8.2.4.6 Placed Collateral Summary

This pre-built report, based on the Placed Collateral subject area,

provides a comprehensive overview of collateral posted against exposures. It

includes details about the type, value, and distribution of collateral placed

across different products and regions, enabling effective monitoring of placed

collaterals from within bank’s asset portfolio.

Note:

This report is about collaterals placed by the bank, and not collaterals received. “Mitgants Summary” pre-built report caters to received collaterals.Types of Collateral Placed

Purpose: Shows the market value of different collateral types

placed to secure liabilities, segmented by year.

Figure 8-70 Types of Collateral Placed

- The distribution and scale of collateral types placed to mitigate borrowings.

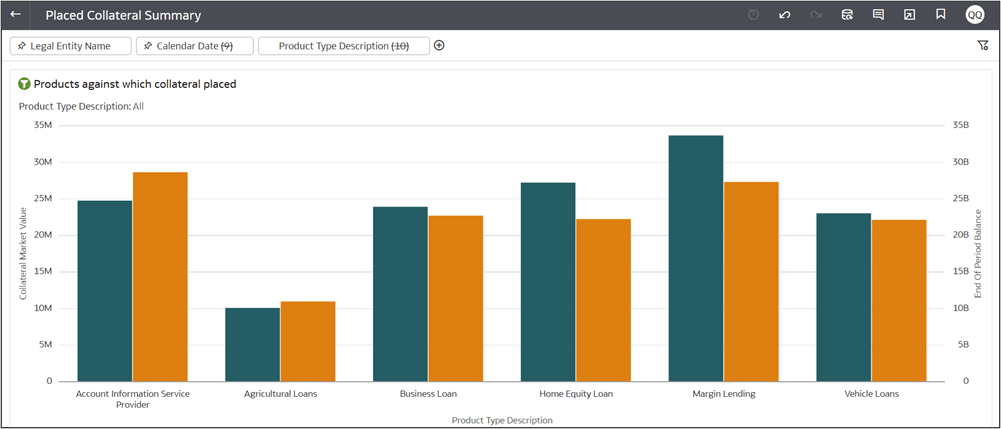

Product against which collateral placed

Purpose: Assesses the portfolio of various product types against which collateral has been placed.

Figure 8-71 Product against which collateral placed

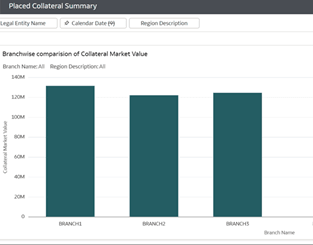

Branchwise comparison of Collateral Market Value

Purpose: Analyzes how placed collateral is distributed across

different branches.

Figure 8-72 Branchwise comparison of Collateral Market Value

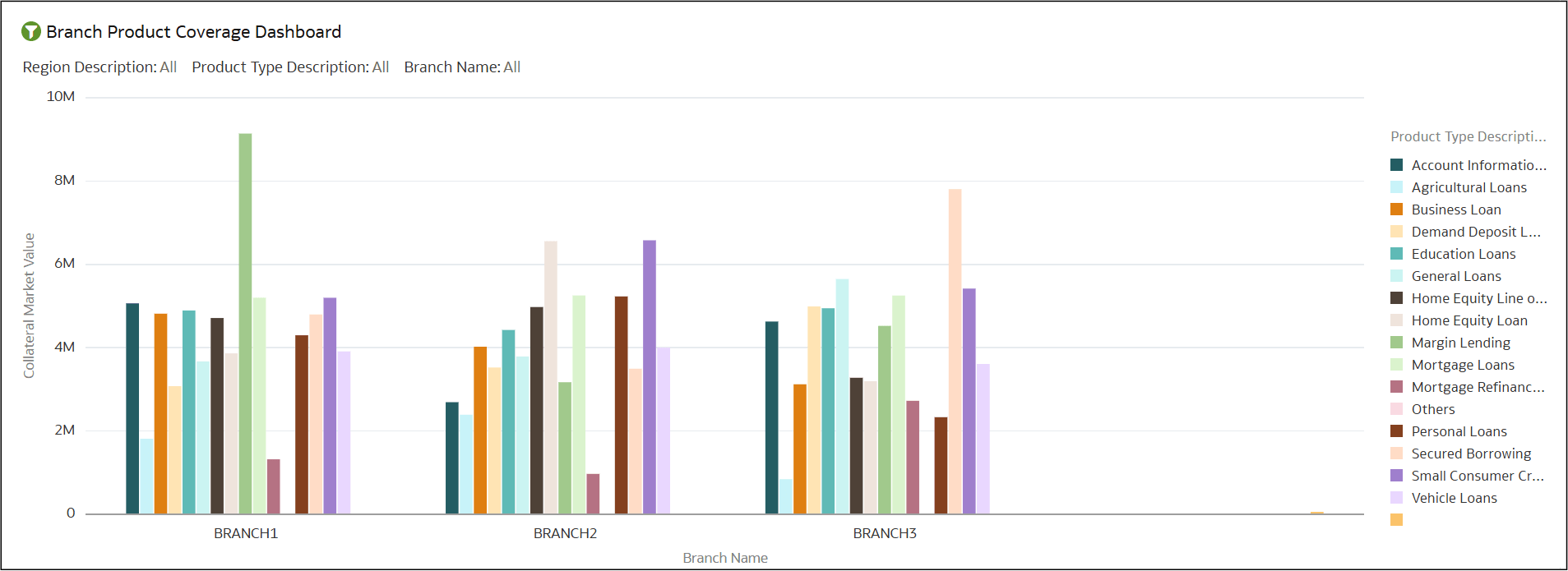

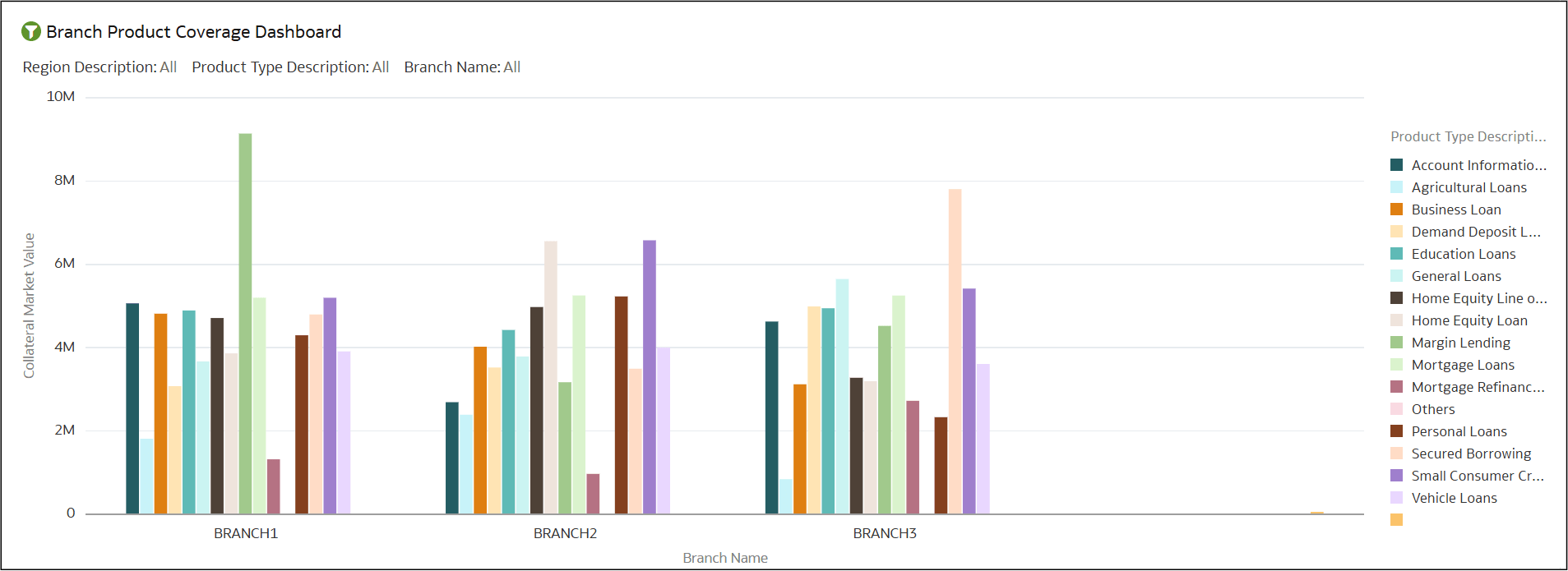

Branch Product Coverage Dashboard

Purpose: Displays product-wise placed collateral coverage at the

branch level.

Figure 8-73 Branch Product Coverage Dashboard

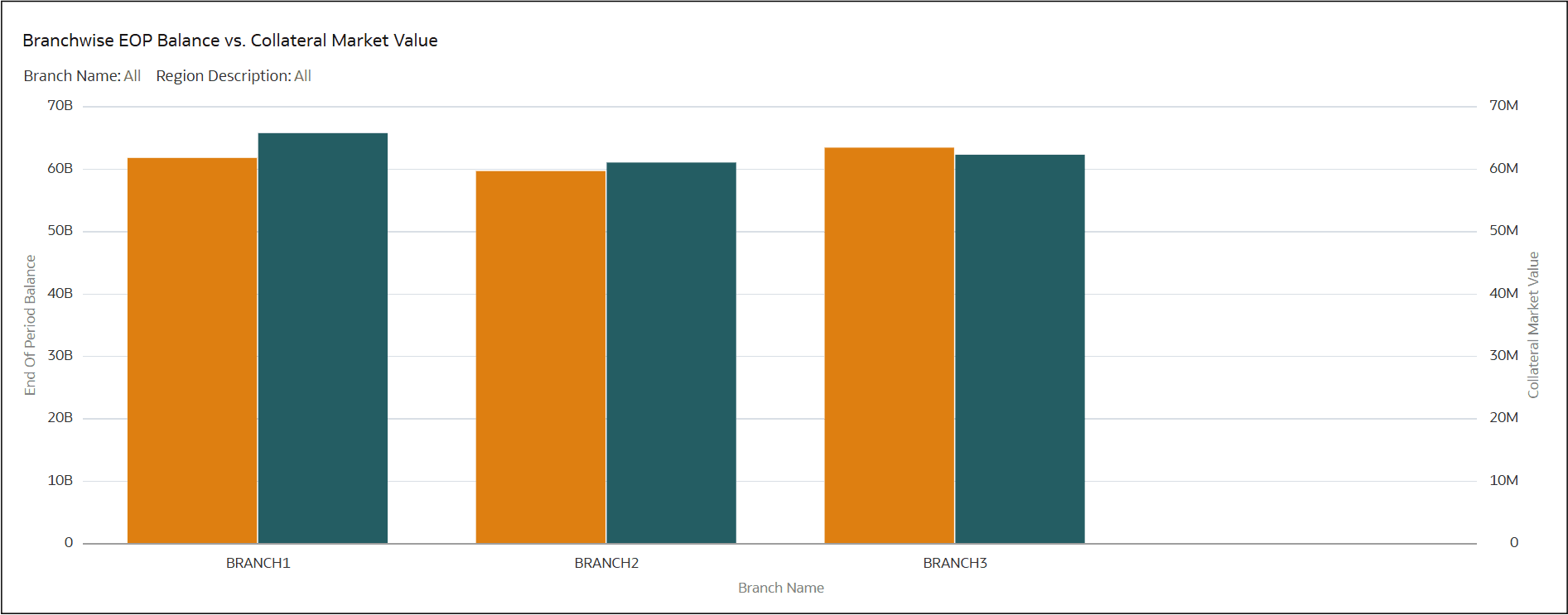

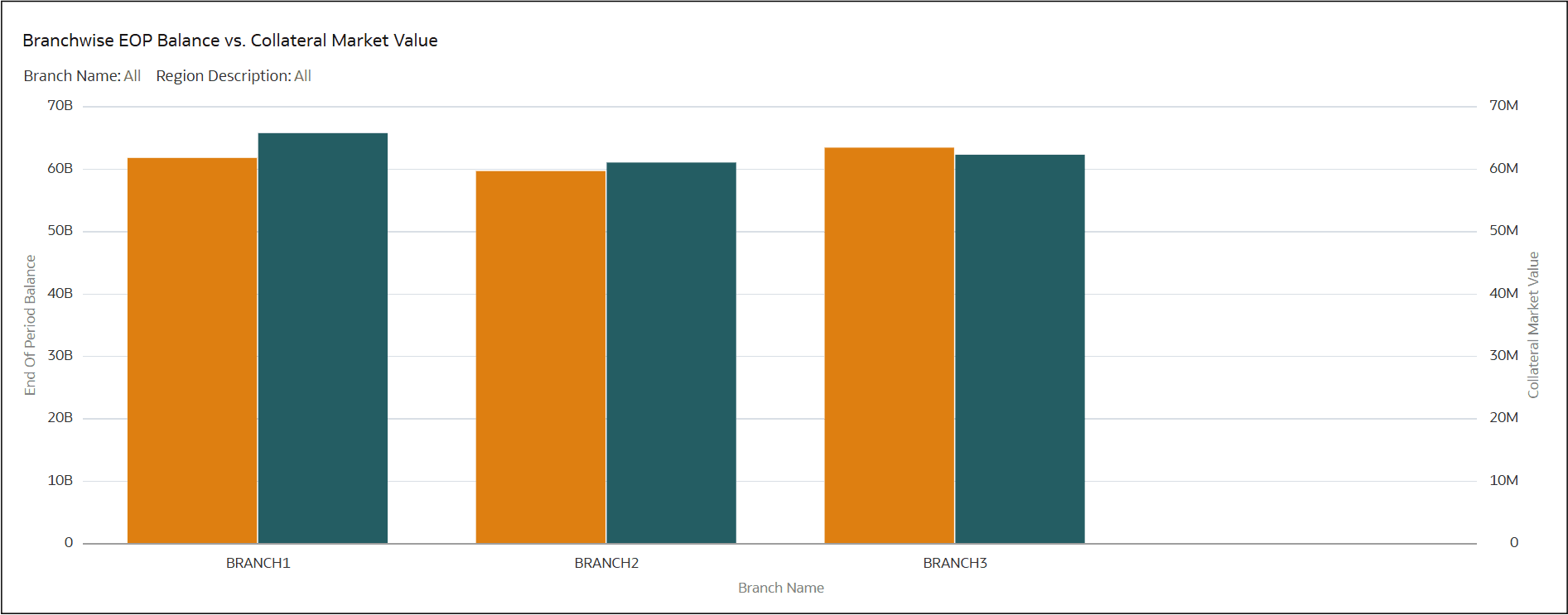

Branch-wise EOP Balance vs. Collateral Market Value

Purpose: Compares End-of-Period (EOP) balances across

branches to placed collateral market values at each branch.

Figure 8-74 Branch-wise EOP Balance vs. Collateral Market Value