5.3.4.1.1 Cash Flow: Average Life

The Average Life Method determines the average life of the instrument by calculating the Effective Term required to repay half of the principal or nominal amount of the instrument. The Transfer Pricing Rate is equivalent to the rate on the associated Interest Rate Curve corresponding to the calculated term.

Figure 5-35 Cash Flow: Average Life

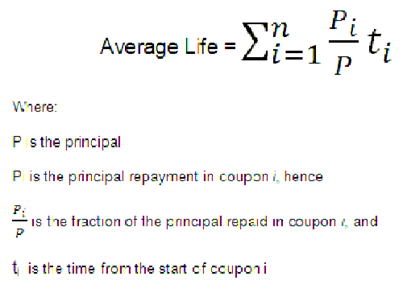

Figure 5-36 Cash Flow: Average Life Formula

Oracle Funds Transfer Pricing Cloud Service derives the Average Life based on the Cash Flows of an instrument as determined by the characteristics specified in the Instrument Table and using your specified Prepayment Rate, if applicable. The average life formula calculates a single term, that is, a point on the yield curve used to transfer the price of the instrument being analyzed. The Average Life Calculation does not differentiate between fixed-rate and adjustable-rate instruments. It applies the same calculation logic to both. It computes the Average Life of the Loan (to maturity).

Note:

The Average Life Transfer Pricing Method provides the option to Output the result of the calculation to the Instrument Record (TP_AVERAGE_LIFE). This can be a useful option if you would like to refer to the Average Life as a reference term within an Adjustment Rule.Users also have the choice to populate the TP_AVERAGE_LIFE column directly with a value computed outside of Oracle Funds Transfer Pricing Cloud Service. If this value is populated, the Funds Transfer Pricing Cloud Service Engine reads the TP_AVERAGE_LIFE and will look up the Funds Transfer Pricing Rate for the given term. In this case, the Transfer Pricing Engine does not generate Cash Flows and will not re-compute the Average Life. It simply uses the value that is provided and lookup the appropriate Funds Transfer Pricing Rate from the specified TP Interest Rate Curve.