3.14.6 Define the Breakage Charge Economic Loss Method

The Breakage Charge option has the following methods:

- Do Not Calculate: No Add-on Assumptions will be assigned to the particular product-currency combination.

- Fixed Amount: Allows users to directly input the amount of the breakage charge.

- Economic Loss: Used to compute the cost to the organization (economic loss) incurred after terminating the account (asset/funding liability).

- Fixed Percentage: Allows you to input a percentage that is multiplied by the Breakage Amount to determine the Breakage Charge.

Defining the Economic Loss Breakage Charge Assumption requires the following additional steps:

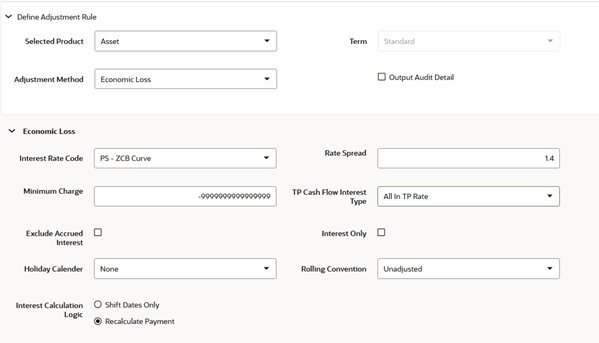

Figure 3-68 Add-on Rule Definition Mode – Breakage Charge (Economic Loss) Calculations

- Select the Interest Rate Code and Rate Spread to use for discounting the remaining term Cash Flows.

- Select the minimum charge amount. Default to -99999 if you want to calculate both gains and losses.

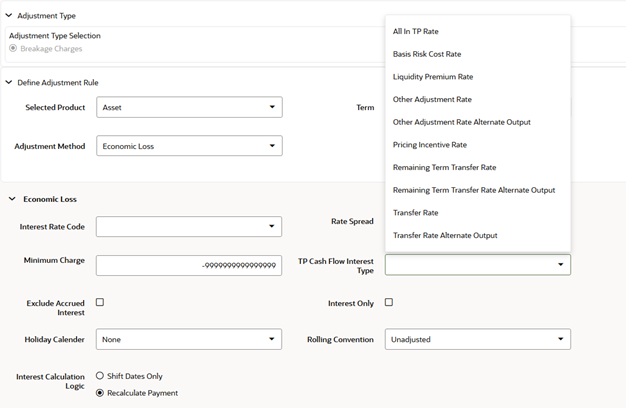

- Select the TP Cash Flow Interest Type. This interest rate will be used to

generate Interest Cash Flows.

Figure 3-69 Add-on Rule Definition Mode – TP Cash Flow Interest Type

- Select the option to Exclude Accrued Interest if applicable.

- Select the Interest Only option to discount only the Interest Cash Flows.

- Select a Holiday Calendar if you want to adjust Cash Flows for Holidays and

Weekends.

The default selection for Holiday Calendar is None. If this option is selected, then Holiday Calendar will not be applied to cash flow dates. If you wish to apply Holiday Calendar Add-on, then select the appropriate Calendar.

- Select the appropriate Rolling Convention. When Holiday Calendar has been selected

in the preceding field, this drop-down list becomes active and contains 4 values:

- Following Business Day

- Modified following Business Day

- Previous Business Day

- Modified previous Business Day

- Select the appropriate Interest Calculation Logic from the following:

- Shift Dates Only

- Recalculate Payment

- Select Apply.