5.3.5.4.1.2 Breakage Charge – Economic Loss

The Economic Loss Breakage Charge Method sets out to compute the cost to the organization (economic loss) incurred for terminating the funding liability (also known as the shadow liability). The calculation assumes the funding liability has the exact attributes of the funded/terminated instrument.

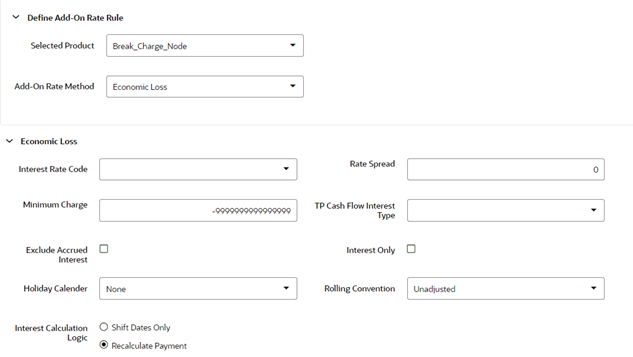

Figure 5-75 Breakage Charge - Economic Loss

The rate of the funding liability is equal to the Transfer Rate. Economic Loss is computed as follows:

For Assets:

Economic Loss =BV - MV

For Liabilities:

Economic Loss = MV– BV

Where:

MV: Market Value of the funding Liability

BV: Book Value of the broken instrument

The following is a simplified example of the Economic Loss calculation for a standard Term Deposit:

Book Value: $1,000.00

Original Term: 24 Months

Break after: 12 Months

Original TP Rate: 2.40% (based on straight term method)

Table 5: Reference Rates

| Effective Date | 1 M | 12 M | 24 M |

|---|---|---|---|

| At Origination | 2.00 | 2.40 | 1.75 |

| At Month 12 | 2.00 | 2.40 | 1.75 |

Table 6: Cash Flows of remaining Funding after Break Event

| Original | |||

| TP COF | Total | ||

| Month | Principal | @ 2.40% | CF Orig TP |

| 13 | $ 2.00 | $2.00 | |

| 14 | $2.00 | $2.00 | |

| 15 | $2.00 | $2.00 | |

| 16 | $2.00 | $2.00 | |

| 17 | $2.00 | $2.00 | |

| 18 | $2.00 | $2.00 | |

| 19 | $2.00 | $2.00 | |

| 20 | $2.00 | $2.00 | |

| 21 | $2.00 | $2.00 | |

| 22 | $2.00 | $2.00 | |

| 23 | $2.00 | $2.00 | |

| 24 | $1,000.00 | $2.00 | $1,002.00 |

| Market Value at Month 12 | 1,003.957 | ||

| Book value | -1,000.00 | ||

| Breakage charge | 3.957 |

Note:

If you are calculating Breakage Charges, using the Economic Loss method, you must select the "Remaining Term" option in your Transfer Pricing Process, to generate the correct Cash Flows for the funding liability.Both Current and Prior Period Cash Flows will be logged which are used for Break Charge Calculations in FSI_O_CFE_OUTPUT_HIST table using the Record Sequence (n,n+1) for Prior/Current Period Record, respectively. Record sequence is concatenated with Account Number, so you can identify Cash Flows belonging to prior/current period record.