8.1.3.5 Sample Credit Line Reporting

This sample report is based on Credit Line subject area. It gives an

overview.

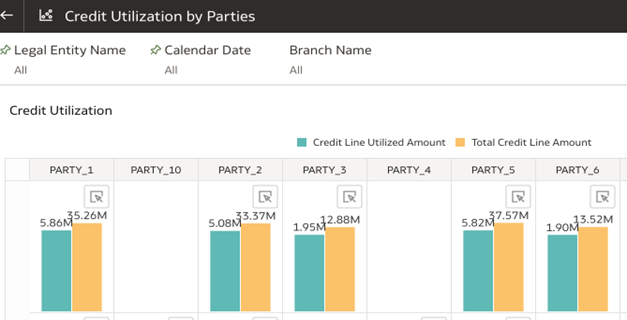

- Credit Utilization by Parties: This bar graph illustrates total credit

line against the utilized amount, and helps bank quickly assess the overall

credit utilization rate. This helps in identifying trends over time, such as

increases in credit usage which might indicate economic stress among borrowers

or a growing confidence and spending capability. The visualization helps user

analyze credit utilization numbers for each party and currency as of date and

analysis can be done at branch level.

- Objective – To highlight the total credit line and utilized

amount for various parties across different currencies as of given date

for selected branch/branches.

Figure 8-46 Credit Utilization by Parties

- Objective – To highlight the total credit line and utilized

amount for various parties across different currencies as of given date

for selected branch/branches.

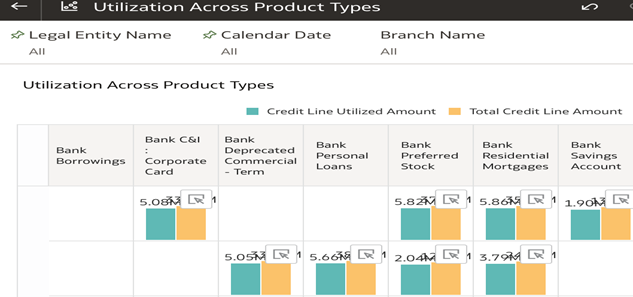

- Utilization Across Product Types : The visualization

illustrates the total credit line commitment amounts and the utilized amounts

across different products denoted in multiple currencies. This helps to analyze

which products are most and least utilized, banks can identify successful

features or gaps in their offerings. This information can drive the development

of new products or adjustments to existing ones to better meet customer needs.

- Objective – To highlight the total credit line amount and

utilized amount by different product types for selected branch/branches.

Figure 8-47 Utilization Across Product Types

- Objective – To highlight the total credit line amount and

utilized amount by different product types for selected branch/branches.

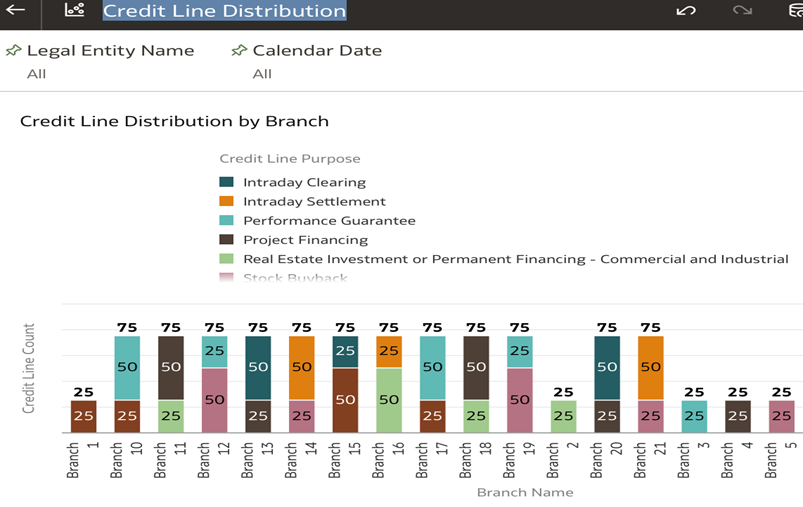

- Credit Line Distribution: The Visualization provides insight

into the predominant credit line purposes at each branch allows a bank to tailor

its products to better match local demand. This helps management to assess the

commitment track to aid in performance review and Risk management.

- Objective – To view number of credit lines by credit line purpose

for each branch within the legal entity.

Figure 8-48 Credit Line Distribution

- Objective – To view number of credit lines by credit line purpose

for each branch within the legal entity.

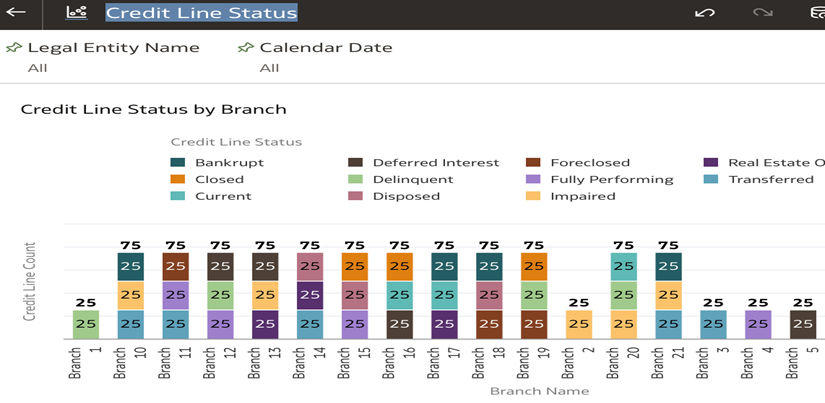

- Credit Line Status: The dashboard illustrates the segregation of credit lines into various credit status categories such as fully performing, delinquent and impaired. This helps Banks to quickly identify areas of concern, particularly the proportion of non performing or delinquent accounts. This allows for early intervention strategies to be deployed, such as reaching out to customers who are falling behind on payments to offer restructuring or support services that might prevent further delinquencies.

- Activity - Results Data Browsing

- Objective – To view number of credit lines by credit line status like

fully performing, delinquent, impaired for each branch within the legal

entity.

Figure 8-49 Credit Line Status

- Objective – To view number of credit lines by credit line status like

fully performing, delinquent, impaired for each branch within the legal

entity.

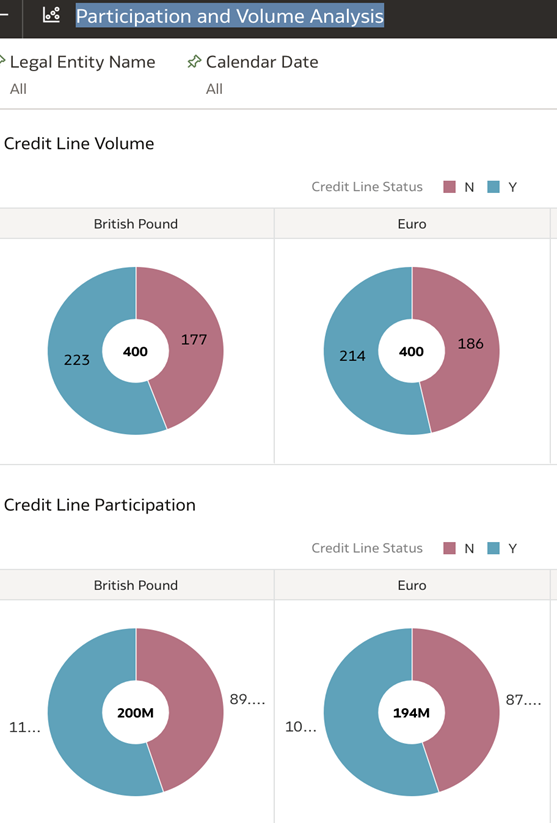

- Participation and Volume Analysis: The visualizations show the

participation flag for credit lines alongside the sum of total credit line amounts

tagged with that flag which helps banks in analyzing how participation in specific

credit programs impacts their overall credit portfolio. Participation flag indicates

if the credit line facility is a part of the syndication.

- Objective – To highlight the total credit line amounts and

Participation counts by Legal entity and Calendar date.

Figure 8-50 Participation and Volume Analysis

- Objective – To highlight the total credit line amounts and

Participation counts by Legal entity and Calendar date.