1 About OFS Compliance Studio

Introduction

OFS Compliance Studio is an advanced analytics application that supercharges anti-financial crime programs for better customer due diligence, transaction monitoring, and investigations by leveraging the latest innovations in artificial intelligence, open-source technologies, and data management. It combines Oracle's Parallel Graph Analytics (PGX), Machine Learning for AML, Entity Resolution, and notebook-based code development and enables Contextual Investigations in one platform with complete and robust model management and governance functionality.

Capabilities offered by Compliance Studio

- Purpose-Built for Fighting Crime

- Fully defined and sourced Financial Crime Graph Model supporting detection and investigation

- Provided Accelerators for finding the needles in the haystack.

- What if Analysis for existing Scenarios

- Integration with ECM and Investigation Hub to provide meaningful guidance to investigators for rules-based and ML-generated alerts

- Enterprise-ready and compatible with the underlying OFSAA framework

- Works with earlier 8.x releases of Oracle Financial Compliance Management Anti Money Laundering (AML), Enterprise Case Management, and Fraud applications.

- Entity Resolution for AML

- Entity Resolution to enhance monitoring effectiveness and provide a single customer view

- Linking and Resolution across internal and external data to improve single entity detection

- Allows for Scenario/Model detection across internal data

- Multi-attribute enabled with ML boosts for Name/Address models

- Prebuilt Integrations and easily configurable for Data Sources like ICIJ etc

- Analytics of Choice

- Choose from our proprietary models or bring your own

- Fully embedded Graph Analytics Engine and Financial Crime Model

- Embedded with a highly scalable in-memory Graph Analytics Engine(PGX)

- Industry's most intuitive Graph Query Language to gain rapid insights

- Model Management and Governance

- End-to-end management from model creation to model deployment

- Data Ingestion (Oracle DB, Graph,Hive)

- Model Development

- Supports virtually all open source packages, interpreters,etc.

- Process in Database or Big Data

- Model Training

- Model Performance Evaluation

- Model Explainability

- Model Tracking and Audit

- Approval Mechanisms

- Model Deployment

- Scheduling

- Ongoing Monitoring

- End-to-end management from model creation to model deployment

- ML Foundation for Financial Crimes

- Integrated with Oracle Financial Crime Application Data and readily usable across the enterprise financial crime data lake

- Pre-engineered features and transformations to address each use case

- Simplified APIs for each stage of the modeling lifecycle

- Leverage the power of Graph, Supervised ML, and Unsupervised ML buildtypology detection models, detect anomalies, and risk score customers or events

- Event Scoring for false positive prediction and disposition

- Dashboards and KPIs to measure the impact of ML and generate insights for business users

- Ongoing Monitoring of Model Performance and Concept Drift

- Automated Scenario Calibration and Scenario Conversion Utility for Oracle AML Scenarios

- Graphs

- Graph Pipeline feature allows you to view the data relationships in a graphical format.

- Graph Analytics will give Financial Institutions the ability to monitor the data financial institutions effectively. The data is organized as nodes, relationships, and properties (property data is stored on the nodes or relationships). The results of analytics algorithms are stored as transient properties of nodes and edges in the Graph.

Architecture Overview

For more information on Compliance Studio architecture, see the OFS Compliance Studio Architecture Guide.

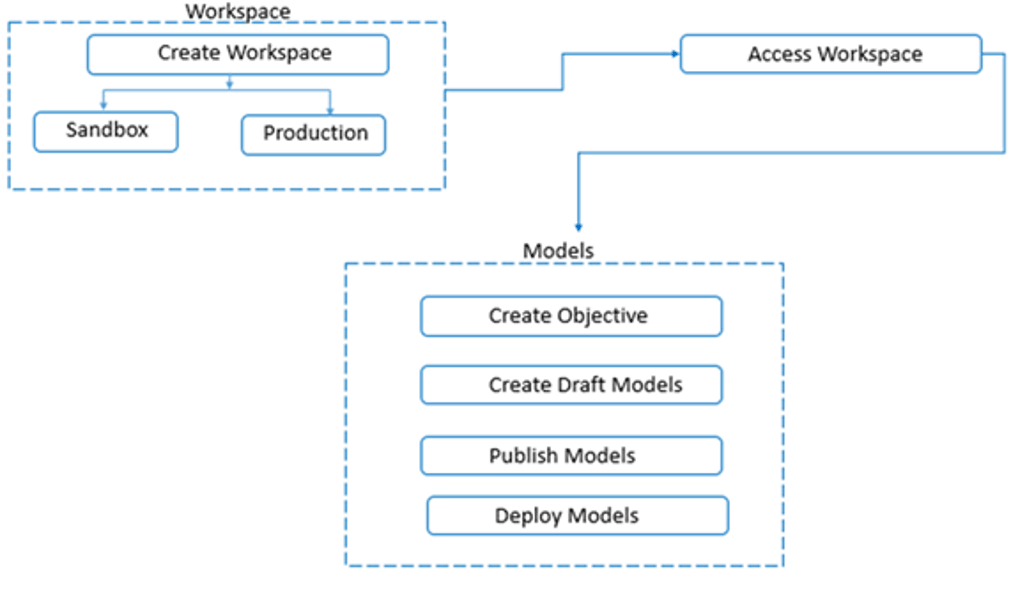

Process Flow

Figure 1-1 Process Flow of Compliance Studio