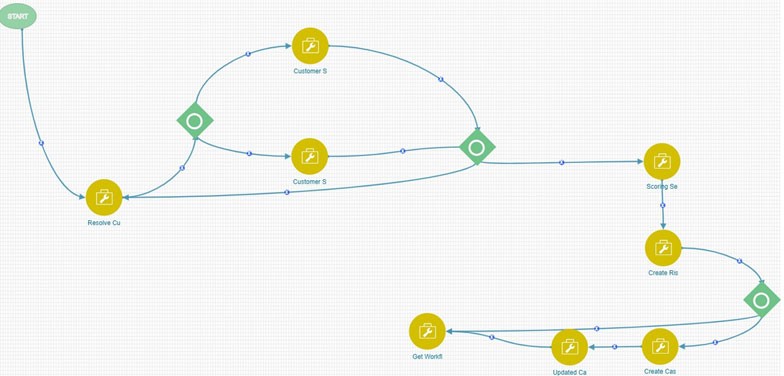

3.1 Onboarding Process Flow

Before you begin the Onboarding process, ensure that Oracle Financial Services Analytical Applications (OFSAA) and Behavior Detection (BD) version 8.0.7.0.0 are installed and configured for KYC.

Even though the global requirements for KYC indicate what processes must be performed during Onboarding, the process flow for Onboarding differs from bank to bank. OFS KYC comes with a predefined Onboarding process covering all the major aspects of KYC compliance regulations. It also allows the flexibility to easily configure the workflow according to their requirements. The pre-defined Onboarding process has multiple ready-to-use sub-processes, which all banks can reuse by providing the details of the external verification systems.

KYC Onboarding has defined the Application Programming Interface (API) request data elements by considering the different processes to be conducted during onboarding. KYC supports both synchronous and asynchronous API for Real-time Risk Assessment from version 8.1.2.0.0 onwards. A new JSON attribute, SyncAPIFlag, has been added to the request data elements. For synchronous calls, pass the value as Y else N.

The Onboarding process includes the following steps:

- Workflow Access: The ready-to-use workflow is available on the Process Modeller page in the Common Tasks menu. To access the workflow, see the Getting Started chapter in the Oracle Financial Service Know Your Customer Administration Guide.

The service URLs must be provided in the following format:

- For the scoring service:

http://#deployedserver#:#port#/RAOR/service/json/score

- For the Customer screening service (individual):

http://#deployedserver#:#port#/edq/restws/CustomerScreening:IndividualScreen

- For the Customer screening service (non-individual):

http://#deployedserver#:#port#/edq/restws/CustomerScreening:EntityScreen

- For the create case service:

http://#deployedserver#:#port#/#CONTEXTNAME#/rest-api/CMRestService/ RealTime CaseCreationService/saveEventsAndPromoteToCase

- For the scoring service:

- Resolve Customer: Every party of an application must be verified and screened against the watch list. The decision to Onboard a prospect depends not only on the prospect’s details but also on the details of the related parties of the prospect. The Onboarding system can divide every related party into sub-processes and do the processing of each sub-process.

- Watch list Screening: The prospect and related parties must be screened against different watch lists to verify whether they belong to the watch list or not. This is a key criterion to decide the Onboarding process. OFS KYC is pre-integrated with Oracle Financial Services Customer Screening (OFS CS) and internal watch lists to perform this process. To enable or disable a screening process, see step 2, Invoking the KYC Onboarding Service.

- Identity Verification: The integration process of Identity Verification is similar to the integration process of Customer Screening for RESTful API services. For other types of service integration, contact My Oracle Support (MOS).

- Customer Scoring: OFS KYC comes with a ready-to-use scoring model for the Onboarding service, which can be used to score a Customer with the available risk factors or score a Customer by adding more risk factors. The scoring service is the last service that must be called, as this service uses the outputs of each of the above processes to arrive at the Customer’s risk profile. The ready-to-use Onboarding process converts the outputs of all individual services, such as screening and identity verification into a risk factor.

- Risk assessment creation: This is an internal process that creates the risk assessments for a request for audit purposes and, if required, for investigation. The users can also manually promote the risk assessments to cases from the user interface.

- Case creation service: This service creates cases for enhanced due diligence. The ready-to-use case criteria are defined as a decision rule in the Process Modelling Framework (PMF) workflow. Every range of risk category has a user review flag and an Onboard flag. The Onboarding system currently only assigns a user review flag for a risk category range. In the ready-to-use configuration, the case criteria are converted to a risk factor. In this way, the decision to create a case is determined by this configuration. A case is then created in Enterprise Case Management (ECM).

- Case ID creation: After the case is created in ECM, the Onboarding system generates a task with a unique case ID against the risk assessment created.