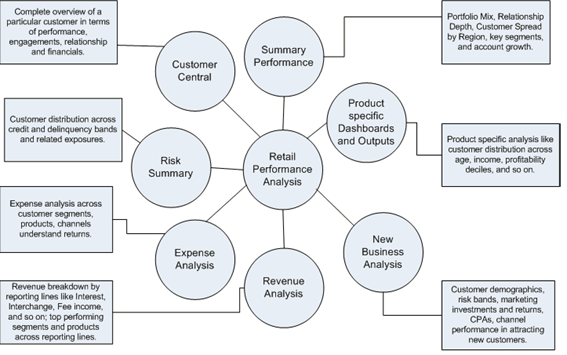

3.1 OFS RPA Process Flow

Oracle Financial Services Retail Performance Analytics (OFS RPA) utilizes OBIEE technology to:

- Gain deep insight into customer engagements across target segments and products or LOB including lending, credit cards, and so on.

- Perform Wallet share analysis and Customer Profitability.

- Understand the efficiency of investments (like marketing, branch, and channel, and so on) over time.

- Monitor customer distribution across credit and delinquency bands and related exposures.

- Perform an enterprise-wide revenue analysis across customer segments, products, and reporting lines including fee income, interest, and interchange.

- Summary performance of the LOBs, overall Profitability, and Portfolio mix.

- Customer trends across performance drivers like Sales, Balances, Deposits, Product subscriptions (revenue services), Credit scores, Delinquency bands, Losses, and so on.

- LOB-specific performance reports can be analyzed against key dimensions like customer segments, product family, region, branch, risk scores, and so on.

- Analyze expenses across customer segments, products, and channels to understand ROI.

Figure 3-1 Objectives of RPA

For details on OFSRPA reports and how OBIEE is being utilized, see Overview of OFSRPA Reports.

OFSRPA is designed for OBIEE reading data from a relational database. The relational database comprises of various dimensions and facts in the BI data model.

OFSRPA can be independently licensed and installed to work on top of the OFSAA Infrastructure.