frequency | Frequency of payment (P & I), Interest or Principal). For bullet instruments, use zero. |

| Interest Type |

Determines whether interest is calculated in arrears or advance or if the rate is set in arrears. There are three interest types:

For conventional amortization products, interest in arrears is the only valid choice. |

| Rolling Convention | Reserved for future use. |

| Accrual Basis |

The basis on which the interest accrual on an account is calculated. The choices are as follows:

|

| Compounding Basis |

Determines the number of compounding periods per payment period. The choices are the following:

|

| Net Margin Flag |

The setting of the net margin flag affects the calculation of the net rate. The two settings are:

|

Note:

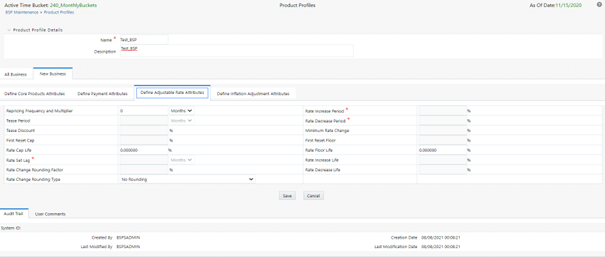

* A Holiday calendar selection is required if a business/252 accrual basis is selected. Business/252 accrual basis is only applicable to the recalculate option of the holiday calendar rule. If the user selects the shift payment dates, the payment will still be recalculated for the non-holiday/weekend date.Figure 17-6 Adjustable Rate Attributes tab

Table 17-5 Adjustable Rate Attributes Tab Fields and Descriptions

| Field | Description |

|---|---|

| Repricing Frequency | Contractual frequency of rate adjustment |

| Tease Period | The tease period is used to determine the length of the tease period. |

| Tease Discount | The tease discount is used in conjunction with the original rate to calculate the tease rate. The tease rate is the original rate less the tease discount. |

| First Reset Cap |

This indicates the maximum delta between the initial rate and the first reset for mortgage instruments that have a tease period. This rate will be applicable at the tease end period, before the first reset. After this, the periodic and lifetime cap value will be applied. The value of this field will be automatically populated from the Product Profile window if the product is mapped to Product Profile and the value is defined for First Reset Cap. For example: Current Rate = 3.5% (from the instrument record) Margin = 0.3 % First Reset Cap = 0.5% (from the instrument record) First Reset Floor = 0.1% (from the instrument record) Scenario 1: If New Forecasted Rate = 5.1% (Forecast Rates Assumption) Fully indexed rate (after applying minimum rate change, rounding effects) is higher than the (Current Rate + First Reset Cap). So, the new rate assigned will be 3.5% + 0.5% = 4.0% |

| First Reset Floor | This is the initial minimum value for mortgage instruments that have a tease period. This floor rate will be applicable at the tease end period, before the first reset. After this, the periodic and lifetime floor value will be applied. The value of this field will be automatically populated from the Product Profile window if the product is mapped to Product Profile and value is defined in for First Reset Floor. |

| Rate Cap Life | The maximum rate for the life of the instrument. |

| Rate Set Lag | Period by which the rate lookup lags the repricing event date. |

| Rate Change Rounding Factor | Percent to which the rate change on an adjustable instrument is rounded. |

| Rate Change Rounding Type | The method used for rounding of interest rate codes. The choices are as follows: no rounding, truncate, round up, round down, round nearest. |

| Rate Increase Period | The maximum interest rate increase allowed during the cycle on an adjustable-rate instrument. |

| Rate Decrease Period | The maximum amount rate can decrease during the repricing period of an adjustable-rate instrument. |

| Minimum Rate Change | The minimum required change in rate on a repricing date. |

| Rate Floor Life | The minimum rate for the life of the instrument. |

| Rate Increase Life | Maximum interest rate increase allowed during the life of an adjustable-rate instrument used to calculate rate cap based on forecasted rate scenario. If both rate increase life and rate cap are defined, the process uses the more restrictive rate. |

| Rate Decrease Life | The maximum amount rate can decrease during the life of an adjustable-rate instrument, used to calculate the rate floor based on the forecasted rate scenario. If both rates decrease the life and rate floor are defined, the process uses the more restrictive rate. |

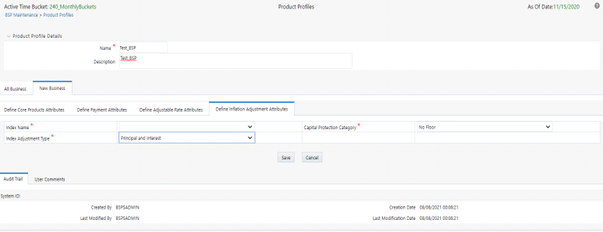

Figure 17-7 Negative Amortization Attributes Tab

Table 17-6 Negative Amortization Attributes Tab Field and Descriptions

| Field | Description |

|---|---|

| Payment Change Frequency | The frequency at which the payment amount is recalculated for adjustable negative amortization instruments. |

| Equalization Frequency | The frequency at which the current payment is necessary to fully amortize the instrument is re-computed. |

| Payment Decrease Life | Maximum payment decrease allowed during life of a negative amortization instrument. |

| Payment Decrease Period | Maximum payment decrease allowed during a payment change cycle of a negative amortization instrument. |

| Equalization Limit | Maximum negative amortization allowed, as a percent of the original balance. For example, if the principal balance should never exceed 125% of the original balance, this column would equal 125.0 |

| Payment Increase Life | Maximum payment increase allowed during the life of a negative amortization instrument. |

| Payment Increase Period | Maximum payment increase allowed during a payment change cycle on a negative amortization instrument. |

Table 17-7 Business Fields in Product Characteristics Rules

| Field | Description |

|---|---|

| Customer Credit Score | The default value of this is 700 and it should be in the range of 300-850. The value of this field will be automatically populated from the Product Profile window if the product is mapped to Product Profile and value is defined for Customer Credit Score. |

| Original Loan To Value | The default value of this is 80 and it should be in the range of 1-300. The value of this field will be automatically populated from the Product Profile window if the product is mapped to Product Profile and value is defined for Original Loan To Value. |

| Issuer | Select the name of the Issuer. The default value is FANNIE_MAE. |

| Prepayment Index | This is the first index value fetched by the UI among the defined ADCo Curves. |

Note:

This tab will be displayed if ADCo LDM mapping is done, and if the selected currency is USD and the product is of account type “Earning Assets”.