8.1.3.3 Sample Accounts Reporting

This sample report is based on Accounts subject area. It provides stakeholders with an overall summary of credit status of institution’sassets such as loans as of the selected date.

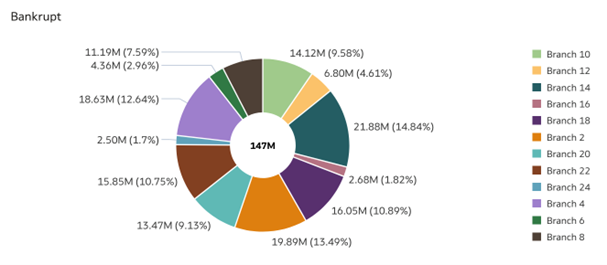

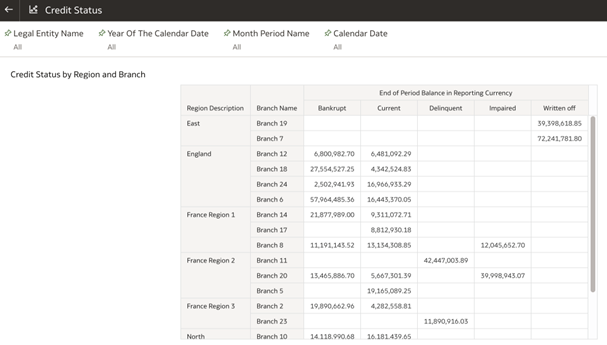

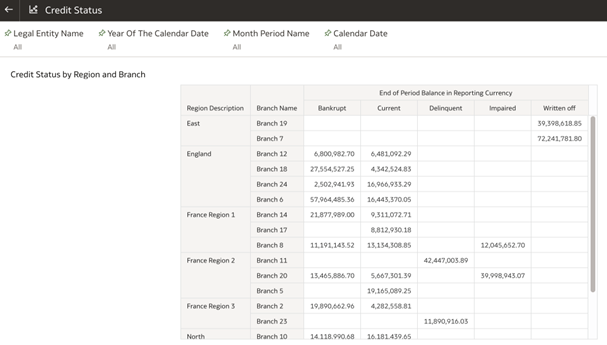

Credit Status: This provides a view of end-of-period balance in the

reporting currency by credit status across regions and branches. It enables stakeholders

to assess the health of credit portfolios and identify areas requiring attention. This

helps in monitoring regional and branch-level credit performance and risk exposure and

helps identifying if any specific region or branch needs attention.

Figure 8-39 Credit Status

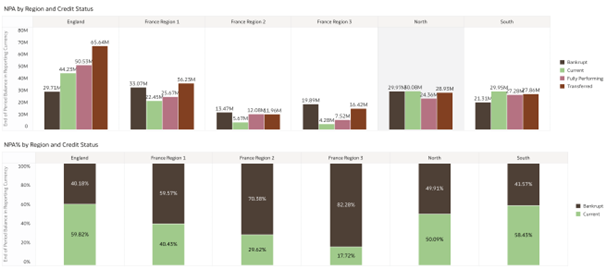

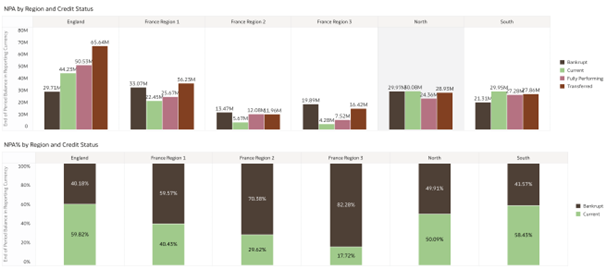

Non Performing Assets: Provides a visual representation of non

performing assets (NPAs), where definition of non performing asset is as per

jurisdictional regulator and user provides data marking accounts as NPA. This

visualization is based on across regions using bar charts. It offers insights into the

distribution and health of non-performing assets (NPAs) by region.

Figure 8-40 Non Performing Assets

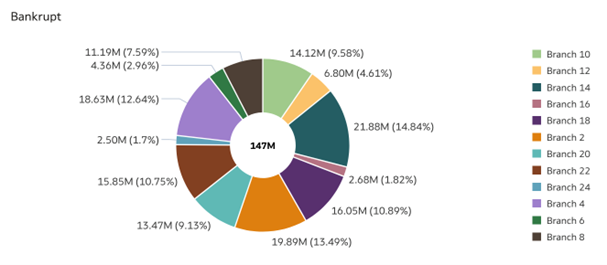

Branchwise NPA - This displays the distribution of non-performing

assets (NPAs) across branches for a particular region, segmented into various credit

status categories such as Bankrupt, Impaired, Written Off, and

Delinquent. This chart provides a view of NPA composition for each branch,

enabling stakeholders to quickly assess and compare the extent and type of financial

risk across different branches of a given region. This is especially helpful if user

sees unexpected data for a given region in previous visualization, and wants to view

data spread across branches for that region.

Figure 8-41 Branchwise NPA