Intercompany Elimination and Consolidation

Introduction

Oracle Financial Services Climate Change Analytics Cloud Service enables users to perform elimination and consolidation of intercompany balances in accordance with widely accepted accounting frameworks and standards.

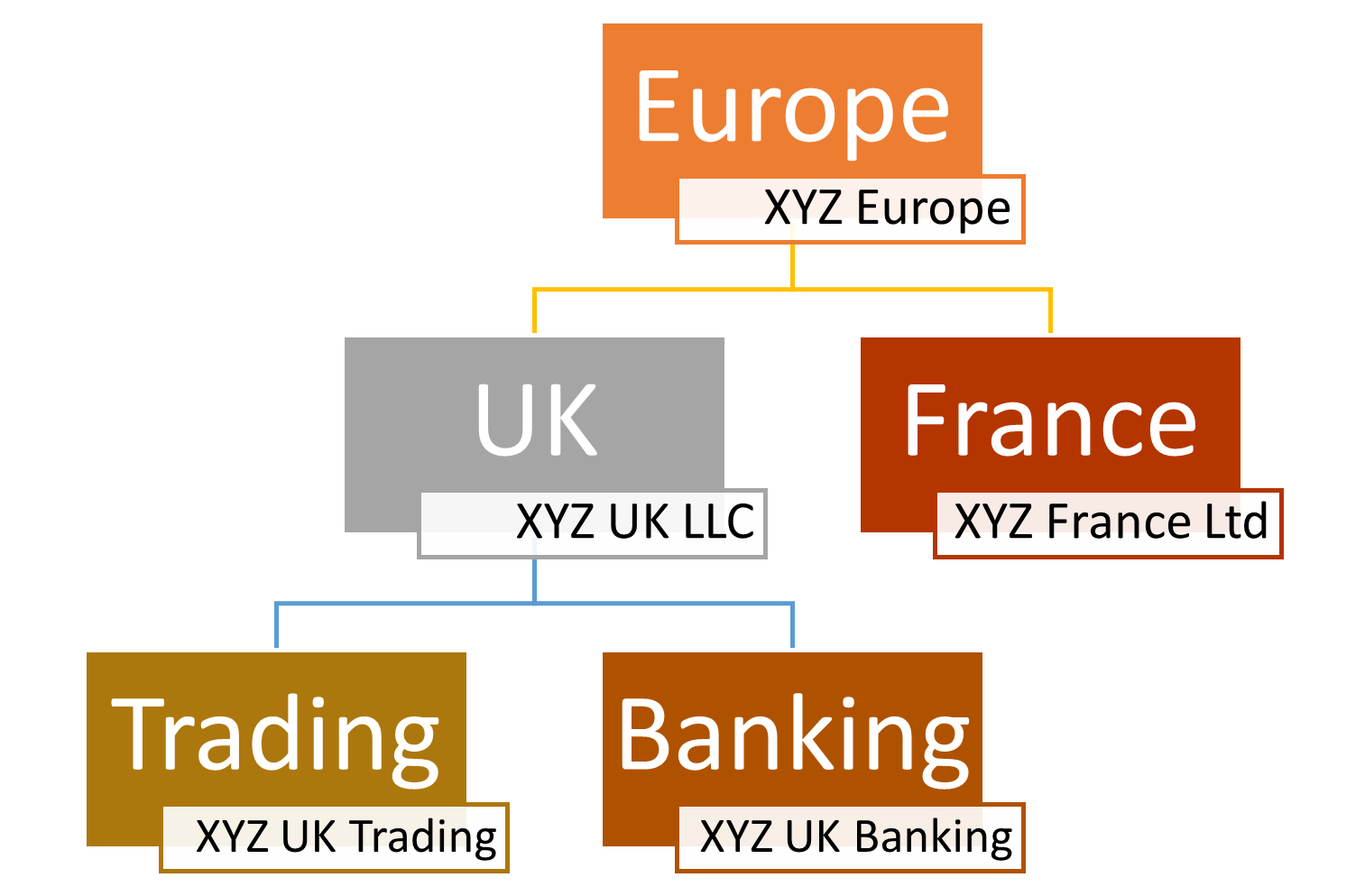

For the elimination and consolidation to perform effectively, users need to ensure that legal entity hierarchy is properly set up within the database. Essentially, there needs to be a proper mapping of holding or parent and subsidiary or child companies.

The application will eliminate all intercompany balances for subsidiary/child entities falling with the hierarchy of holding/parent entity and aggregate all other third-party balances to present a consolidated result.

The following illustration depicts the legal entity hierarchy and displays the consolidation logic:

Example

In this section, we will look at how intercompany balances will be eliminated and third-party balances will be aggregated to produce a consolidated result.

Figure 10-17 Example of Elimination of Inter Company Balances

Table 10-7 The Standalone Entity Balances as of 1st January 2023

| Legal Entity | Balance | Intercompany (IC) Balance | Receivable from | Third-party Balance |

| XYZ Europe | 200 | 75 | XYZ UK LLC | 125 |

| XYZ UK LLC | 200 | 50 | XYZ UK Trading | 150 |

| XYZ France Ltd | 100 | 0 | N/A | 100 |

| XYZ UK Trading | 50 | 0 | N/A | 50 |

| XYZ UK Banking | 75 | 0 | N/A | 75 |

| Total | 625 | 125 | 500 |

Table 10-8 Intercompany Balances that will be Eliminated

| Legal Entity | Intercompany (IC) Balance eliminated |

| XYZ Europe | 75 |

| XYZ UK LLC | 50 |

Legal Entity values after Inter-Company Elimination (excluding Asian Companies)

Table 10-9 Legal Entity values after Inter-Company Elimination

| Legal Entity (LE) | Standalone LE Value |

| XYZ LLC | 200 |

| XYZ Europe | 180 |

| XYZ France | 200 |

| XYZ UK | 90 |