D.6 Alternate Process Flow for MiFID Clients

Derivations done by the FDT process for the MiFID scenarios, which use the Order Size Category, require the use of the Four-week Average Daily Share Quantity (4-wk ADTV) to define an order as small, medium, or large based on how it compares to a percentage of the 4-wk ADTV.

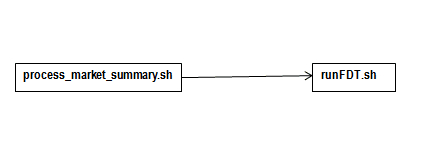

The 4-wk ADTV is derived on a daily basis by the process_market_summary.sh script in the end-of day batch once the Daily Market Profile is collected for each security from the relevant market data source.

For firms using the MiFID scenarios and running a single end-of-day batch, the process_market_summary.sh script must be executed prior to running the runFDT.sh script such that the 4-wk ADTV for the Current Business Day incorporates the published Current Day Traded Volume.

Figure D-3 Dependency between process_market_summary.sh and runFDT.sh