8.2.4.4 Mitigants Summary

This pre-built report, based on the Mitigants subject area, offers a comprehensive view of risk reduction strategies implemented across products, branches, and regions. It aids in evaluating the effectiveness of various mitigants, identifying exposure gaps, and enhancing risk management practices.

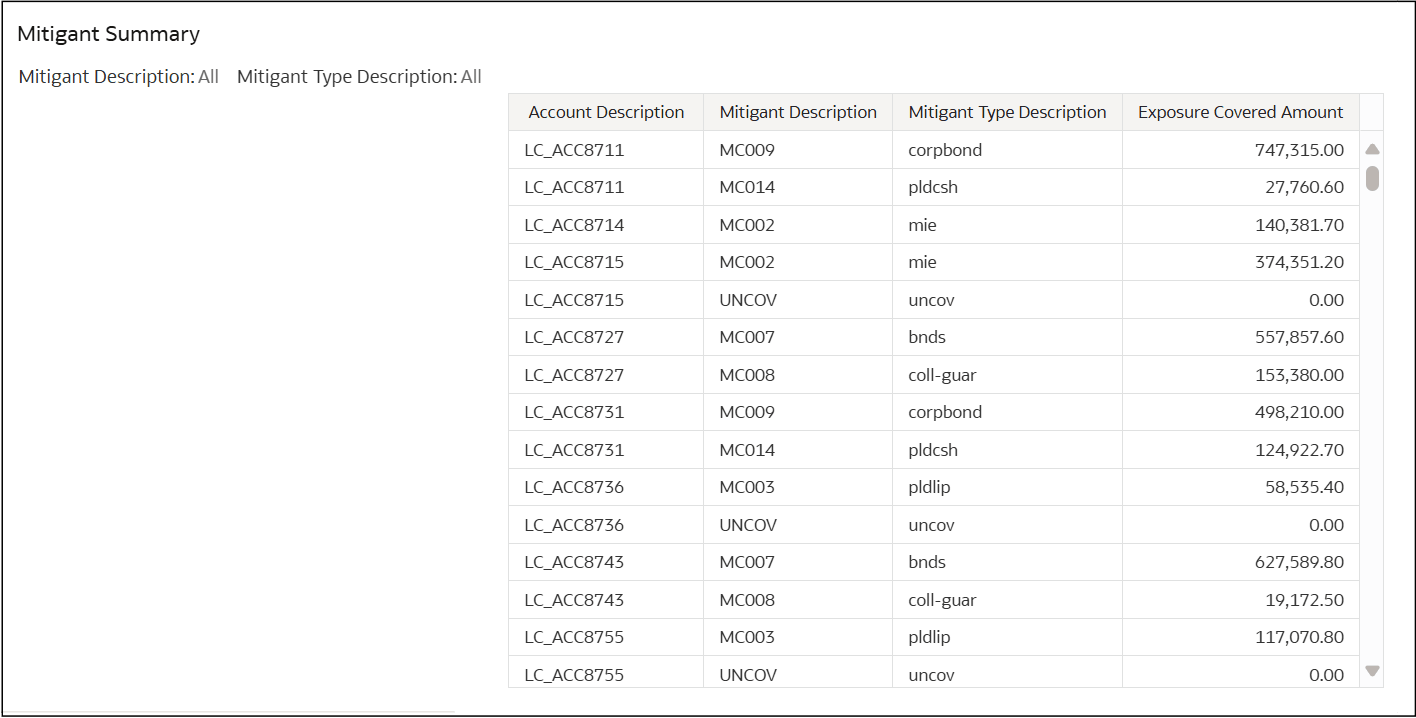

Mitigant Summary

A mitigant summary table displays various mitigating factors or actions designed to reduce risk or exposure. In financial contexts, this could refer to strategies or assets that reduce the risk associated with liabilities, investments, or other financial obligations.

Figure 8-59 Mitigant Summary

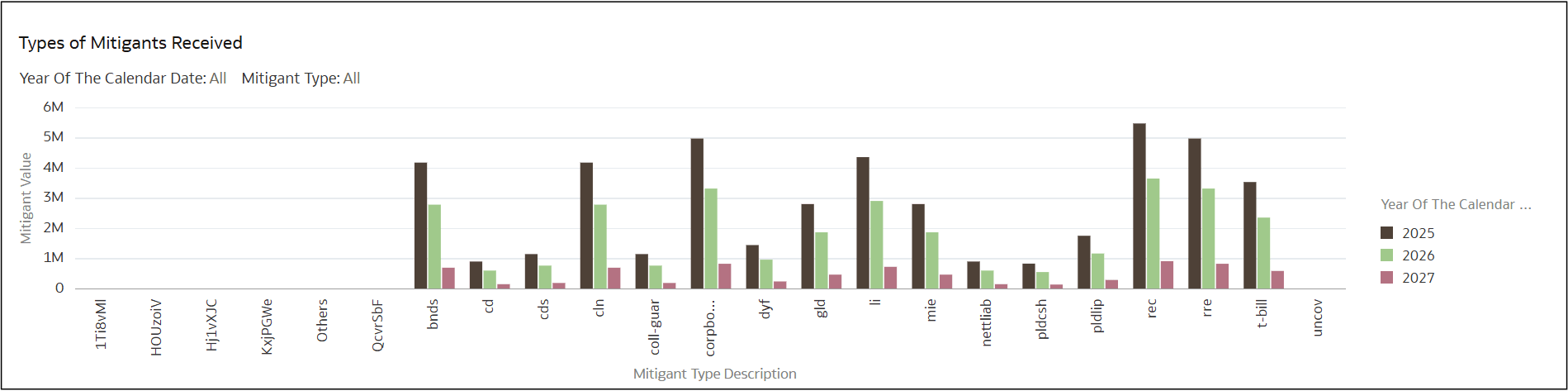

Mitigant and Risk Coverage

Figure 8-60 Types of Mitigants Received

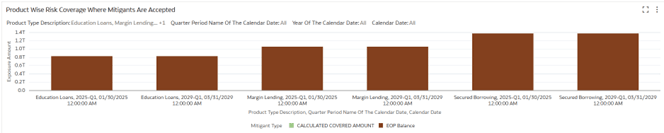

Product Wise Risk Coverage Where Mitigants Are Accepted

Figure 8-61 Product Wise Risk Coverage Where Mitigants Are Accepted

Note:

Users have an option to filter for Uncovered as Mitigant type, as some banks capture Uncovered portion of exposure (with Mitigant type as Uncovered) in separate row in Entity Fact Account Mitigant Map.Specific Product Risk Coverage – Trend Analysis

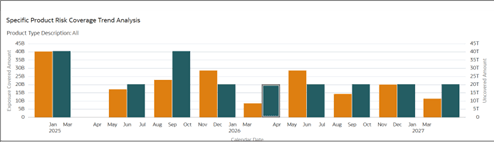

Figure 8-62 Specific Product Risk Coverage – Trend Analysis

- Visibility into changes in product-level exposure

- Evaluation of mitigant impact over time

- Strategic input for improving product-specific risk handling

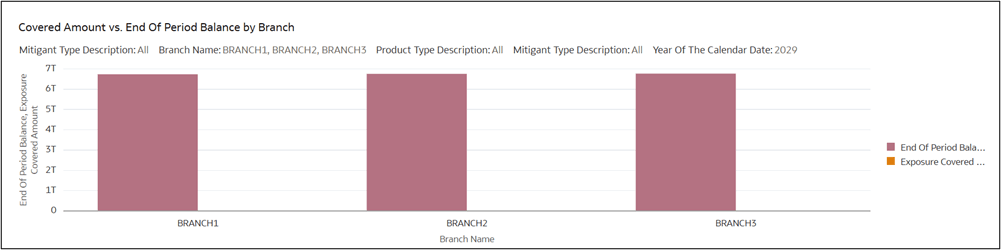

Covered Amount vs. End Of Period Balance by Branch

Figure 8-63 Covered Amount vs. End Of Period Balance by Branch

- Branch-level exposure visibility

- Effectiveness of mitigants at individual locations

- Identification of high-risk branches for further action

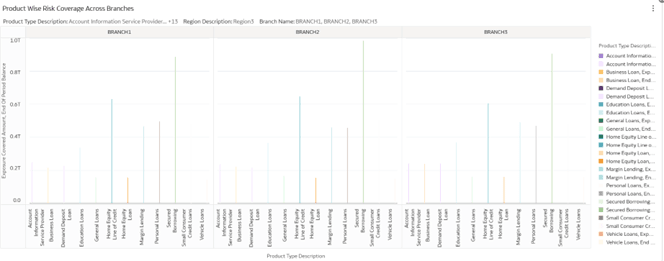

Product-wise Risk Coverage Across Branches

Figure 8-64 Product-wise Risk Coverage Across Branches

- Detailed branch-level performance by product type

- Coverage adequacy and gaps

- Data to support localized mitigation strategies

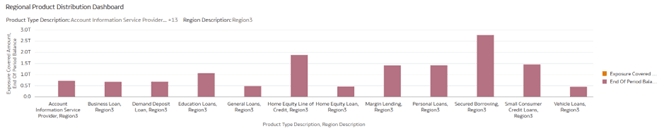

Regional Product Distribution Dashboard

Figure 8-65 Regional Product Distribution Dashboard

- Product demand by geography

- Regional risk profiles

- Market segmentation and strategic planning inputs