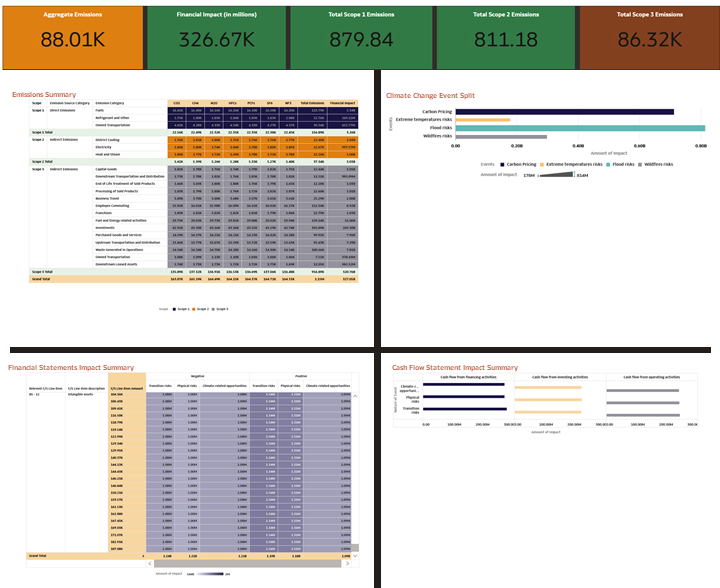

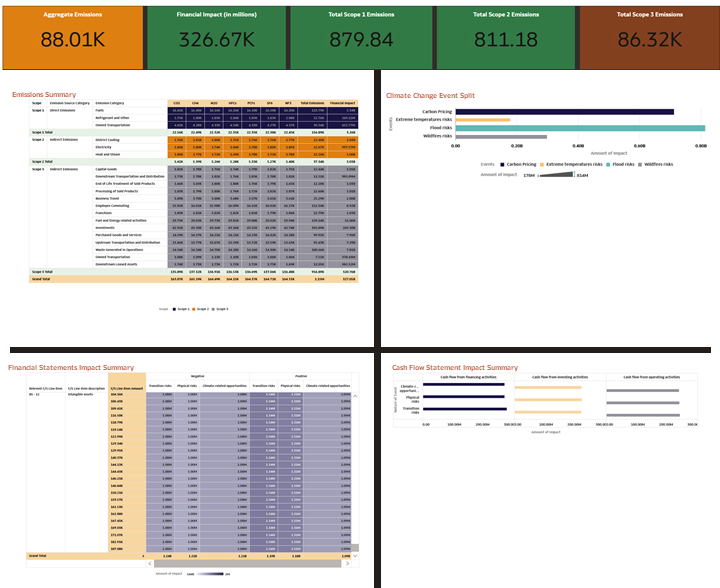

U.S. SEC Reports

This section contains reports to aid users visualize reports curated to the specific needs of U.S. SEC climate change reporting rules.

The U.S. SEC Reports contain the following visualizations:

Figure 12-4 U.S. SEC Reports Visualizations

Users will be able to filter reports using various prompts. Examples of such

prompts include:

- Fiscal Year - You can use this filter to select a specific Fiscal Year derived from As of-Date.

- Month - You can use this filter to select a specific Month derived from As-of-Date.

- Region – Use this filter to select a Region.

- Legal Entity - Use this filter to select a Legal Entity.

- LOB – Use this filter to select a Line of Business.

- Business Unit – Use this filter to select a business unit.

The reports can be filtered by using the following two prompts via a single select

drop-down field:

- Consolidation Type – Use this filter to select either Standalone or Consolidated status.

- Currency – Use this filter to select a currency.

Several reports within this section allow users with a data drill-down

capability, leveraging underlying data across below data elements.

- Legal Entity – Displays the breakup of various legal entities holding relevant value.

- Line of Business - Displays the breakup of various lines of businesses holding relevant value.

- Business Unit - Displays the breakup of various business units holding relevant value.

- Country of Incorporation - Displays the breakup of various countries wherein relevant legal entities are incorporated.

- Counterparty – Displays the breakup of various counterparties holding relevant value.

- Country of Counterparty - Displays the breakup of various countries where relevant counterparties are incorporated.

For more details on prompts and drill-down capabilities, users can refer to the Reports document on MOS.