B.2.3 Risk Calculation for Customer F

Customer F is a Correspondent Bank (CB) (Financial Institution). Therefore, the Correspondent Bank risk model will be used.

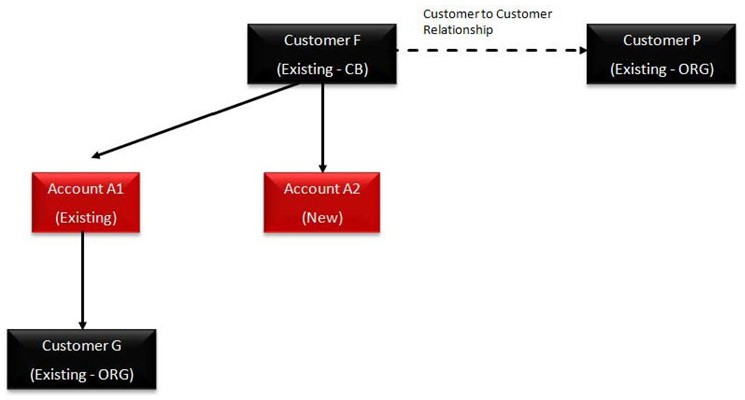

When Customer type = ORG or FIN, NNS or WLS will consider Interested Parties as well which are determined based on Customer-to-Customer relationship(s) and Customer to Account relationship(s).

Figure B-2 Risk Score Calculations for Customer F

The following table shows the risk score calculations for customer F.

Table B-9 Risk Calculation for Customer F

| Parameter | Weight | Calculation or Verification Step | Calculation for Customer F |

|---|---|---|---|

| Geography Risk associated with Country of Headquarters | 5 | Risk as it appears on the Parameter Risk Score Jurisdiction tables for Country Geography Risk. |

Customer F’s headquarter is in the UK. Per Country Parameter Risk Score Jurisdiction table, UK risk is 70 Customer F’s Country of HQ Geo Risk = 70. |

| Geography Risk associated with Countries of Operation | 10 | The maximum risk of countries in which the corporation conducts business. |

Customer F operates in Europe and the UK Per Country Parameter Risk Score Jurisdiction table, UK risk is 70, Europe risk is 85. Customer F’s Country of Operation Geo Risk = 85. |

| Watch List for Primary Customer | 10 | If the customer is on a trust or exempt list (that is, a list with a risk <0), Watch List Risk --> 0 Else, (highest risk of the matched list x 10). | Customer F appears on a Trust list and the risk level is 2 Customer E’s Watch List Match Risk = 20. |

| Watch List for Interested Parties | 10 | For this parameter, calculate MAXIMUM INTERESTED PARTIES WATCH LIST RISK). |

Customer G, P is on Watch List A, Watch List B, and Watch List C. Watch List A’s risk is 1. Watch List B’s risk is 2, Watch List C’s risk is 3 Watch List Match Risk = 30. |

| Operational Risk – Markets Served by the bank | 15 | Risk as it appears on the Parameter Risk Score Jurisdiction tables for industry types. |

Customer F serves Private Banking – Trust, and Private Banking – Wealth Management which has a score of 30 and 20, respectively. Maximum (30,20). |

| Corporation Age | 5 |

0 - 12 months --> 80 13 - 36 months --> 60 37 - 120 months --> 40 More than 120 months --> 0 |

Customer E has been a customer since 12 months. Customer E’s Corporation Age Risk = 80. |

| The risk associated to Public Company | 5 | Risk as it appears on the Parameter Risk Score Jurisdiction tables for legal structure types. |

Customer F is a Public Corporation. Based on Legal Structure & Ownership Parameter Risk Score Jurisdiction, Public Corporation Risk is 0. Customer F’s Legal Structure & Ownership Risk = 0. |

| Risk Associated with Account Type | 5 | Maximum Risk of all the accounts a customer has a controlling role on. |

Customer F has 2 accounts – Credit Card and Savings Account for which the score are 60 and 25 respectively. Customer F’s Account Type Risk is Maximum of (60,25). |

| Risk Associated with Method of Account Opening | 5 | Maximum Risk of all the accounts a customer has a controlling role on. |

Customer F has 2 accounts that have been opened via Online and Walk-in and the scores are 70 and 20 respectively. Customer F’s Method of Account Opening Risk is Maximum of (70,20). |

| Length of Relationship with the bank or FI | 10 |

0 - 12 months --> 80 13 - 36 months --> 60 37 - 120 months --> 40 More than 120 months --> 0 |

Customer E has been a customer since 12 months. Customer E’s Corporation Age Risk = 80. |

| Operational Risk – Products Offered by the bank | 10 | Maximum of different products being served by the bank. |

Customer F offers products related to Securities and Checking with a score of 40 and 20. Maximum (40,20). |

Risk Score = Sum (value of the risk assessment parameter * weight in decimals) Final Risk Score = 33

Sum of [(0*0.05)+(20*0.05)+(70*0.05)+(85*0.1)+(20*0.1)+(30*0.1)+(60*0.05)+ (30*0.15) +(70*0.05)+ (40*0.1)]

Risk Category: Low.